Allworth Chief Investment Officer Andy Stout takes an objective look at today’s economy and what might lie ahead.

As I watched the news last week with my wife and children, one of my kids made a comment about how the world seems so depressing. Sensing the opportunity for a teachable moment, we then began to discuss how what you see on tv, or read online, is intentionally tilted to scare you because fear helps to boost ratings and leads to an increase in advertising revenue.

That conversation served as the inspiration for this article, which is neither blindly optimistic nor unnecessarily pessimistic. Instead, it’s a fact-based analysis of our current economic situation.

The Growing Disconnect Between Main Street and Wall Street

High inflation, Covid, elevated valuations, tensions with China, potential tax hikes, and the possibility that the Federal Reserve (our nation's central bank) will raise interest rates. All these economic threats, and others, have people wondering why the stock market remains at or near a record high.

While all the above are genuine concerns that could cause market turbulence, there are two critical mitigating factors that have helped lift the market: Robust earnings growth and low recession risk.

Record Corporate Profits

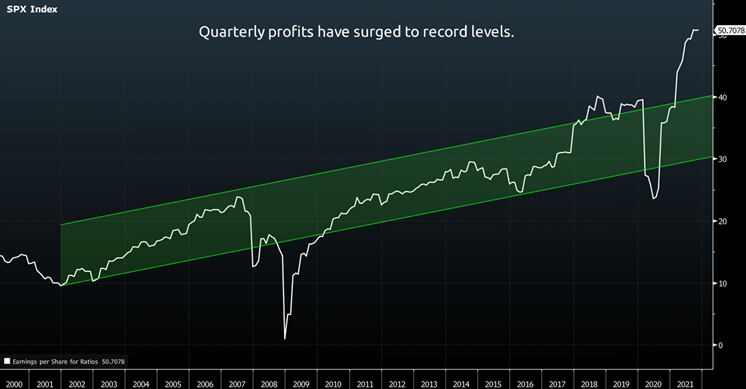

A stock’s trading price is directly related to the amount of money that company makes both today and in the future. In other words, there is a tendency for a stock’s price to increase if its earnings are growing. In the chart below, we can see that quarterly profits for large-cap companies skyrocketed from last year’s economic shutdown to above-trend levels.

Above-trend earnings are not a bad thing, as it shows corporate America has adapted to the pandemic environment. However, there is some risk to profit margins if workers demand higher wages.

Fortunately, from a stock investors’ perspective, companies can pass on those higher prices to consumers, helping keep healthy margins. The ability for earnings to keep pace with inflation is why many investors consider stocks one of the better hedges against inflation. But, of course, should inflation run too hot, there will eventually come a time when demand destruction manifests, and consumers stop paying higher prices for goods and services.

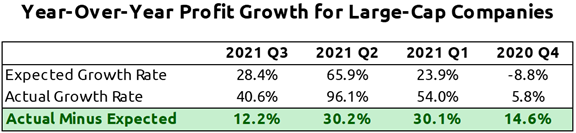

It’s not enough for growing earnings to lift stocks, but profits need to be better than what Wall Street expects. The following table shows expected profit growth heading into earnings season compared with realized growth. As you can see, large-cap companies have reported year-over-year profit growth that has materially outpaced forecasts.

So far, we’ve checked off two boxes: robust earnings growth and better-than-expected earnings growth. A third factor is future earnings expectations, which can influence stock prices more than past earnings. The following chart shows forecasts of earnings over the next 12 months. As you can see, Wall Street is expecting record-level profits.

