Allworth Chief Investment Officer Andy Stout gives you an in-depth update on where things stand with inflation.

We are all looking forward to the day when our Monthly Market Update can, if not totally ignore inflation, then at least view it as an afterthought and push it back to where it stood for some 40 years: the end of the line of our chief economic concerns.

Unfortunately, today is not that day. That’s because the Federal Reserve (Fed) may have won the battle, but has it won the war?

To begin: Consumer inflation (CPI) peaked last June at 9.1% and has since fallen to 5%.

A few indicators suggest the Fed has won the war against inflation. For example, the difference between traditional treasury bonds and treasury inflation-protected securities (TIPS) is the breakeven inflation rate. That’s the inflation rate the bond market estimates over different periods, and it points to a continued move lower in inflation. Inflation expectations are 2.9% over the next 12 months and 2.2% over the following 12 months.

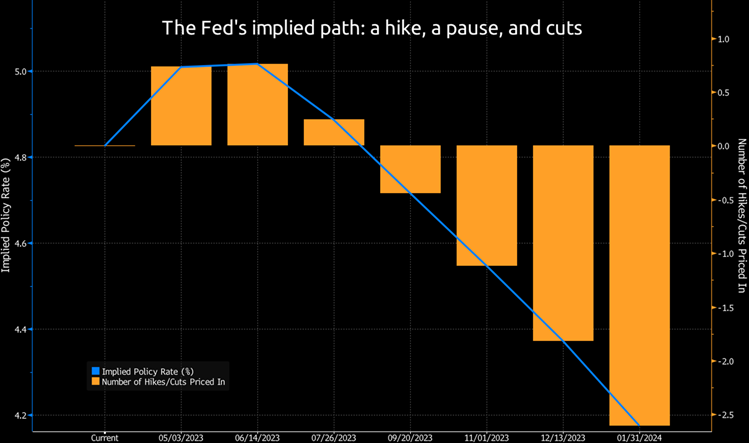

In addition, Wall Street traders buy and sell securities called fed fund futures, and their prices show what traders expect the Fed’s rate hike path to be. Currently, the implied path is about a 70% chance of a quarter-point hike on May 3rd, followed by a brief pause, and then approximately three quarter-point rate cuts over the next nine months.

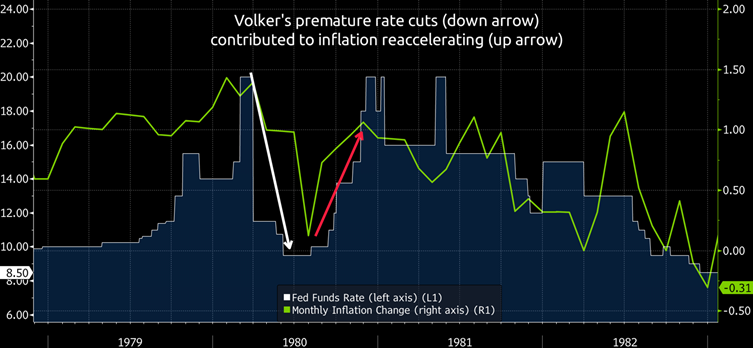

We believe the market might be ahead of itself regarding rate cuts. At his press conference following the Fed’s last meeting, Chair Jerome Powell stated that no members had a rate cut in their forecast. In addition, Powell has repeatedly mentioned the 1970’s policy errors, by then Fed Chairs Arthur Burns and William Miller, that led to the high inflationary environment of the early 1980s. Powell appears set not to repeat those same mistakes.

It wasn’t until Paul Volker took over the Fed that inflation was finally under control. But contrary to popular opinion, Volker also made a mistake: For instance, inflation started to drop in the first half of 1980, and the economy fell into a recession, so Volker quickly cut rates from 20% to 9.5% from March to June of 1980. Unfortunately, inflation immediately increased after those rate cuts, forcing Volker to lift rates back to 20%.

Chair Powell appears determined to kill inflation and, not surprisingly, is reluctant to lower interest rates, especially because there are signs that inflation could persist at a higher-than-normal level.

