Allworth Chief Investment Officer Andy Stout takes a look at how the Federal Reserve hopes to tame inflation.

The year 1982 is known for many things, including the breakup of Ma Bell and the debut of E.T. the Extra-Terrestrial. But, nostalgia aside, that year is often most associated with soaring inflation.

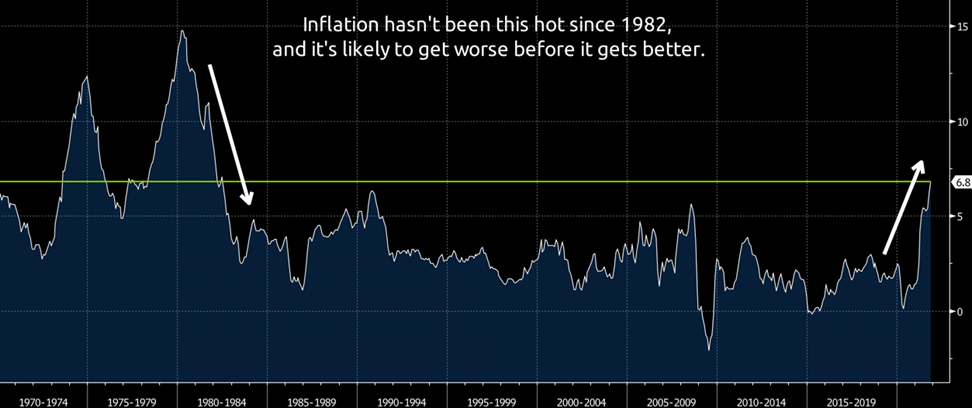

Inflation will likely rise from here

Unfortunately, the current year-over-year change in consumer prices is a staggering 6.8%, the hottest inflation since 1982. Back 39 years ago, inflation was on its way down, which is obviously much different from today’s trajectory.

Inflation was on the decline from its March 1980 high thanks to our nation’s central bank, the Federal Reserve (Fed), rapidly increasing the fed funds rates. (The fed funds rate is the overnight interest rate the Fed adjusts to attempt to achieve its dual mandate of stable prices and full employment.)

That is much different from today’s environment. In March 2020, as the pandemic took hold, the Fed immediately cut interest rates to zero and bought billions of longer-term bonds.

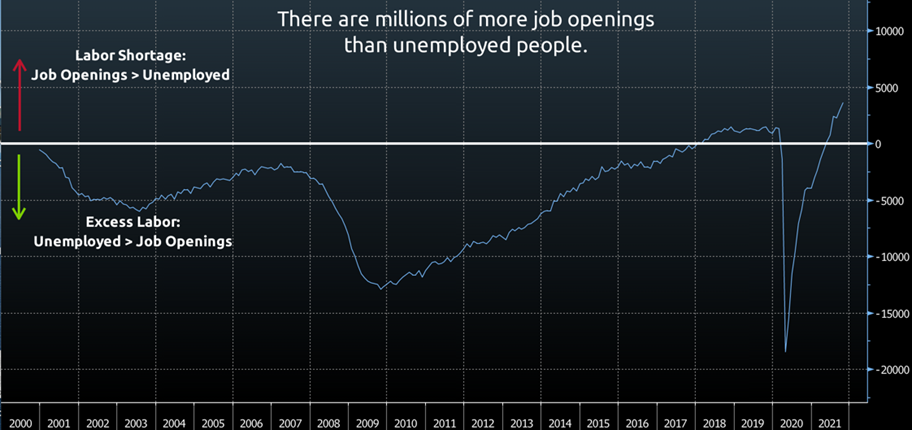

While these measures were necessary to encourage economic growth and a properly functioning bond market, the Fed must now adapt to a new inflationary environment characterized by a massive labor shortage and supply chain dislocations.

Over the past 20 years, there have typically been more unemployed people than job openings. However, the economic reopening coupled with people being reluctant to return to work has resulted in a record 3.6 million more job openings than unemployed people.

Another example of the labor shortage is the record low layoffs. Weekly jobless claims recently fell to 184,000, its lowest level since 1969, when the labor force was half the size it is today. Fewer layoffs suggest employers don’t want to let go of workers out of fear that they won’t be able to replace them. As a result, employers are raising wages to attract and retain workers.

Another inflation catalyst is the broken supply chain. While it’s still far from fixed, there are some signs of improvement. For example, manufacturers are reporting rising production, shorter delivery times, and backlogs growing at a slower rate.

Despite this modest improvement, inflation shows no sign of cooling off in the near term, forcing the Fed to adapt.

