Allworth Chief Investment Officer Andy Stout discusses today’s market uncertainties and what that means for your retirement.

As I write this monthly missive, the leaves outside my home office are changing colors. It’s quite breathtaking. It reminds me why fall is one of my favorite times of the year.

However, some change is harder to deal with. The upcoming election has the potential for people to worry that the “wrong” political party will control the White House and Congress.

I explored the election and its implications in the August Market Update, which can be found here.

The takeaway from that article is that your money is neither red, nor blue; it’s green, meaning it has no political affiliation. Throughout history, stocks and bonds have generated positive returns under both Democrat and Republican presidencies. While policy is important, what matters most for markets is beyond the control of any political party.

The economy, however, is one of the more important factors.

Today’s economy is much different from where it was a year ago, as the global pandemic has ground the economy to a halt. While the recovery is underway, there is still plenty of room for growth.

To see where we stand and where we need to go, I’ll analyze three major parts of the economy: labor, spending, and manufacturing.

The Labor Market

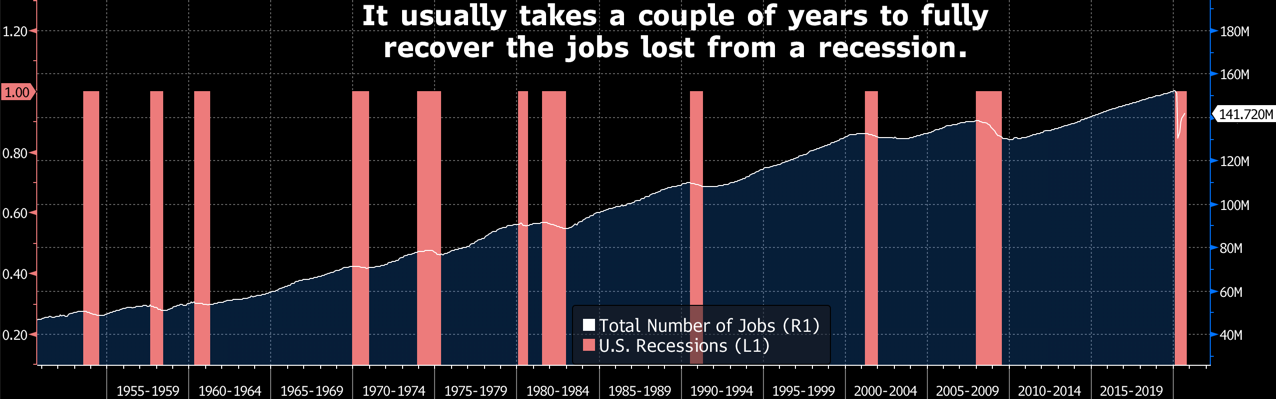

The total number of jobs lost in March and April was 22.2 million. Not surprisingly, the bulk of those losses occurred in services, where 18.7 million jobs were eliminated. Within services, it was restaurants and retailers that were hit the hardest.

So, as restaurants and retailers have reopened their doors, the hiring has been concentrated there. With that said, the total jobs in these industries are still relatively low compared to where they were.

The number of jobs in many other industries is also well short of pre-crisis levels. The areas that have been the most affected are education, temporary work, healthcare, and local government.

Overall, there are 10.7 million fewer jobs than there were in February. It wasn’t until 2014 that the total number of jobs fully recovered from the Great Recession. With past recoveries as a guide, and knowing it will take time for the economy to fully reopen, we would expect that the number of jobs will eclipse pre-crisis levels around 2023.

Spending

Retail sales have fully recovered from the decline. The composition of how people spend their money is significantly different, however. Restaurant and gasoline sales are much lower, but online, building materials, and many other areas, are enjoying stronger sales.

Retail sales have been able to hold up because of the fiscal stimulus. With nearly 11 million fewer jobs today, more fiscal stimulus from Congress will be needed so that incomes and spending don’t collapse.

One of the reasons this is important is that spending from consumers like you make up about 70% of the total economy. So, when consumers stop spending, the economy stops, as well.

Manufacturing

One way to measure manufacturing output is to analyze industrial production, which is made up of manufacturing, mining, and utilities. Isolating the manufacturing subcomponent shows that manufacturing initially declined by 20.1%. It has since retraced 68.6% of the decline. Capturing the rest of the decline will take time due to the virus causing significant disruptions to supply chains.

Looking Ahead

The virus will determine how this recovery evolves. Unfortunately, we’re seeing the number of new daily cases in the U.S. and around the world move steadily higher. While a national lockdown here in the states is unlikely because the economic costs would be too high, local economies could impose their own restrictions. This would increase unemployment and reduce spending in many areas.

The above would in turn reduce the potential growth of our total economy. Economic growth can be measured by gross domestic product (GDP). Economists are currently expecting the U.S. economy to have grown by about 32% on an annualized basis in the third quarter compared to the second quarter (the official GDP growth rate will be released on October 29th).

Despite this likely record-setting quarterly growth rate, the total size of our economy probably won’t surpass the December 2019 level until sometime in 2022. This expected timeline isn’t out of the ordinary. After all, it wasn’t until 2011 that GDP recovered from the 2007-2009 recession.

Your Retirement

In these uncertain times, you might be tempted to try to “time” the market to avoid the next downturn. Doing that would require you to monitor the markets around the clock. Even if you can watch the markets that much, studies have shown that timing the market often does more harm than good.

At Allworth Financial, we have a team monitoring the world economy and your investments. We follow a disciplined asset allocation process and avoid the pitfalls of market timing so you can enjoy your life and retirement to the fullest.

All data unless otherwise noted is from Bloomberg. The Allworth Recession Index is made up of leading economic indicators, which are data points that have historically moved before the economy. The index value is calculated as a percent of the indicators that are sending signals that suggests recession risk is elevated. When the index value is greater than 40%, we believe there is a greater chance for a recession in the next six to nine months. All data begins by 1971 unless noted below. The indicators that make up the Allworth Recession Index are the 3-Month Government Bond Yield, 2-Year Government Bond Yield (beginning in 1976), 10-year Government Bond Yield, BarCap US Corp HY YTW – 10 Year Spread (beginning in 1987), Conference Board Consumer Confidence, Consumer Price Index, NFIB Small Business Job Openings Hard to Fill (beginning in 1976), Private Housing Authorized by Building Permits by Type, US Federal Funds Effective Rate, US Initial Jobless Claims, US New Privately Owned Housing Units Started by Structure, and US Unemployment Rates.

Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

October 23, 2020