Allworth Chief Investment Officer Andy Stout examines the link between the economy and the Federal Reserve.

It is easy to feel disconnected from the Federal Reserve because its monetary policy decisions seem unrelatable. We know that what they decide will impact our lives, but why should we care?

Unresponsive? Or overly reactive? Or just unbalanced? Deciding to ignore the Fed’s policies could result in misguided investment decisions and a poorly constructed portfolio.

Which, of course, could lead you into a less secure financial position. Therefore, my goal with June’s Monthly Market Update is to help explain the complex interconnections between the economy and the Fed.

This matters.

Let’s begin by analyzing the Federal Reserve’s meeting from this past week when the committee announced it was keeping interest rates at their current level. However, be forewarned: A recent and unexpected shift in the Fed’s messaging projected anything but stability.

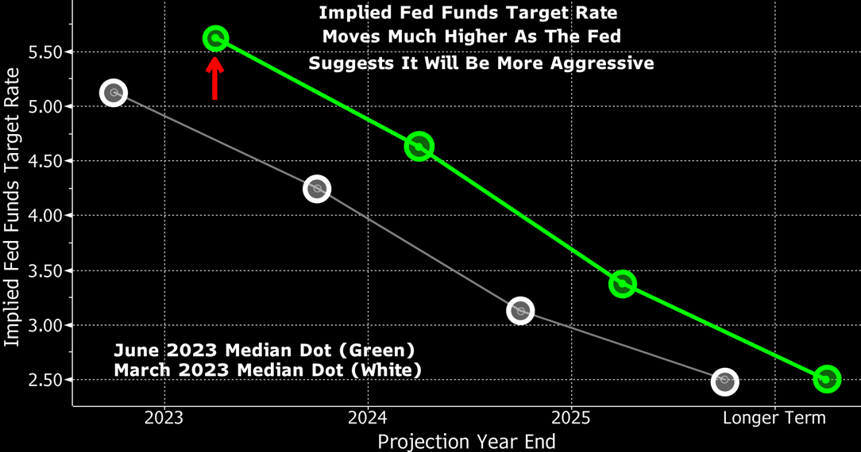

Specifically, the Fed updated its “dot plot” to suggest more future rate hikes than previously indicated. The dot plot shows where voting and non-voting members believe the fed funds rate should be at the end of the upcoming calendar years. We focus on the median, or middle dot, because it enables us to avoid placing undue attention on outliers.

The Fed’s prior dot plot update came in March, and it showed the Fed thought short terms rates would be in the range of 5 – 5.25%, which is where they currently reside. Wall Street analysts thought the Fed would lift the median dot by a quarter point, or 0.25%. However, the Fed signaled year-end rates higher by 0.5%.

It seems unlikely, but not impossible, that the Fed will raise rates by 0.5% more this year. That may not sound like a lot, but … it bears examination. Because what’s most probable is that the Fed will increase rates by 0.25% on July 26. If the Fed as a collective group is savvy and even wary that it might be telegraphing one more quarter-point rate hike, financial conditions would ease, resulting in an even more difficult battle to bring down inflation.

This too, of course, matters.

Nonetheless, the market has underestimated the Fed’s resilience all year. For example, just a few weeks ago, fed fund futures traded at levels suggesting no more hikes and even cuts of 1% before January 2024. But market pricing now suggests one 0.25% hike followed by a 0.25% cut by next January.

