After a Volatile 3 Days, Is It Time to Make Big Changes?

The past few days have rattled the markets—and understandably, many investors are starting to wonder if now is the time to take action. When headlines are dramatic and losses feel sudden, it’s only natural to question your plan. But moments like these are precisely when staying grounded and informed matters most.

Allworth Chief Investment Officer Andy Stout provides some data on an historic past three trading days, and what it could mean moving forward.

Markets Panic: Should You?

We understand last week’s market reaction has made some investors very nervous. That is normal, but letting emotions dictate your investments can lead to costly decisions (i.e., selling at the wrong time). There are many things we believe all investors should keep in mind:

- Your portfolio was not built to predict headlines but to weather them

- Markets move in cycles, and this is part of a typical cycle

- The current environment needs to be understood (more on that in a bit)

- We are here for you – let us know immediately if you want to talk about your investment strategy

President Donald Trump’s tariff plans lift the average effective tariff rate from 2.3% to 22%. This larger-than-expected move caused stocks to suffer the steepest decline since the throes of Covid in March 2020, as large-caps fell 6% on Friday and 10.5% on Thursday and Friday. Markets had a bit of a reprieve on Monday but still declined 0.2%.

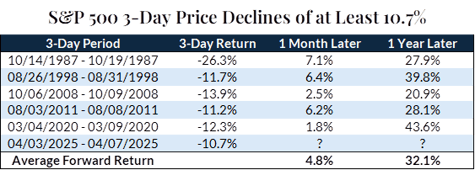

While nothing can ever be guaranteed, it’s interesting to note that there have now been ten total occurrences since 1950 when stocks fell more than 10.7% in a three-day period. These occurred across five distinct groupings. To avoid double counting, only the first occurrence in each grouping was considered in the table below—and patient investors were rewarded each time.

It’s clear that the president’s tariffs introduced a new level of economic uncertainty, and that’s what markets are attempting to price into the equation. Rather than fixate on one potential outcome, we find it beneficial to analyze possible scenarios and end-game goals through game theory, with these being the more likely ones:

- Strategic Stalemate: Tariffs remain selective, and partial deals are reached. This leads to ongoing economic and inflation uncertainty without a full-blown trade war.

- Tariff Escalation (Trade War): High tariffs provoke a strong, lasting retaliation, causing long-term economic disruption and sustained inflationary pressures.

- Grand Bargain: Tariffs lead to comprehensive trade agreements, improving trade terms and contributing to economic stability.

- Manufacturing Revival: Tariffs are used as a long-term lever to encourage domestic production and reduce reliance on foreign supply chains. This could reshape the industrial base over time, but it may contribute to higher input costs and near-term inflation.

- Congressional or Judicial Intervention: Courts rule against certain aspects, or Congress moves to limit presidential tariff authority through new legislation. This results in a reversal of tariff policy and a potential decline in inflation and economic uncertainty.

- US Unilateral Retreat: US tariffs are withdrawn without meaningful concessions, easing trade tensions and reducing inflationary pressure globally.

- Partners Capitulate: Trade partners quickly meet US demands to avoid further escalation. This reduces short-term trade uncertainty and inflation pressure, but it may raise concerns about future negotiation dynamics and supply chain stability.

We believe the most likely outcome could be a mix of these scenarios since trade partners rarely act in unison:

- Fragmented Response: Some trade partners retaliate, others negotiate or partially concede, and the US somewhat softens its stance, leading to an uneven global response that prolongs uncertainty and creates sector-specific inflationary pressures.

The Federal Reserve must also consider all these scenarios, and it appears the committee is taking a wait-and-see approach. On Friday, Fed Chair Jerome Powell said that policymakers are not in a hurry to change interest rates. Presently, markets have priced in four quarter-point rate cuts this year, with the first occurring on June 18th.

Large-cap stocks are 17.6% lower than the February 19th record high as of Monday’s close. An analysis of prior significant declines from peak levels reveals that markets tend to bounce back from sharp selloffs. That said, we would not be surprised if there is more turbulence in the near term.

While additional volatility is possible, attempting to time the market could have a negative impact on your financial goals. There’s a reason people say that it’s not about timing the market but time in the market—because it’s true.

Every investor would love to avoid all the downside and enjoy nothing but gains. Unfortunately, that’s nearly impossible, mainly as some of the best days occur after broad selloffs. So, trying to miss the move lower could inadvertently result in missing some of the best days.

While markets will continue to digest the shifting policy landscape, remaining disciplined and focused on your financial plan matters more than ever. Volatility is uncomfortable, but it’s also part of normal market cycles. If you have questions about your portfolio, the current environment, or anything else—we’re here to help. Reach out anytime.

This information is meant for educational purposes and not as direct tax or legal advice. Rules and regulations can shift anytime, so it’s always best to consult a qualified tax advisor, CPA, or attorney for guidance tailored to your specific situation.

All data are from Bloomberg unless otherwise noted. Past performance does not guarantee future results. Investments involve risks, including market, credit, interest rate, and political risks. For more information, please refer to Allworth Financial’s Form ADV Part 2.

Past performance may not be indicative of future results. Asset allocation does not ensure profits or guarantee against losses; it is a method used to manage risk. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment, investment allocation, or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Allworth Financial), will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Advisory services offered through Allworth Financial, an S.E.C. registered investment advisor. A copy of our current written disclosure statement discussing our advisory services and fees is available upon request. Allworth Financial is an Investment Advisor registered with the Securities and Exchange Commission. Securities offered through AW Securities, a Registered Broker/Dealer, member FINRA/SIPC.

February 09, 2026

Why a Single Withdrawal Rate Isn’t Enough and What to Do Instead

February 09, 2026

Why a Single Withdrawal Rate Isn’t Enough and What to Do Instead

Relying on a single withdrawal rate can leave your retirement plan exposed to market swings, but a bucketed approach helps protect short-term income …

Read Now February 03, 2026

Why a Real Financial Advisor Matters in an AI World

February 03, 2026

Why a Real Financial Advisor Matters in an AI World

AI can be a powerful tool, but when it comes to building a personalized, adaptable financial plan, there’s no substitute for the judgment, …

Read Now January 26, 2026

Funded Contentment: The True Definition of Wealth After Retirement

January 26, 2026

Funded Contentment: The True Definition of Wealth After Retirement

True wealth in retirement isn't about reaching a number, but about building a financial life that funds your values, priorities, and peace of mind. …

Read Now