Low Recession Risk

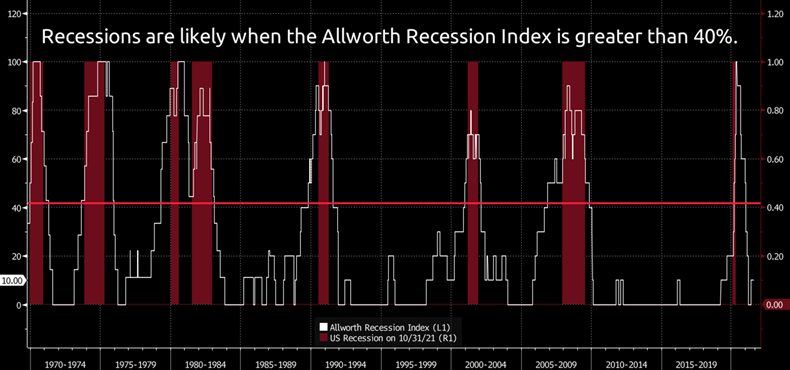

Another vital factor supporting current stock price levels is that there is a low probability of a recession over the next six to nine months. Of course, high recession risk is strongly correlated with declining future corporate profits because, if the economy slows down, companies make less money as consumers and businesses spend less.

We analyze recession risk by studying 'leading economic indicators.' Leading indicators are data points that move before the broad economy does. For example, one of the top leading indicators is the difference in yields between the 2-year Treasury and 10-year Treasury bonds.

Recession risk is elevated when the 2-year yield is greater than the 10-year yield.

At Allworth Financial, we’ve created a proprietary index made up of ten individual leading economic indicators. When more than 40% of these indicators suggest that recession risk is high, an analysis of history shows that a recession has typically occurred, on average, within seven months.

Fortunately, only one of the ten indicators currently points to a slowdown (the indicator in question has flagged a downturn because of rising inflation).

The Path Ahead

The data indicate a growing economy and robust corporate profits in the coming months. But, to be objective, we acknowledge there are risks.

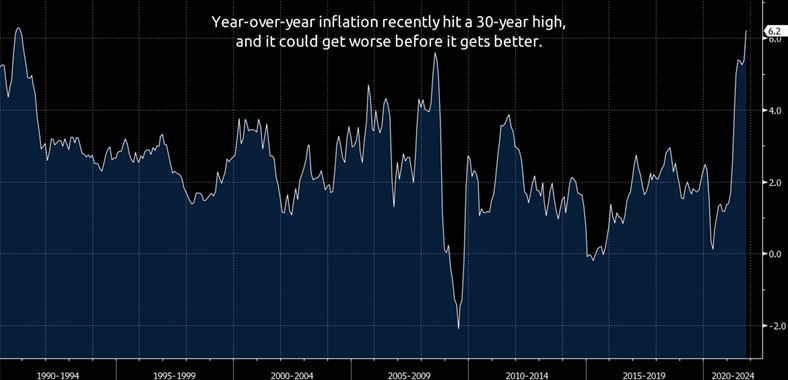

Inflation is one of those risks. The year-over-year change in the Consumer Price Index (CPI) recently hit a 30-year high at 6.2%. We believe this number will increase over the next two months because of base effects, meaning the relatively low monthly changes (+0.2%) from November and December 2020 will drop off and be replaced by higher inflation prints. We expect inflation will increase in 2021’s final month because of continued supply chain issues and a strong demand for goods.

Additionally, we closely watch consumer inflation expectations because higher inflation expectations can become a self-fulfilling prophecy, causing core inflation to remain high for longer than expected. Unfortunately, the New York Fed’s October Survey of Consumer Expectations revealed that consumers think inflation will be 5.7% over the next year.

This reading is the highest since the data series began in 2013.

We believe the most likely path is that due to supply chain normalization, increased energy output, and an improvement in the labor shortage, that inflation will begin to moderate in the second half of 2022.

Under this scenario, the Federal Reserve could hike short-term interest rates in July 2022. While inflation and other risks can induce market volatility, low recession risk and growing profits are more important for markets.

However, as the economy evolves over the next year, the big picture will undoubtedly change. Therefore, it will be critical to monitor corporate earnings guidance, along with the other leading economic indicators, to help determine if any changes to your portfolio are required.

Please call us if you have any questions.

November 19, 2021

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now