Allworth Chief Investment Officer Andy Stout discusses what the latest COVID medical developments and the election mean for your retirement.

Like many of you, I’m still here working from my home office. I’ll admit that it’s turned out much better than I thought it would, as our team continues to be extremely productive. However, I find myself missing the natural collaboration and impromptu brainstorming sessions that come along with working out of a traditional office.

Of course, the pandemic-induced restrictions imposed by governments magnify these feelings. Fortunately, recent medical progress has many people feeling optimistic and the clouds of uncertainty are beginning to break apart.

Earlier this week, drug partners Pfizer and BioNTech announced that their vaccine was 90% effective. To put that into perspective, the FDA originally stated that a 50% effective rate would merit approval. Further, 90% efficacy is very similar to the mumps vaccine’s 93% effective rate. Presently, Pfizer and BioNTech are planning to ask the FDA for emergency approval use in the third week of November.

With 7.8 billion people in the world, more than one vaccine will be needed. There are 10 other vaccines in phase three trials (testing on several thousand people). Another vaccine of note is one being developed by U.S.-based Moderna. Like Pfizer and BioNTech, Moderna’s vaccine is based on using "messenger RNA."

It’s very possible that there could be more than one vaccine approved by the FDA prior to yearend, possibly Moderna’s. As you can see from the table above, half the phase three vaccines have been developed in either China or Russia and were approved by their countries for emergency use. FDA approval for those vaccines won’t occur until reliable data from additional studies is available.

What do these vaccines mean for the economy?

The short answer is that it’s a clear boost because it means people might spend less time looking at screens and more time out and about. Yes, it will take quite a few months for everyone who wants a vaccine to be vaccinated, so clouds of uncertainty will remain for the time being.

Should things continue to move in a positive direction, it’s possible that value stocks (like banks) and small-company stocks could do well because they are often more sensitive to economic growth. Remember, markets don’t wait for an “all-clear” signal from the economy. The full economic reopening should be priced in well in advance.

The government is split

With Joe Biden set to become the next president and Republicans appearing to retain control of the Senate, investors are assessing what that means for the economy and their investments. The market had been pricing in a "blue wave." In a Democrat sweep scenario, fiscal stimulus likely would’ve been very large, maybe around $3 trillion. This would’ve been positive for the economy (deficits are another story).

However, Republicans showed better than expected by (probably) keeping the Senate and capturing more House seats than most expected. At the time of this writing, there are two Senate seats where a winner has yet to be declared, but political pundits expect Republicans to maintain their majority.

Under this split government scenario, it’s likely there will still be a decent-sized stimulus package of perhaps around $1 trillion.

This is a good thing because it will take many months for enough people to be vaccinated. And as time passes, virus cases will continue to mount, and more businesses could be forced to shut their doors. This will keep the economy well below its full potential. Because of this potential economic constraint, and the 11 million people that are currently unemployed, there is a strong case for fiscal stimulus.

From an economic perspective, some investors were worried about higher taxes and how the markets might respond. But with Republicans maintaining their majority in the Senate, any plans that Biden had for higher taxes are likely dead on arrival.

As far as stock returns go, a split government has historically been a good thing for investors. Going back to 1980, large-cap stocks have enjoyed annualized returns of 10.6% when the government was split and 7.2% when the government was unanimous (same president and controlling party of the Senate and House of Representatives).

Your Retirement

Enjoying your retirement is what we strive to help you achieve. Some people are/were worried that the “wrong” party would control the White House, and some people are/were concerned that the world would never go back to the way it was.

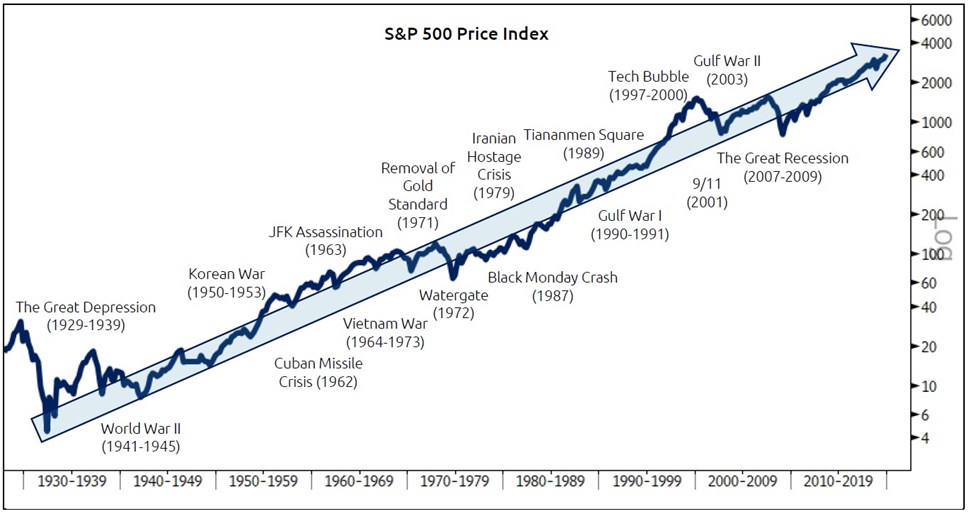

It’s normal to feel uneasy about those things, but it’s imperative to not let them influence your investment decisions. Over the past 100 years, patient investors have been able to enjoy retirement despite the countless issues to worry about.

Stocks Climb A Wall Of Worry

That’s why, at Allworth Financial, we stick to our disciplined process, sift through and avoid the noise that can cause emotional decisions, and focus on the future.

All data unless otherwise noted is from Bloomberg. The Allworth Recession Index is made up of leading economic indicators, which are data points that have historically moved before the economy. The index value is calculated as a percent of the indicators that are sending signals that suggests recession risk is elevated. When the index value is greater than 40%, we believe there is a greater chance for a recession in the next six to nine months. All data begins by 1971 unless noted below. The indicators that make up the Allworth Recession Index are the 3-Month Government Bond Yield, 2-Year Government Bond Yield (beginning in 1976), 10-year Government Bond Yield, BarCap US Corp HY YTW – 10 Year Spread (beginning in 1987), Conference Board Consumer Confidence, Consumer Price Index, NFIB Small Business Job Openings Hard to Fill (beginning in 1976), Private Housing Authorized by Building Permits by Type, US Federal Funds Effective Rate, US Initial Jobless Claims, US New Privately Owned Housing Units Started by Structure, and US Unemployment Rates.

Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

November 13, 2020

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now