Allworth Chief Investment Officer Andy Stout discusses the end of the longest economic expansion ever and what that means for you.

In a shock to absolutely no one, the U.S. economy is now in a recession because of the coronavirus.

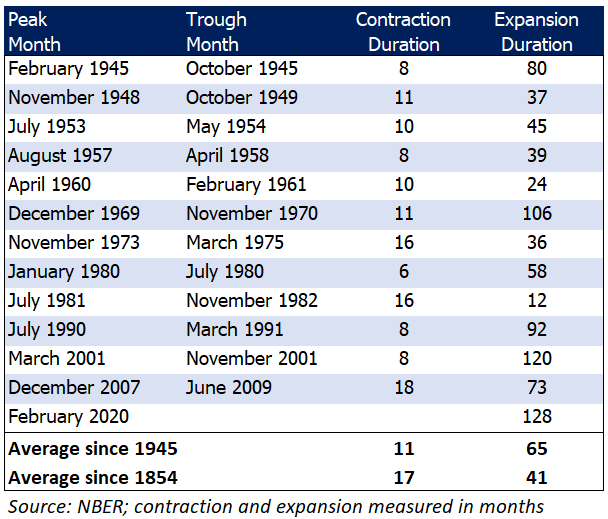

The National Bureau of Economic Research (NBER) announced that the record-long, 128-month economic expansion officially came to an end in February. Now that we’ve slipped into a recession, after such a long expansion, the pragmatic question is: How long will the recession last?

The average contraction in the U.S. since 1854 is 17 months; however, more recent recessions have been shorter. In the post-World War II era, the average recession has been 11 months.

The shortest recession on record is six months, but many economists believe this recession could be even shorter.

(Contrary to popular belief, a recession is not defined as two consecutive quarters of negative Gross Domestic Product - GDP - growth. Instead, the NBER analyzes multiple economic data points, including personal income, employment, industrial production, wholesale-retail sales, and GDP.)

The response to stemming the spread of the coronavirus caused the U.S. economy – and most of the rest of the world – to come to a complete stop. Now that the economy is reopening, economic data is likely to improve. Improving data – at least compared to the depths of the stop in April – could mean the recession ends sometime in the second quarter.

The economic data leading up to the coronavirus crisis was exceptionally strong, but it came to an immediate halt. For example, the unemployment rate went from a 50-year low (3.5%) in February to the highest level since the Great Depression (14.7%) in April. Further, retail sales and industrial production both experienced their sharpest monthly drop ever in April.

Fortunately, the economy is already showing signs of life.

While businesses cut payrolls by a record 21.7 million in April, they added a record 2.5 million in May. To be fair, the economy has a long way to go to undo the massive damage caused by the economic stop.

The decline in GDP for the second quarter is currently expected to be around 40% on an annualized basis. A decline of this magnitude means that the economy probably won’t be back to 2019 levels until 2022 at the earliest.

If the May jobs data does mark the turning point for the economy, then GDP growth should see a marked improvement in the third and fourth quarters of the year, possibly around 10-15%.

Even if the recession ends in the second quarter, the NBER likely won’t determine if it’s over for many months. Since the NBER’s inception in 1978, the bureau has declared an end to recessions usually about 15 months after the recession had already ended.

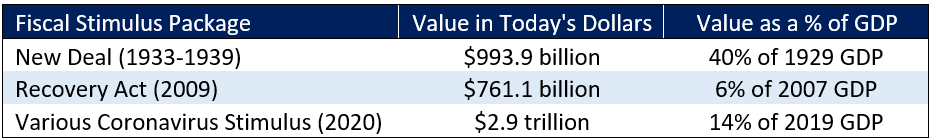

What might determine if the recession is short lived is government support. Congress has passed $2.9 trillion of aid for the economy. For perspective, this is the most amount of fiscal stimulus ever, even after adjusting for inflation.

The stimulus passed this year is only about 1/3 the size of FDR’s New Deal when measured as a percent of GDP, though. Given that there are still about 21 million people unemployed, it might be necessary for Congress to approve more stimulus so the economy is able to climb out of this recession.

The Federal Reserve (Fed), our nation’s central bank, is also supporting the economy.

The Fed is doing this by purchasing trillions of dollars of bonds to keep interest rates low. This has resulted in the Fed increasing its balance sheet from about $4 trillion (earlier this year) to a record $7.1 trillion. The Fed will need to keep short-term interest rates at zero for many more months to help support the economy.