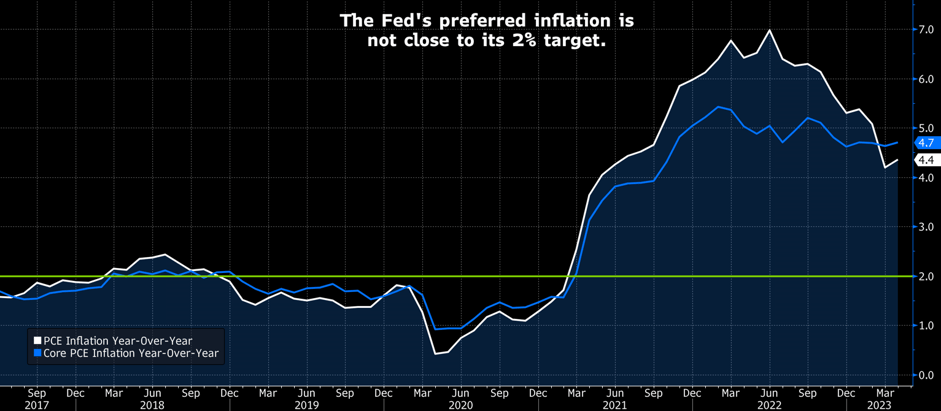

Of course, the Fed’s path will be determined by inflation’s evolution. The most recent inflation print came from the Consumer Price Index (CPI) this past week. It showed that consumer prices increased just 0.1% in May (compared to April), helping the year-over-year number decline from 4.9% to 4.0%.

This is much lower than last June’s 9.1% peak, but it’s still not where the Fed wants it.

The Fed targets a 2% inflation rate but prefers to measure inflation using PCE, not CPI. The committee likes PCE because CPI includes only out-of-pocket consumer spending. In contrast, PCE consists of consumer, business, and government spending, and PCE also takes into consideration changing consumer behaviors.

The government hasn’t yet released PCE for May, but April’s print stated that the 12-month change in PCE was 4.4 and 4.7% in Core PCE, which excludes food and energy prices. These are not close to the Fed’s target, and the Fed doesn’t believe PCE will get close to that level until 2025. The Fed thinks that by the end of 2023, PCE will drop to 3.2%, and Core PCE will come in at 3.9%.

We believe that the Fed could be underestimating how much inflation will decline this year. If inflation comes down more than expected, the Fed may raise rates one more time, but then pause for the remainder of the year.

However, if the Fed needs to be more aggressive with interest rates, the chance of a hard landing (i.e., recession) becomes much greater. Remember, when the Fed raises rates, borrowing for consumers and businesses becomes more expensive. It may not impact you personally right away, but it can. And then, consequently, nationwide, the demand for goods and services will come down because spending falls.

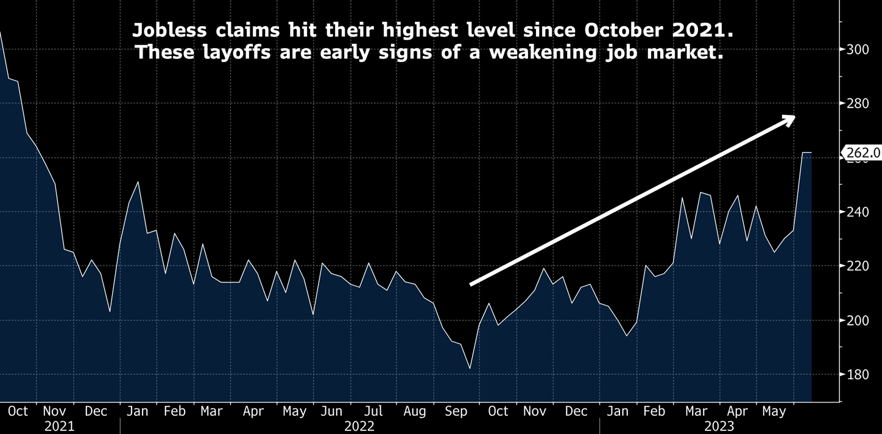

In turn, this leads to lower business revenue. Business profits are also hurt in today’s environment because they are unable to pass on all of the inflationary pressures. So, what could happen then? These companies could employ cost-cutting tools if earnings fall, including laying people off.

We’re already seeing a rise in the number of people filing for first-time unemployment benefits, with the most recent readings hitting their highest level since October 2021.

Banks then could become more cautious about who they lend to as more people are out of work and cannot afford loans. This vicious feedback loop results in even less spending and crashing consumer confidence. And, ultimately, the economy falls into a recession.

This has happened numerous times before. And, of course, the economy has always eventually recovered. This occurs for a few reasons. Some examples include spending from the federal government, businesses and consumers adapting to the environment, and, not surprisingly, the Fed cutting interest rates and employing other expansionary policies.

As you can see, the intricacies of the Federal Reserve’s reaction function and its impact on the economy are complex. And to be fair, I’ve only scratched the surface. There are significantly more factors that can and do affect the economy’s growth trajectory.

Be watchful. And speak with your advisor. Remember, we’ve seen this all before. And we will undoubtedly see this all again.

June 16, 2023

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now