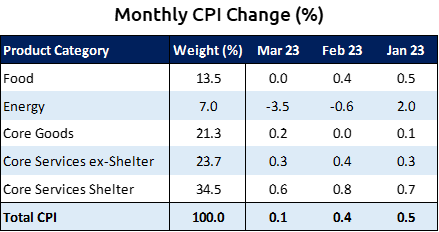

Overall, March’s CPI release was encouraging on many levels, as total consumer inflation increased by just 0.1% for the month and 5% over the past year. Other month-over-month inflation highlights include egg prices falling 11%, energy expenditures declining 3.5%, and shelter costs increasing at their slowest pace since April 2022. We expect further shelter disinflation as price increases in lease agreements begin to slow.

However, the Fed has recently honed in on core services (ex-shelter) as a key indicator in determining how entrenched inflation is in the economy. Unfortunately, there’s been little reprieve here, as it’s hovered between 0.2% and 0.4% over the past six months. The Fed needs this to decrease more to conclude inflation is under control.

Other inflationary measures have also improved. For example, producer inflation (PPI) declined 0.5% in March compared to February, pushing the 12-month change from 4.9% to 2.7%.

Based on the current environment, we believe the Fed will hike one more time and pause for the remainder of the year, even if there is a mild economic slowdown.

Even though we believe that’s the path, we also understand how the market can expect about three rate cuts this year. It would be the midpoint of our baseline scenario (no hikes) and a severe credit crunch. The Fed could cut rates by about 2% this year if a financial crisis erupts.

Leading economic indicators are data points that move before the broad economy does, and they currently point to economic weakness. How much of a slowdown we experience may depend on the cost of money and the availability of money.

The Fed has made the cost of money quite expensive, increasing the likelihood of a slowdown. The availability of money is dependent on how much banks lend out. The failure of Silicon Valley Bank, Signature Bank, and Credit Suisse is forcing banks to shore up their balance sheets. As a result, bank lending will likely decrease. The depth of a potential economic slowdown depends on how much banks pull back their lending.

We’ll continue to monitor many other factors besides the Fed’s policy, but one that we want to point out is earnings. Wall Street expects earnings for the first quarter to have declined by 8.2% compared to 2022’s first quarter.

Usually, about 70-75% of large-cap companies report better-than-expected profits, so it’s not surprising that companies often report better earnings (orange line) than expected earnings (white line).

Meanwhile, analysts believe sales will rise by 1.9%. Increasing sales and decreasing earnings means profit margins will contract.

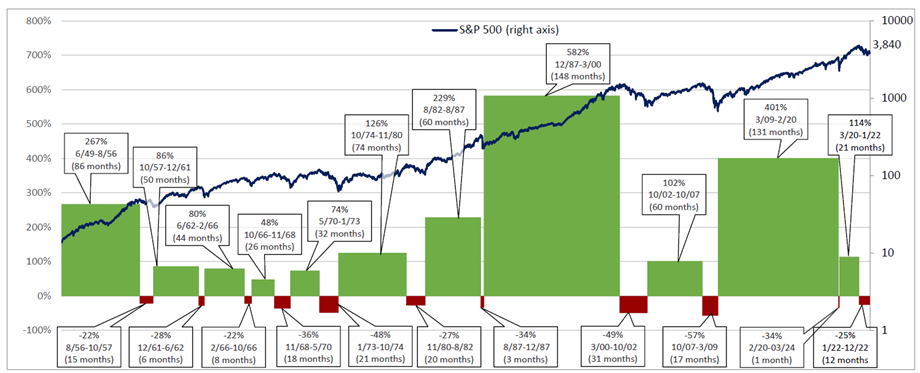

We are clearly in an uncertain environment with many possible outcomes, which is why it’s critical that you have the right investment mix of stocks, bonds, and cash to not only withstand market volatility but so you’re invested during market rallies.

Below is a chart of the S&P 500 tracking the last seven decades, but I could have used other indexes to make my point, as well.

The key is to stay invested and stick with your plan. While it’s certainly true that selloffs can be challenging, history shows again and again that markets move higher much more often than they move lower.

April 14, 2023

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now