Allworth Co-CEO Scott Hanson explains why debt is about to get more expensive.

The impact of a quarter-percent interest rate hike on your finances may seem trivial, but it isn’t.

Especially if it’s both part of a larger trend of rate hikes and coupled with record inflation.

The fact is, if you have debt you are soon going to be paying more to service it. And, depending on things like your credit score, income, and the amount of your obligations, these expected interest rate bumps will quickly add up to serious money.

How so?

The Federal Reserve (Fed) is our central banking system, and, quite simply, it’s arguably the most powerful economic institution in the world. Comprised of 12 regional Federal Reserve Banks that work in tandem (but which are each responsible for a different region of the United States), the Fed regulates banks and monetary policy. And it has just announced that it’s going to start ramping up short-term interest rates beginning this March.

And this is all intended to help curb the impact of white-hot inflation.

Briefly, interest rates play a foundational role in how much it costs to borrow money (including not just how much those monthly payments will be, but how much of those payments go to principal, and how much of those payments go to interest).

Raising interest rates will increase the cost of borrowing money, which (the thinking goes) will decrease demand, and a decrease in demand should in turn lower prices (never mind the supply chain issues for now).

There are, of course, other implications. For instance, raising interest rates can also contribute to a decrease in the demand for products (and borrowing), in part because good savers, enticed back into investment alternatives that may now offer better returns, may again be enticed to save more.

All clear?

Some experts believe that the Fed will increase interest rates up to four times this year. No one knows for certain, but those rate boosts may be 0.25% each time, or they could get aggressive and be as high as 0.50%, or more.

But for borrowers – people and businesses that are in debt – who have enjoyed near-record low interest rates for years, these hikes are going to hurt.

How so?

Assume that the Fed increases interest rates four separate times this year. Also assume that each increase is a quarter of a percent, so that at the end of the year, rates have gone up by 1%.

Meh. What’s 1%?

Let’s take a look at a credit card example since these typically come with variable interest rates that follow what the Fed does. Say you have $10,000 in credit card debt at a 16% APR (and you’re paying $200 a month towards that debt). It will not only take you 83 months to pay off that amount, but you’ll also have to pay about $6,600 in interest.

If your APR gets boosted by just 1% to 17%? Now it will take an extra five months (88 months) to pay that amount off; and, all other things being equal, you’ll have to pay almost an extra $1,000 in interest ($7,500) to do it.

And what if the Fed gets even more aggressive and rates go up 1.5% this year?

This all returns me to inflation. Because, frankly, that isn’t likely going away any time soon.

In December alone, inflation rose 7%. That means that the groceries, clothes, and hardware you once purchased for $3,000 likely now cost you $3,210.

Now, consider that inflation isn’t expected to slow down in the near term. And that means that even if that 7% was a high-water mark (and no one is saying it was), some compound increase will likely continue for the foreseeable future.

Simply, you could quickly be spending $300, $400, $500, or more, even much more, each month, than you were just a year ago.

Finally, I’d like you to consider the combined costs of both inflation and those higher interest rates on debt.

These changes are serious business.

Right about now is when I would typically say that I am not trying to scare you. But in my 30 years as an advisor, my experience has clearly been that times like these that are rife with economic policy changes – even changes that may seem small, slow, and insignificant – are the ones that impact personal financial situations the most over time.

Just beware, especially if you have debt, that changes are coming. Get proactive. And if you are in debt, now is the time to talk to your creditors about lowering or keeping your interest rates low.

And please speak with your advisor.

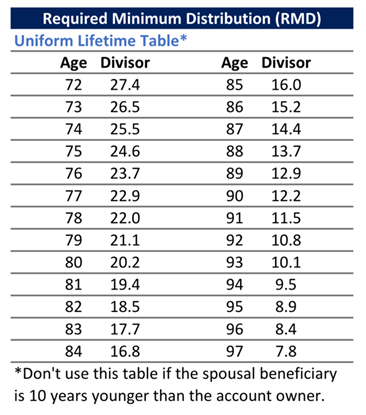

A quick word about new RMD tables for 2022

Are you taking a Required Minimum Distribution (RMD) from your retirement account (or one you inherited) this year?

There have been changes for both account holders and beneficiaries.

If you don’t have an advisor, these tables (and up-to-date information) are not only confusing, but they are surprisingly difficult to find online.

Below is a uniform lifetime table to use as a starting point.

You can also find a 2022 RMD calculator here, but just remember, mistakes are costly, and this should only serve to help you estimate your distribution. Always speak to your advisor, accountant, or fiduciary financial professional before taking an RMD.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

November 01, 2024

Should you be using a Donor-Advised Fund for charitable giving?

November 01, 2024

Should you be using a Donor-Advised Fund for charitable giving?

Learn more about a charitable giving strategy for high-net-worth investors that offers flexibility and significant tax benefits.

Read Now September 24, 2024

Alternative investments: The need-to-knows

September 24, 2024

Alternative investments: The need-to-knows

Are alternative investments right for your portfolio? Allworth Partner Advisor Victoria Bogner, CFP®, CFA, AIF®, helps you answer the question.

Read Now May 23, 2024

How underspending (yes, underspending) can ruin retirement

May 23, 2024

How underspending (yes, underspending) can ruin retirement

Allworth co-founder Scott Hanson tackles a problem that you wouldn’t think would be an issue: Not spending enough money in retirement.

Read Now