5 Times in Life When You Need Financial Advice

Here are some times when seeking a financial advisor can help you avoid financial setbacks.

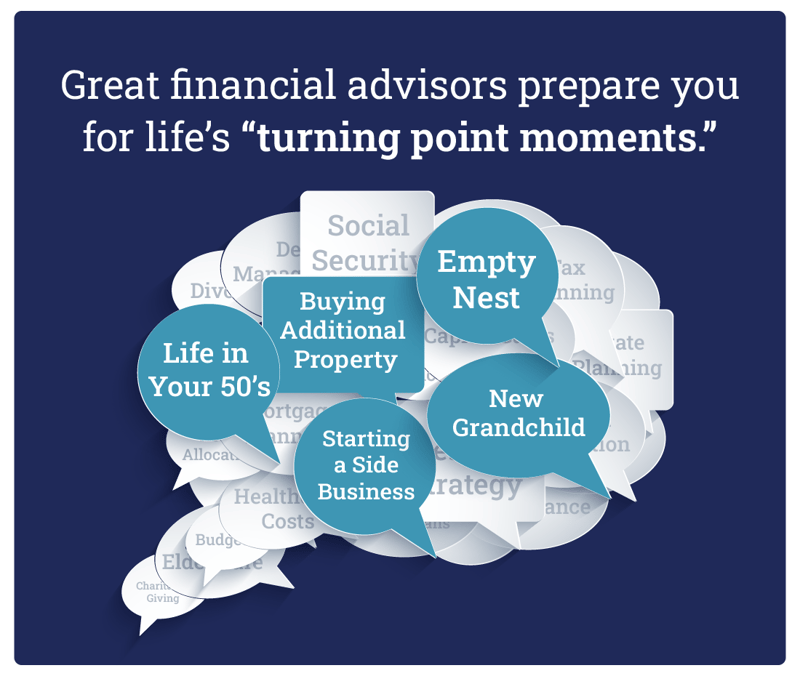

There are many times in life when you will have to make important decisions about your finances. At mid-life, these turning points can become more complex as you juggle home ownership, career concerns, paying for college, saving for retirement, and caring for elderly parents or other family members.

While you may have previously taken key financial steps on your own, the financial decisions you make at this stage have higher stakes: With retirement approaching, you have less time to recover from any mistakes. Here are some times when seeking a financial advisor can help you avoid setbacks.

1. Empty Nest

The cost of raising a child from birth to age 17 is more than $300,000 on average, so once your last child heads to college or moves to their first apartment, you might want to take stock of your finances.

It's the perfect time to consider things like:

- Downsizing to an apartment, townhouse, or condominium

- Assessing your retirement accounts

- Paying down debt

- Reviewing your insurance coverages

Partnering with a great advisor can change your life!

Fees. Motivations. Legal standards. Our new “5 Keys to Selecting the Right Financial Advisor” guide contains everything you need to know about who you should partner with.

Yes, show me how to assess my current financial situation.

Our Retirement Planning Checklist helps you keep track of all the important things you need to prepare to retire as well as assess your overall current financial situation.

Allworth’s proactive wealth management is comprised of personalized financial and investment strategies. This means that when you partner with a fiduciary Allworth advisor, you receive an investment game plan that is unique to your individual goals and needs. That’s because our entire approach to advising was created with maximum flexibility and the personalized preferences of our clients in mind.

Some firms have an entirely passive approach. This could limit your investment options or mean that your balance of assets quickly strays far from your ideal allocation. This could cause you to become dangerously “overweight” in, for instance, a volatile or underperforming asset class.

2. Buying Additional Property

For many, earning so-called passive income — through a commercial or residential investment property — may look good on paper, but there are risks involved with this type of investment that need to be thought through. Or maybe you've always wanted to own a vacation home at the beach or in the mountains. Whatever your real estate dreams, it will take some financial planning to make the most of your new property investment.

From saving for a down payment and applying for a mortgage to identifying a business structure and managing your property, many factors could determine whether the investment becomes a true asset or a liability. A financial advisor can take a holistic view of your financial picture to help you develop a real estate investment strategy.

3. Starting a Side Business

Thinking about starting your own business or launching a side gig? You're in good company — research shows people who create startups in their 50s enjoy a similar success rate as their 20-something counterparts. But when taking this new professional step, it's important to consider how you're funding the business and the implications for your personal assets and retirement accounts.

If the business were to fail, how would it affect your retirement timeline? Would you have sufficient time to replenish your savings and meet your retirement and other life goals? If it's more of a hobby than a new career, how much can you afford to invest in it? And what happens if it ends up being more successful than planned? Talking to a financial advisor can help you minimize the financial risks as you take this exciting new step.

Do all advisors add equal value?

The answer is, “No.”

That’s because some professions that call themselves “advisors” are in-reality 100% commission-based stockbrokers or even insurance salespeople with no motivation to improve your overall financial well-being – often only recommending proprietary, commission-based investment products.

When you decide it is time to hire a financial advisor to help you increase your wealth and to expertly manage your overall financial life, we recommend you start by hiring a full-time fiduciary advisor like Allworth – one that has the experience and infrastructure in place to help move your whole wealth forward.

Learn the 7 key financial considerations you must understand when planning for your future.

Your current and future financial well-being (enjoying today while also preparing for retirement) largely depend on whether you understand a handful of concepts related to money, debt, investing, and planning.

4. Life in Your 50s

When you're in your 50s, retirement — and related financial decisions — loom larger than before. That's true whether you're married, single, or divorced, working in your longtime profession, or starting a second or third career.

By consulting an advisor, you can assess whether you're on track to support your retirement goals through your retirement and investment accounts and anticipated Social Security income. You can also determine whether your mix of retirement and non-retirement accounts will help minimize your tax position when you stop working and make adjustments as needed.

Of course, if you reach your 60s without connecting with a financial advisor, the second best time to do so is now. It's never too late — or too early — to address any longstanding debt, make catch-up contributions, or identify ways to increase your income before retirement.

Are you in your 50s or 60s and in need of a financial plan? Learn why more than 20,000 clients have chosen Allworth Financial for financial guidance.

5. New Grandchildren

For parents, one of the most exciting milestones is when their children start having families of their own. Whether you're eagerly anticipating your first grandchild or you're already enjoying quality time with the new generation, you might want to consider how — and when — you're going to share your financial legacy. Have you saved for birthday and holiday gifts? How about travel expenses for summer visits or holiday vacations? Is your home suited to hosting the extended family, or is it time to upgrade the kitchen or add an extra bedroom?

If your main concern is your grandchild's education but you're not sure about the difference between a 529 plan and a custodial account such as a Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA), an advisor can help sort the options. Whatever the vehicle, you will want to ensure your generosity has the maximum benefit for your little ones while not impacting your own retirement and savings goals.

Financial clarity for ALL of life's moments

As critical as these five scenarios may be, this list is not exhaustive. After all, life is full of changes – both expected and unexpected. But you don’t have to go through them alone. In our free financial planning guide, get a glimpse inside the 7-step planning process that our advisors have used for decades to confidently navigate our clients through their own personal turning points.

Quickly learn:

- How to easily calculate your retirement income needs

- The essentials of investment risk management

- Money-saving, forward-thinking tax planning

- And more!

Looking for more information? You can sign up for the Allworth Financial newsletter or connect with an advisor.

A complimentary consultation could change your life.

Investment allocations. Savings rates. Retirement and Social Security planning. Virtually every one of our more than 20,000 clients nationwide began their Allworth partnership with a free, no obligation consultation.

.svg)

.svg)

.svg)

.svg)