Allworth Chief Investment Officer Andy Stout discusses why you shouldn’t be so quick to forget 2020.

2020 has been a challenging year. I know I’ve been missing so many things that I took for granted like family birthday parties and graduations, lunch with co-workers, and a traditional Thanksgiving. Fortunately, with the vaccines right around the corner, we will someday soon be able to breathe a sigh of relief… and not through a mask!

With everything we’ve been through, it makes sense that everyone keeps saying that 2020 is a year to forget. But I would argue there have been invaluable financial lessons, making this a year we must always try and remember.

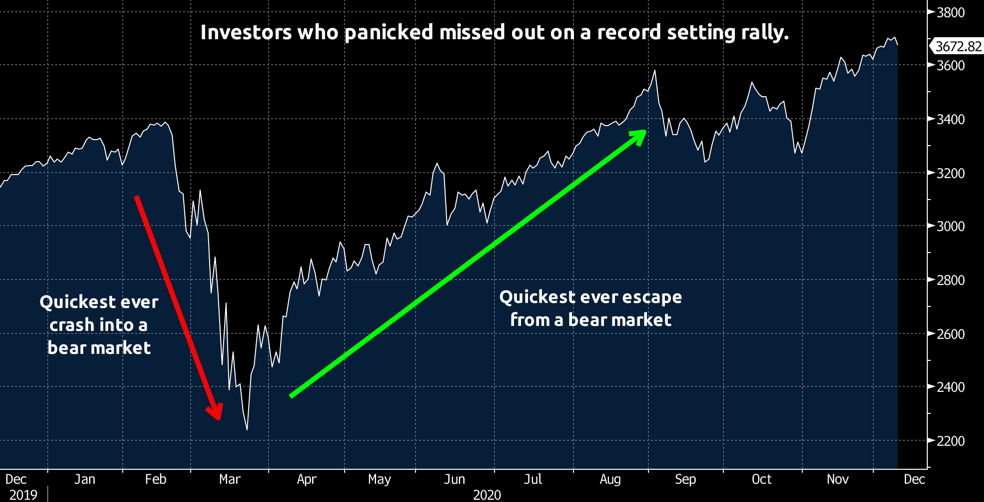

The year started on a good note, but in the blink of an eye, the world economy screeched to a halt, and markets responded. From February 19 to March 23, large-cap stocks fell 33%, which was the quickest ever decline into a bear market from record highs. These stocks then staged a historic rally that over the next six months recaptured the record highs.

This was the quickest ever escape from a bear market in history.

During the market crash, some investors were understandably afraid. After all, everything around us looked bleak. The lesson here is, that it’s times like that when it’s critical to remove your emotions from the equation. Otherwise, you’re tempted to sell out of stocks at the exactly wrong time, causing you to miss the violent market rally up from the bottom.

Of course, ignoring your emotions is easier said than done, which is why you ideally have a personalized financial plan that you and your advisor put together to help guide you through rough periods like this. (Which is also why our investment team closely analyzes noisy and chaotic economic and market data for our clients using a disciplined process.)

Besides the “forget 2020” articles that are everywhere, I’m also seeing many articles from “so-called” experts who are making bold predictions as to exactly where the stock market will be at the end of next year. Just remember, that these types of predictions happen every year, and I’ve yet to see anyone who gets it completely right or comes close to nailing it.

Rather than the whole of 2020, the only thing I would really like you to forget is those types of articles.

At Allworth Financial, we are thoroughly analyzing the economy and the markets (and we don’t wait until the end of the year), but we’re not wasting your time with meaningless, single-point market forecasts that are intended to create a buzz and gain readers and clicks. Doing so would be a disservice to you and your retirement.

Instead, we’re constantly looking for opportunities to complement your personalized financial plan to help you enjoy your retirement and thrive.

With that in mind, as we look ahead, we see potential economic growth tied to the virus and the rollout of the vaccines. Said simply, as our population heals, so should the economy. Until that healing process can take hold, the effects of the virus and the economic data will probably get worse.

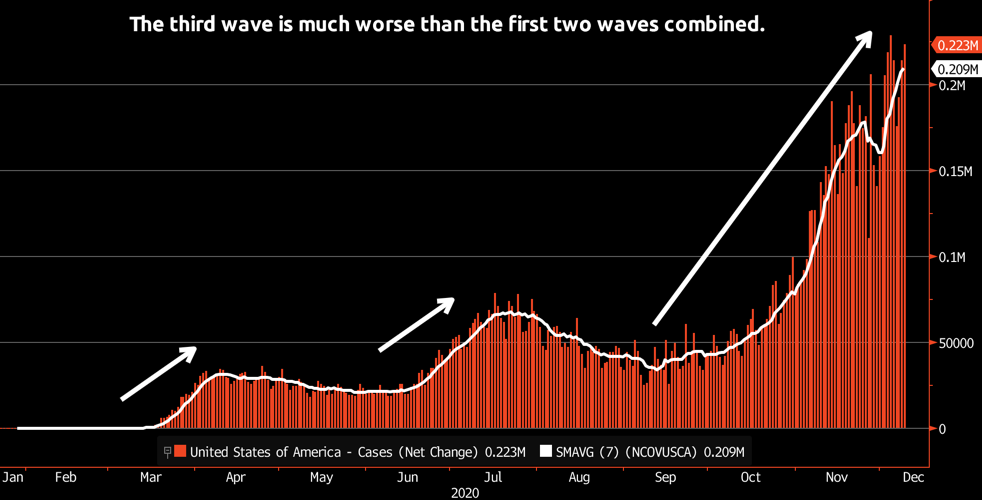

The U.S. is now in the throes of the third wave, and this wave is much worse than the first waves. The chart below shows the number of new daily cases (orange bars) soaring to record levels. The 7-day moving average (white line) in this wave is currently around 200,000. The first wave (earlier this year) saw the 7-day moving average peak at 31,595, and the high mark of the second wave’s 7-day moving average was 67,440.

(Using the 7-day moving average smooths out the uneven reporting that occurs, especially on weekends.)

The rise in cases and increased use of hospital resources is driving new local restrictions, which limit people (and businesses) as to what they can do.

We’re already seeing a negative economic impact from this third wave and accompanying restrictions. Credit and debit card sales in stores are now starting to decline after recovering from the earlier lockdowns. Also, foot traffic and restaurant reservations are quickly moving lower.

On the jobs front, the number of people filing for first-time unemployment insurance is moving higher after improving since late March. From just 11/27 to 12/4, the number of new claims jumped from 716,000 to 853,000. This is the highest level in about three months.

With more people losing their jobs, there will probably be a hit to spending. This is important because spending from consumers like you makes up about 70% of the total economy. This lower spending has the potential to reduce GDP (a measure of our nation’s economic output).

What’s helped keep consumers afloat despite nearly 11 million people unemployed was the first stimulus bill, which saw many people saving much of that money. By the end of this year, with many people’s unemployment benefits expiring and no jobs to find (because businesses are closed), spending and the economy could feel the pinch. Should Congress come together to pass another stimulus bill, that will help keep the economy growing and speed up the vaccine-induced economic recovery.

With that backdrop, many investors are wondering why stocks have hit record levels when the economy is getting worse. The answer is fairly simple: markets tend to look ahead.

The market appears to be pricing in a return to some semblance of normality thanks to the vaccine’s healing effects on the psyche of the population and on the economy.

This all brings us back to why we must never forget 2020.

You shouldn’t make investment decisions based on what you see today, but instead, those investment decisions should be made after a deep analysis of where the economy and corporate profits might be headed relative to expectations.

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

December 11, 2020

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now