Allworth Chief Investment Officer Andy Stout explains the potential impact the coronavirus could have on the global economy - as well as here at home.

Back in November when I was getting my flu shot, I never imagined the markets would shift from worrying about the trade war to worrying about the coronavirus.

While this epidemic (officially designated COVID-19) is of course extremely troubling from a humanitarian perspective, economically it remains less so – at least so far here in the United States.

It’s understandable to want to compare this outbreak to 2003 and the SARS epidemic, but that’s not the best comparison. One reason it’s not comparable is because SARS was far less serious.

In totality, there were 8,098 reported cases and 775 deaths attributed to SARS. Unfortunately, the reported cases and number of deaths from the coronavirus outbreak are already both much higher. (These numbers will continue to climb, but at the time of this writing, there are close to 77,000 confirmed cases and approximately 2,200 deaths attributed to this outbreak.)

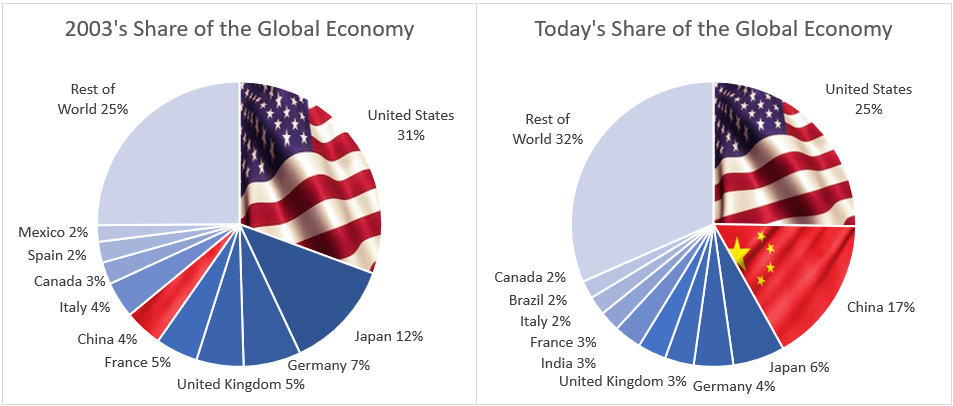

Another reason comparing the coronavirus and SARS is difficult is, from an economic point of view, China’s economy is much different today from what it was in 2003. In 2003, China’s economy was just 4% of global GDP, but since then, it’s grown to account for 17% of global GDP.

China’s surging role in the global economy since 2003, coupled with the large absolute number of infected people, means there is, unfortunately, a greater potential for global workforce and supply chain disruption.

One key concern is that Chinese factories produce about 20% of intermediate products, which is more than any other country. (An intermediate product is a product that becomes part of the supply chain for another product.)

The problem is that we here in the U.S. are even more reliant on China than other countries, as approximately 30% of our intermediate products are manufactured there.

The fact is, we’re already seeing global supply chain disruptions. A few weeks ago, Hyundai halted production in South Korea because it ran out of the parts it gets from China.

Apple is also already experiencing supply chain problems. True, Apple’s manufacturing facilities in China have all reopened, but they have done so at a slower-than-expected pace. (This is part of the reason Apple said it will not meet its previously provided quarterly revenue guidance for the first three months of the year.)

These supply chain problems are partly because China has essentially quarantined off the manufacturing-heavy province of Hubei from the rest of the world. For some perspective, the population of Hubei – almost 60 million – is about equal to the combined population of California and New York. (Apple’s facilities are not in Hubei.)

Should China’s containment efforts succeed in quelling the virus, economists estimate that China’s first-quarter economic growth will come in closer to 4.5% instead of the 6% that was originally forecast. While this seems high compared to the 2% growth in the U.S., the 4.5% growth would be a record low for China. What’s unknown is how much money the Chinese government will pump into its economy to offset the impact from this coronavirus.

