Allworth Chief Investment Officer Andy Stout outlines the latest on the debt ceiling negotiations, and explains how we're protecting your money.

The markets have finally started to take notice of the debt ceiling drama, and understandably, you may have questions about it. So, I wanted to share with you the Allworth Investment Committee’s perspective on this pressing topic to help address your concerns.

X-date

Congress established the debt ceiling in 1939 to provide fiscal oversight of the government’s spending and borrowing. Since then, Congress has raised the debt limit 98 times, but it wasn’t until the past few decades that it became a political weapon.

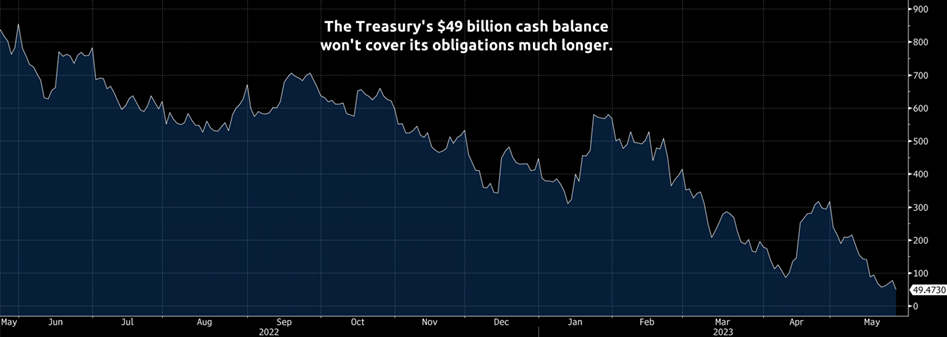

We are now just a few days away from what’s known as “X-date,” or the day the Treasury’s extraordinary measures will no longer be able to meet its obligations unless Congress raises or suspends the debt ceiling. Treasury Secretary Janet Yellen estimates that X-date could be as soon as June 1, and that’s when the Treasury will need to make some tough decisions.

Because the Treasury won’t be able to issue debt to pay all its obligations, it will have to cut something. On June 1, our government is obligated to pay $101 billion for Medicare, military, and social security. There is also $117 billion of maturing Treasury bills due that day. The Treasury will probably receive about $20 billion in revenue then, and it currently has only $49 billion in cash, so it wouldn’t be surprising if that’s the X-date.

No one knows with certainty when X-date will occur, but it will happen in the absence of a deal. The government might be able to push back the X-date by moving some things around; Goldman Sachs estimates the Treasury can pay its obligations until June 8 or 9.

X-date consequences

If X-date arrives, many analysts believe the government will reduce spending in other areas, like Social Security payments, to make payments on our outstanding debt. After all, US Treasury bonds are considered the safest instruments in the world, not missing any payments since 1789.

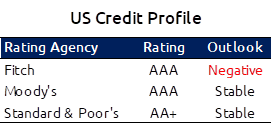

Unfortunately, our government’s creditworthiness is already being called into question, as rating agency Fitch said the US’ AAA rating was in jeopardy. Consequently, they moved the US to “ratings watch negative” yesterday. In 2011, during another debt ceiling scare, Standard & Poor’s downgraded the US from AAA to AA+. Moody’s, the third major rating agency, has made no adjustments so far.

There is no blueprint for the government to follow in this situation. President Joe Biden would be responsible for prioritizing payments if the ceiling is hit. He will likely decide to keep paying our outstanding debt, resulting in tens of millions of people who rely on some form of federal government payments not getting fully paid. This could include the approximate 70 million receiving social security benefits and 50 million getting other forms of assistance, such as housing assistance, Medicaid, and food stamps (now called SNAP).

As a result, millions of people could lose their jobs as an already-vulnerable economy slips into a recession.

The economic situation would be far worse if President Biden decided not to make payments on outstanding Treasury bonds. The world’s “financial plumbing” is quite complex, and US Treasuries lie at the heart of it. Specifically, countless global financial transactions use US debt as collateral, allowing financial institutions to borrow and lend easily. So, a default could cause the global economy to grind to a halt.

Debt ceiling resolutions

Some people have proposed non-traditional ideas to get around the debt ceiling, such as a trillion-dollar coin and interest-only Treasury bonds. Theoretically, the Treasury can mint coins in any denomination. It could then deposit that trillion-dollar coin to pay its obligations. Issuing interest-only bonds appears more feasible, and they wouldn’t count toward our nation’s debt because there’s no principal. But, unfortunately, this solution won’t work because it would take too long to figure out the logistics for it to work correctly.

Then there is the 14th Amendment, which states, “The validity of the public debt of the United States…shall not be questioned.” Therefore, some argue that the US should be able to keep paying principal and interest payments on its outstanding Treasury bonds regardless of the debt limit. However, legal experts are split on whether that would stand up in court, and the economic damage would already be well underway by the time it made its way to the Supreme Court.

That leaves us with politicians compromising as the most viable solution. Republicans want spending cuts, and Democrats prefer lifting the debt ceiling with no strings attached. There will eventually be a solution somewhere in the middle, but the timing is uncertain.

The most likely outcome is what we’ve been through many times: an 11th-hour deal. That could be either a short-term extension or a longer-term resolution. If a deal is struck a few days before June 1, there might not be any negative effects. But the closer we get, the more likely it is to damage the economy and cause market volatility.

What we’re doing to help protect your money

We reduced your exposure to ultra-short-term Treasury bonds this week. In addition, we shifted a portion of your stocks to funds we believe are better suited to withstand market turbulence earlier this year.

We’ve also contacted the custodians where your money is held, including TD Ameritrade, Schwab, and Fidelity, to ensure that any of your funds in government money market funds were safe. These major custodians do not hold any Treasuries that mature on or around June 1. In other words, your money market funds are secure.

Importantly, your money is diversified, so you’re not overexposed to any single asset class. Further, you and your advisor have worked closely together to make sure you have the right investment mix to help meet your financial goals. Finally, it’s important to remember that we built your financial plan knowing there would be times like this when uncertainty is high.

Please reach out to your dedicated advisor if you have any questions about the debt ceiling, markets, your personalized financial plan, or anything else. We know you may have more questions, and we’re here for you.

May 25, 2023

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now