Allworth Chief Investment Officer Andy Stout tackles the famous last words: “This time is different.”

I love college football. Just last year, I was able – along with my dad and son – to attend an Ohio State game (sorry Wisconsin). Trips like this are some of my fondest memories. So, as a big fan, I was saddened when major college football conferences began to postpone their seasons.

Sad, but, as most of you fans probably weren’t either, not surprised.

After all, new daily coronavirus cases are still high, and other sports have had to make significant changes to be able to restart their seasons (e.g. the NBA bubble). That’s tough to do with young student athletes.

What we’re seeing in college sports is not that different from what we’ve seen in other areas of our lives, where we’ve been limited to not being able to do all the things we’re used to. This reminds me of a valuable economic lesson: The lesson is that this time is NOT different.

Sir John Templeton eloquently noted that:

"The investor who warns, ‘This time is different,’ when in fact it’s virtually a repeat of history, has uttered among the four most costly words in the annals of investing."

The upcoming presidential election is a perfect example.

People sometimes worry that if the “wrong” political party gains the White House, the stock market might be affected in some terrible way that we’ve never witnessed before. However, the data clearly shows that no matter which party is in office, on average, stocks have generated positive returns over time.

Not only that, history shows that trying to “time” the market based on who is president would have caused you to miss out on some large gains.

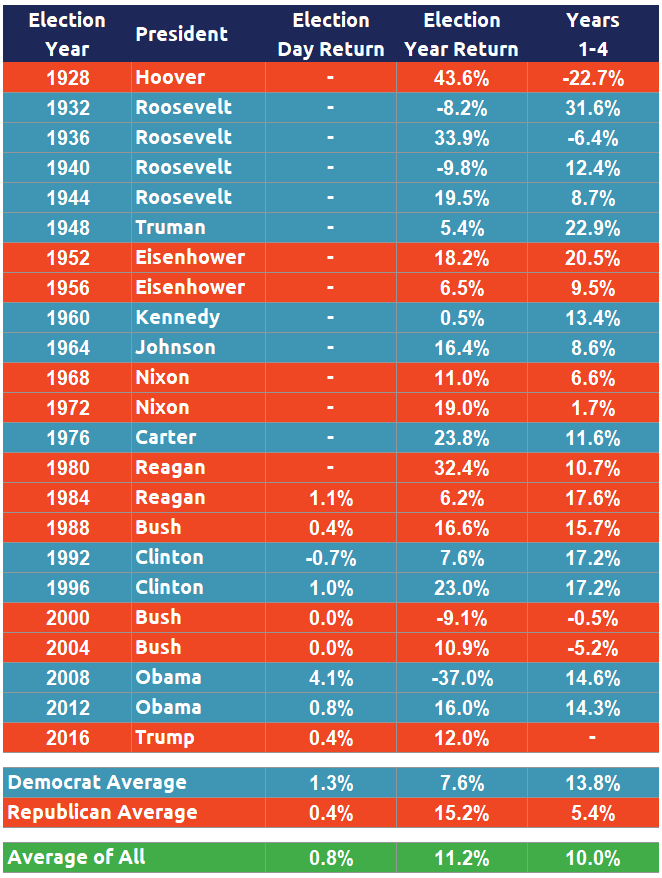

Over a full presidential cycle, stocks typically fared better when there was a Democrat in office. However, stock performance has been superior in election years when a Republican won the White House.

When looking at all the years together, it would have been a mistake to make a financial decision solely on the idea of which party controlled the White House. Stock returns have been positive on average regardless of the political party of the president.

It’s a common misconception that the president – or the president’s party – is the primary driver of the stock market. The reality is that there are many factors that are beyond any single person’s control – including the president’s – that affect the stock market, such as recessions, the Federal Reserve, corporate profits, interest rates, valuations, inflation, and non-financial events (e.g. 9/11 and the coronavirus).