Make no mistake, other countries will also feel the pinch. Not surprisingly, Hong Kong will take the biggest hit because of its close ties with China. The expected drag on first-quarter global GDP is about 0.4%. In the U.S., the economic impact is expected to be less severe at only -0.2% in the first quarter.

The U.S. is a relatively insular country. Most of our economic growth comes from spending by consumers like you. This consumer spending (including residential spending) makes up about 73% of our total economy. It’s currently expected that the U.S. economy will grow around 1.5% in the first quarter, but growth should improve to about 2% for the remainder of 2020.

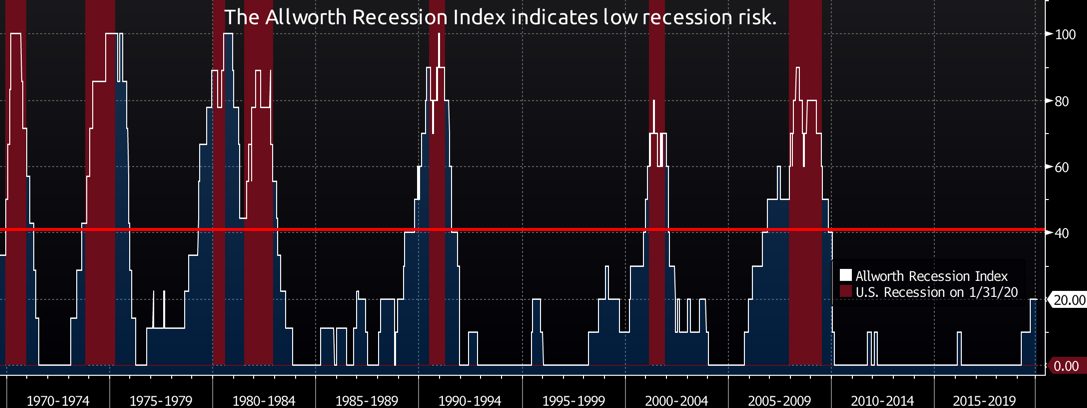

At Allworth Financial, we continually analyze the markets and the economy. One way we do this is by studying leading economic indicators, which are data points that move before the broad economy moves. This analysis led to the creation of our proprietary recession index.

The Allworth Recession Index tracks 10 major leading economic indicators that represent different areas of the economy, such as housing, jobs, confidence, and financial conditions. The combination of these 10 indicators forms a powerful index that has historically warned us of recessions about eight months before one occurred.

Our index is still pointing to growth over the next six to nine months, but there is some risk, as 20% of the indicators are signaling an economic slowdown. The Allworth Recession Index would suggest a recession in the near term when more than 40% of the individual leading economic indicators point to a recession.

Back in November when I got my flu shot, I certainly didn't plan on getting sick (so far, so good!). However, certainly in the United States, the coronavirus wasn’t something that could have been anticipated. Fortunately, unlike a pathogen, you can prepare for your financial future. By following the plan that you and your advisor create, you will be better positioned to enjoy your life and retirement to the fullest.

All data from Bloomberg. The Allworth Recession Index is made up of leading economic indicators, which are data points that have historically moved before the economy. The index value is calculated as a percent of the indicators that are sending signals that suggests recession risk is elevated. When the index value is greater than 40%, we believe there is a greater chance for a recession in the next six to nine months. All data begins by 1971 unless noted below. The indicators that make up the Allworth Recession Index are the 3-Month Government Bond Yield, 2-Year Government Bond Yield (beginning in 1976), 10-year Government Bond Yield, BarCap US Corp HY YTW – 10 Year Spread (beginning in 1987), Conference Board Consumer Confidence, Consumer Price Index, NFIB Small Business Job Openings Hard to Fill (beginning in 1976), Private Housing Authorized by Building Permits by Type, US Federal Funds Effective Rate, US Initial Jobless Claims, US New Privately Owned Housing Units Started by Structure, and US Unemployment Rates.

Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

February 21, 2020

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now