Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024.

At the beginning of this year, many investors were worried about what the future may hold because of 2022’s challenging environment for both stocks and bonds. That’s a normal feeling because people tend to overemphasize recent events while overlooking historical data.

2023: A brief look back

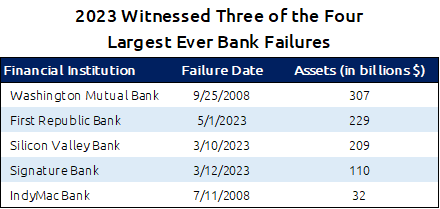

This year has had its fair share of fits and starts. 2023 got off to a solid start, but trouble quickly hit when small regional banks began to feel the pain of the Federal Reserve’s rate hikes. In less than two months, from March 10th to May 1st, three of the four largest bank failures occurred.

Stocks and bonds quickly recovered from that setback; however, markets faltered just a few months later, as the Fed indicated that interest rates would stay higher for longer than most people expected.

But fortunately, inflation continued to decelerate, allowing the Fed to shift away from rate increases, which introduced a brief pause, before suggesting three rate cuts in 2024.

This was the primary catalyst for the markets’ rally that began in late October.

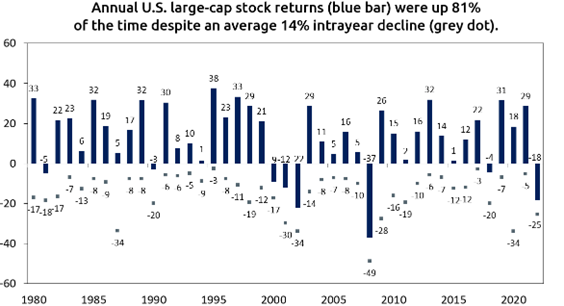

While there are still a couple of weeks left in 2023, the market turbulence experienced this year was typical. This year’s most severe decline from high to low prices for large-cap stocks was 10.3%. Since 1980, that intrayear drop has been 14%, but stocks still had positive returns 81% of those years.

The takeaway is that instead of placing too much weight on the recent past, you should focus on the long run to help avoid costly, emotional decisions.

Over the longer run, one of the primary reasons that investors have benefited from the equity markets is that corporations have increased their earnings while successfully navigating an ever-evolving economic landscape. That’s what we’ve seen this year, as the year-over-year growth in earnings has turned positive and is expected to continue to climb over the next year. Of course, that might change depending on how the economy responds to future challenges.

Rate cuts ahead

The most notable headwind is the high interest rate environment the Fed created to reduce inflation. Fortunately, consumer inflation has plunged from its 9.1% peak in June 2022 to 3.1%. Based on the committee’s meeting this past week, the Fed clearly believes rates have been raised enough for inflation to continue decelerating. In addition, the Fed signaled that its next move will be a cut.

This shift away from rate hikes was evident in a few ways. First, the Fed altered the text in its official statement by adding the word “any” to this phrase: “In determining the extent of any additional policy firming…” This means that rate hikes are now more of an afterthought than a forethought.

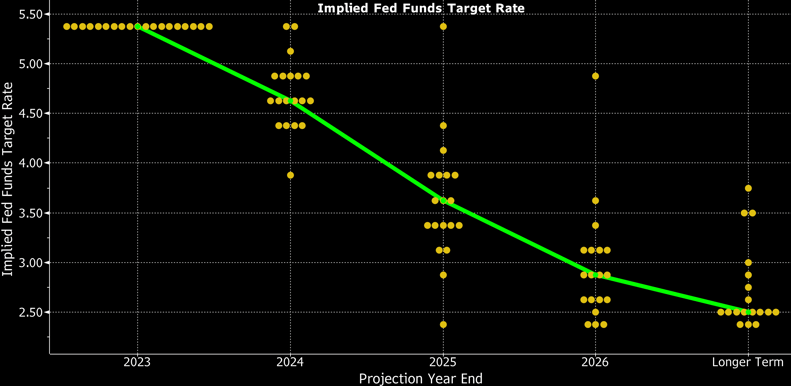

Second, the Fed revised its dot plot to indicate it would cut rates by 0.75% next year. We observe this projection by focusing on the median dot, identified by the green line in the chart below. This 0.75% decline is a significant deviation from the prior median dot plot, which suggested rates would only be 0.25% lower than our current level.

(The dot plot anonymously shows where each Fed member thinks rates should be at the end of upcoming calendar years.)

Lastly, if there was still any doubt about the committee’s thinking, Fed Chair Jerome Powell erased it in his post-meeting press conference. He stated that the Fed’s base case is that rate hikes are done. He also said the committee’s conversation focused on the extent and timing of rate cuts.

The rationale behind rate cuts

There are two prevailing – but contradicting – opinions on why the Fed will cut: the US will avoid a recession (i.e., soft landing), and the US will not avoid a recession (i.e., hard landing).

The Fed seems to believe it has engineered a soft landing, which is an elusive spot where the Fed raises rates enough to quell inflation without causing a recession. Under this scenario, the Fed can cut rates because the committee won the battle against inflation and no longer needs a restrictive monetary policy stance.

There are reasons for the Fed to feel this way. The primary one is the resilient job market. While it has slowed during the Fed’s aggressive rate hike campaign, the unemployment rate remains historically low at 3.7%. This has allowed consumer spending to keep the economy afloat. After all, consumer outlays comprise about 70% of the total US economy.

Though the Fed believes a recession will be averted, some economists think and history suggests otherwise. The Fed has achieved a soft landing only once over the past 50 years, in the early-to-mid 1990s. Every other rate hike cycle resulted in a recession.

Those economists predicting a recession are taking into consideration that rate hikes have a lagged effect on the economy of around 9 months. In other words, at least 0.75% of hikes haven’t made their way into the economy.

Also, while the labor market is strong, cracks are forming. For instance, employers have been adding fewer and fewer jobs throughout the year, the number of job openings has dropped to a 2-year low, and the amount of people collecting unemployment benefits has been trending higher.

Consequently, those economists believe that rate hikes will keep pressuring the job market, eventually resulting in more layoffs and declining consumer spending. As a result, they believe the Fed will have to cut rates to boost the economy, likely more than the 0.75% the dot plot suggests.

How to think about 2024 and beyond

There is no question that economic risks are high, but to be fair, they’ve been elevated for about a year, and the economy has continued to grow. Though the timing is highly uncertain, there will eventually be a slowdown.

We won’t attempt to predict the exact timing of a recession; that’s a fool’s errand. Instead, we will stay true to our disciplined investment process using quantitative and qualitative data analysis. This allows us to avoid market timing pitfalls and behavioral finance traps, such as recency bias (overemphasizing recent events and underemphasizing historical relationships).

Our approach gave us a deep understanding of the regional banking crisis and the Fed’s interest rate path, allowing us to take advantage of the robust stock and bond rally this year. This type of perspective is imperative so your investments can support your financial goals.

December 15, 2023

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now October 20, 2023

October 2023 Market Update

October 20, 2023

October 2023 Market Update

Allworth Chief Investment Officer Andy Stout gives you a closer look at when you should - and shouldn't - consider cash as an 'investment.' One …

Read Now