Allworth Chief Investment Officer Andy Stout explores the prospect of peak inflation, rate hikes, rate cuts, and the effect they could all have on the markets.

Peak inflation?

Like me, you’re probably pleased to be spending much less at the pump than just a few weeks ago. In fact, my 16-year-old daughter not only welcomed these lower prices, but she even asked me whether they would keep dropping or go back up.

Of course, no one can answer that with absolute certainty. However, it does beg the big question that’s probably on your mind these days: Has inflation peaked?

The answer is probably yes, and… probably no.

Let me explain this juxtaposition.

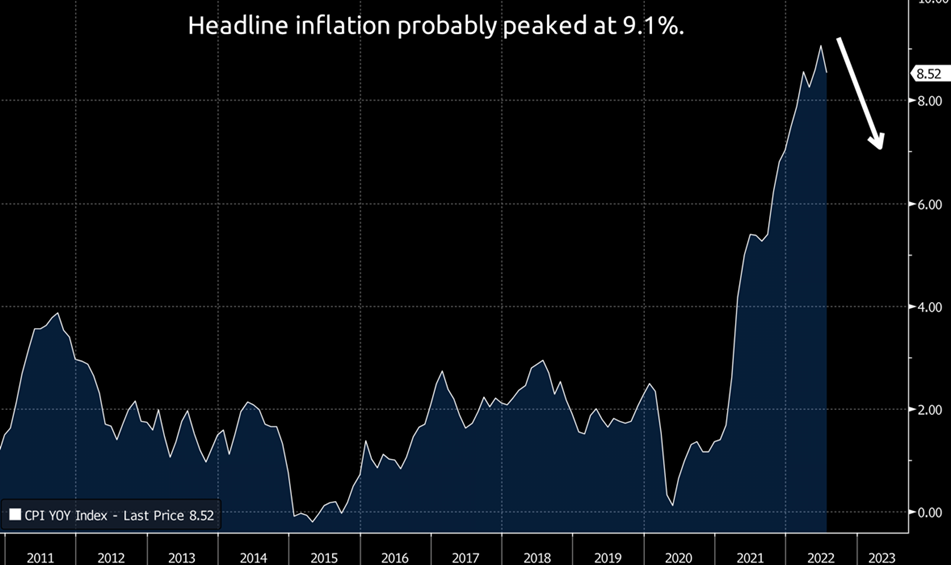

Headline consumer inflation (CPI) stalled last month, showing no change compared to June. As a result, on a year-over-year basis, inflation declined from 9.1% to 8.5%. One of the most significant reasons for the drop in CPI was energy prices fell by 4.6%. (Based on today’s gasoline and oil prices, energy may push the year-over-year change in CPI even lower once we get August’s CPI print.)

So, in terms of headline inflation, the 9.1% reading in June was likely the peak.