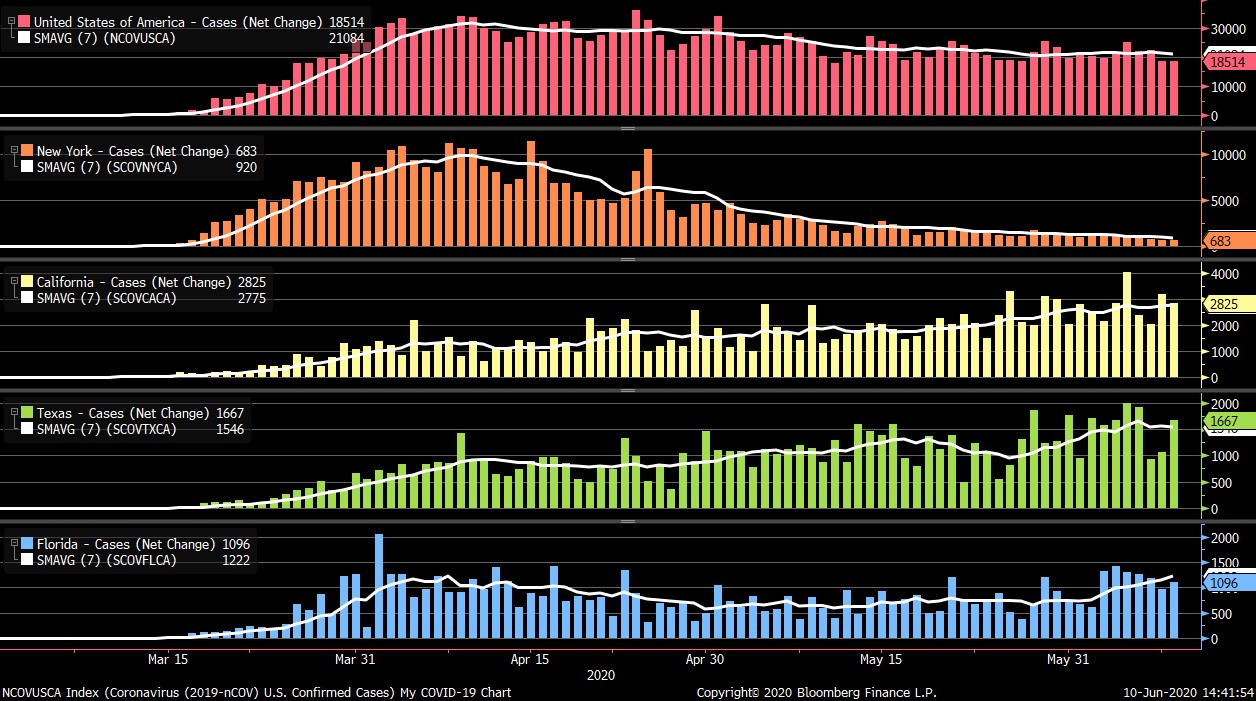

The exiting of the recession could be contingent on not just governmental support but also on a reduction in coronavirus cases.

New daily cases of COVID-19 in the U.S. have flattened; however, different states have different results. For example, new cases in New York have substantially decreased while California, Texas, and Florida are seeing more new infections (the white line represents the 7-day moving average of new daily cases). This suggests a real risk of a second wave.

Given all this economic information, what should investors do?

For investors, the word “recession” often incites fear, panic, and poor decision making due to behavioral finance. However, it’s important to remember that the economy is not the market. Case in point, often, the best buying opportunities occur during recessions. Historically, markets have struggled during the beginning part of a recession, but they often violently recover when investors least expect it.

Since 1945, the market has peaked about seven months before the onset of a recession and recovered about four months before the recession came to an end. The coronavirus recession saw the stocks peak in the same month the recession began.

If the March 23 "bottom" holds (there is, of course, no guarantee), the market decline associated with the recession will have been the shortest ever at just about one month. However, the 34% decline in large-cap stocks is close to the average recession-induced drop of 30% (going back to 1945).

Whether or not the March 23 bottom is the “final bottom,” it’s clear to us that patient investors who focus on the long run have the best chance of meeting their retirement goals.

All data unless otherwise noted is from Bloomberg. The Allworth Recession Index is made up of leading economic indicators, which are data points that have historically moved before the economy. The index value is calculated as a percent of the indicators that are sending signals that suggests recession risk is elevated. When the index value is greater than 40%, we believe there is a greater chance for a recession in the next six to nine months. All data begins by 1971 unless noted below. The indicators that make up the Allworth Recession Index are the 3-Month Government Bond Yield, 2-Year Government Bond Yield (beginning in 1976), 10-year Government Bond Yield, BarCap US Corp HY YTW – 10 Year Spread (beginning in 1987), Conference Board Consumer Confidence, Consumer Price Index, NFIB Small Business Job Openings Hard to Fill (beginning in 1976), Private Housing Authorized by Building Permits by Type, US Federal Funds Effective Rate, US Initial Jobless Claims, US New Privately Owned Housing Units Started by Structure, and US Unemployment Rates.

Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

June 12, 2020

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now