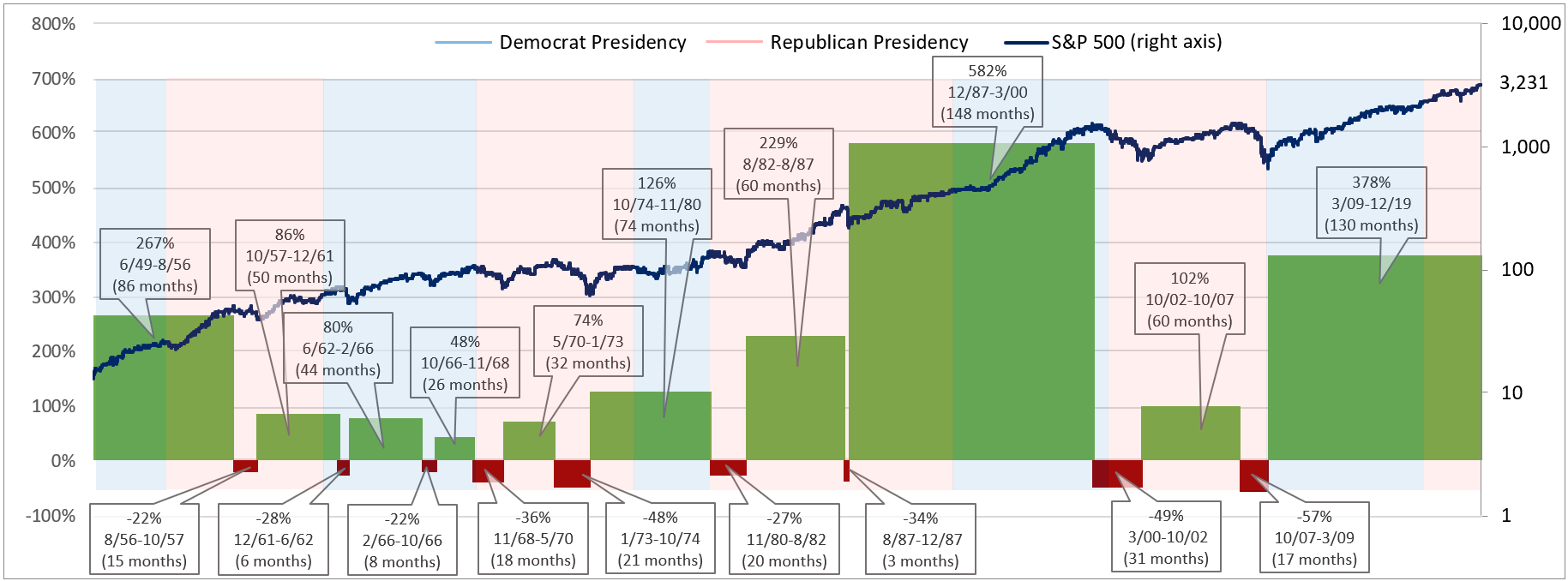

Looking back at the past 70 years shows that bull and bear markets have occurred during both Republican and Democrat presidencies. In other words, the regular ups and downs in the market have happened – and will continue to happen – regardless of who is in office.

All the possible things that might affect the markets over the next four years are anybody’s guess. In 2016, no one would have predicted we would be dealing with a global pandemic in 2020.

There are many things we are watching today, and obviously a lot of them center around the coronavirus. Much of the recent economic data looks very promising. The U.S. has seen a mind-boggling 9.3 million jobs added over the past three months. Also, the latest manufacturing and services data point to expansion thanks to robust business activity and new orders.

While on the surface, this is very strong, the recent data is simply reversing a portion of the economic decline we saw in the spring. For example, there were about 22.2 million jobs lost in just March and April, so the 9.3 million rebound still leaves the U.S. with about 12.9 million fewer jobs than what there were in February.

With the virus raging across the globe, a lot will depend on medical progress. Fortunately, there are a couple of decent therapeutics to help fight the virus (remdesivir and dexamethasone). There are also six vaccines in phase 3 (testing on several thousand people), and it’s expected that three of those could be approved for emergency use in the fourth quarter of 2020. (At the time of this writing, Russia has just registered the first vaccine, but the lack of a phase 3 trial has many scientists questioning its safety.)

Frontline workers, and those who are high risk, will likely receive the first batches of any vaccine, but mass distribution could be logistically challenging (it’s already challenging to get enough therapeutics to those most in need). This means that there is the potential for new virus cases to remain at very high levels, increasing the chances of a pullback in consumer and business spending.

This is all happening as the presidential election draws near. Yes, momentum could lift stocks even higher, but we believe that a well thought out investment portfolio based on a deep understanding of the connection between the economy and markets is required. That’s what our investment process and rebalancing process is designed around, and this is an integral part of our clients’ personalized financial plans.

Focusing on your financial plan – and not who is in office – is the best way for you to reach your retirement goals. After all, your money is neither red, nor blue; it’s green (and has no political preference).

All data unless otherwise noted is from Bloomberg. The Allworth Recession Index is made up of leading economic indicators, which are data points that have historically moved before the economy. The index value is calculated as a percent of the indicators that are sending signals that suggests recession risk is elevated. When the index value is greater than 40%, we believe there is a greater chance for a recession in the next six to nine months. All data begins by 1971 unless noted below. The indicators that make up the Allworth Recession Index are the 3-Month Government Bond Yield, 2-Year Government Bond Yield (beginning in 1976), 10-year Government Bond Yield, BarCap US Corp HY YTW – 10 Year Spread (beginning in 1987), Conference Board Consumer Confidence, Consumer Price Index, NFIB Small Business Job Openings Hard to Fill (beginning in 1976), Private Housing Authorized by Building Permits by Type, US Federal Funds Effective Rate, US Initial Jobless Claims, US New Privately Owned Housing Units Started by Structure, and US Unemployment Rates.

Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now