The Fed’s Great Reset

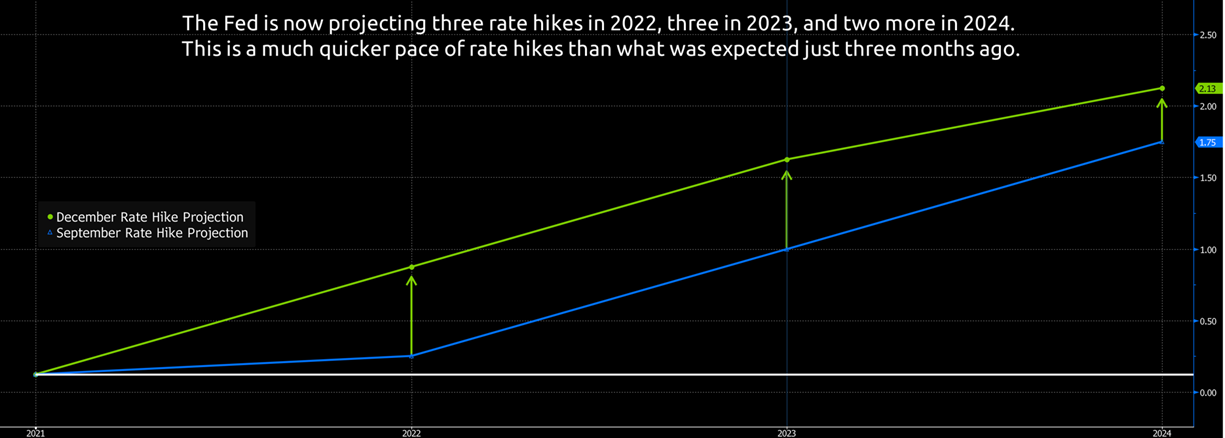

A couple of months ago, our central bank announced it would slow down its bond purchases (known as tapering). However, that was before the Fed was surprised by the highest inflation in almost 40 years. So, the committee doubled the planned tapering, and bond purchases will end in March 2022 instead of June.

That wasn’t the central bank’s only change when it met on December 15th. The Fed also indicated it would hike interest rates three times next year, which is more than the one hike it telegraphed just three months ago in September.

The evolution of inflation over the next 6-12 months will determine if the Fed actually hikes this quickly.

The bond market expects inflation to remain elevated before falling to more normal levels in late 2022 and beyond. We observe this by analyzing and deconstructing inflation breakeven rates, which is the difference in yields between Treasury bonds and Treasury Inflation-Protected Securities (TIPS).

Currently, the bond market is pricing in consumer inflation of 3.6% over the next 12 months, and then inflation is expected to drop to 2.8% over months 12 to 24.

The change in inflation expectations over time suggests the bond market believes the Fed’s shift is not too little too late. However, the central bank might have to go a bit further to curb inflation should consumer inflation expectations remain resilient. Therefore, we wouldn’t be surprised if the Fed came out with bolder talk regarding its fight against inflation.

Inflation outside the US

The havoc wreaked by the pandemic has also caused inflation spikes across the globe. For example, the United Kingdom’s inflation rate has jumped to 5.1%, prices in Brazil are 10.7% higher, and inflation in Germany is 5.2%.

To combat inflation, the Bank of England (BOE) surprised economists when it unexpectedly raised short-term interest rates this past week, its first hike since 2018. The BOE is the first major central bank to raise rates since the pandemic. Other central banks have hiked multiple times this year, including Brazil, Russia, and Mexico.

What lies ahead

As we discussed a couple of months ago, current data suggest inflation will remain elevated, but it should start to moderate in the second half of 2022. The year-over-year change in consumer inflation will probably eclipse 7% in the immediate months before declining.

Regarding the stock market, the historical results might surprise some people. One year after the Fed’s first rate hike, large-cap stocks were higher in the past three rate-hike cycles (1999, 2004, and 2015).

Interestingly, the total US bond market index also rallied over the following year after rate liftoff in 1999, 2004, and 2015.

Of course, that doesn’t mean the pattern will repeat, as there are many differences today, such as lower interest rates and an ongoing pandemic.

The takeaway is that one should not make an investment decision based on just a few pieces of data, no matter how compelling. Instead, one needs to analyze multiple factors, including implied volatility, correlations, valuations, momentum, interest rate spreads, earnings, recession risk, and the Fed’s reaction function.

Fortunately, at Allworth Financial, we regularly analyze the above data and incorporate it into the investment portion of our clients' personalized financial plans.

December 17, 2021

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now