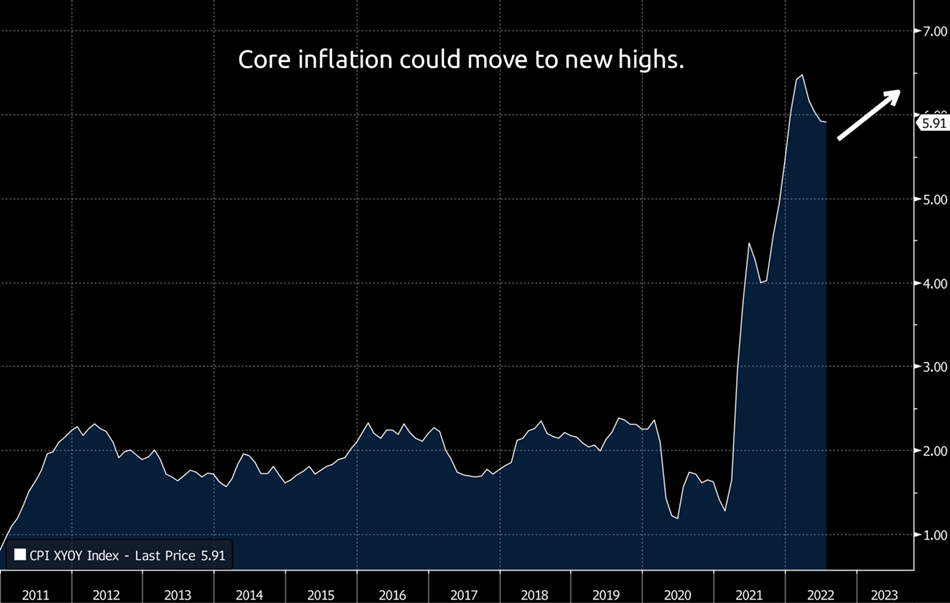

However, it’s a different story when we exclude energy prices. Therefore, we also must analyze Core CPI, which is also inflation, only with energy and food price changes excluded. (We do this because energy and food prices tend to be highly volatile and can be misleading when exploring the implications for the Federal Reserve’s potential interest rate path.)

In March, Core CPI hit its highest level of the year at 6.5%, yet it has since fallen to 5.9%.

That’s, of course, good!

Unfortunately, this inflation measure may increase in the months ahead for the following reasons; the first being simple math. In August and September 2021, the monthly change in Core CPI barely moved, and those readings will soon drop out of the year-over-year change.

Another reason is that housing and rent prices are trending higher. While housing price inflation might slow due to mortgage rates nearing their highest levels in 13 years, the same isn’t true for rental costs. That’s because, first, the rent portion of CPI is poised to move up because landlords typically adjust rental leases at the end of the lease’s term and, second, because the government incorporates changing rents into the CPI calculation with a lag.

In other words, higher rental costs impact inflation over time, and not all at once. Further, shelter costs comprise a staggering 41% of core inflation, so their impact cannot be understated.

Lastly, average hourly earnings are proving sticky and slowly making their way into other areas of the economy.

All this evidence suggests that the peak in core inflation could still be a few months away.

What will the Fed do?

As it’s responsible for both stable inflation and keeping the economy at full employment, our nation’s central bank is in a tough spot. Admittedly, we’re far from stable inflation, but, as evidence by the recent 3.5% unemployment rate, one could argue we’re at least near full employment.

But this economic environment would be expected to allow the Fed to raise interest rates to fight inflation, and that’s precisely what the committee has done. But we’re also at a point where some leading economic indicators are signaling a slowdown may lie ahead. So, in simplest terms, the Fed needs to raise rates to tame inflation, but at the same time, it also runs the risk of slowing down the economy too much.

Regardless, the Fed has made it clear that its top priority is to quell inflation. This determination is why the Fed has raised the fed funds rate by 2.25% this year.

The market expects the Fed to remain aggressive for a few more months before slowing down. Specifically, there is about a 50% chance of either a 0.5% or 0.75% rate hike at the Fed’s next meeting on September 21. However, it appears we’re at the beginning of the end because the market is pricing in rate cuts starting mid-2023.

How might markets respond?

Rate hikes and cut cycles are nothing new, and, historically, markets have cheered rate cuts. Case in point, since 1970, following every initial rate cut, the S&P 500 enjoyed an average return of nearly 15% over the next 12 months.

Rate cuts are also good for your bonds because bond prices and interest rates usually move in opposite directions. In other words, when rates go down, bond prices typically go up.

It’s more complicated than that, however. What matters more is how interest rates move relative to expectations. For example, bonds struggled in the first half of 2022 because the Fed raised rates much more aggressively than anticipated.

At the beginning of 2022, the market expected the Fed would raise rates by 0.75% for the entire year. However, thanks mainly to Russia’s unjustified war on Ukraine, inflation has proved quite resilient, so the Fed has already increased rates by 2.25% just since the start of January. So, looking ahead, even if the Fed hikes rates further, bonds could still perform well, just so long as these hikes are less than what’s been forecast.

What should investors do?

Based on today’s backdrop, history suggests the short-to-intermediate term could be a friendly environment for investors. However, always remember that things can quickly change. One only has to look at the Russia-Ukraine war to realize how an unanticipated event can shake markets to their core. Therefore, your investments must be appropriately positioned for multiple economic scenarios, including and especially the things we call the “unknowable unknowns.”

August 19, 2022

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now