Allworth Chief Investment Officer Andy Stout shares his thoughts on where inflation might be headed in 2023.

Welcome to the final Monthly Market Update of 2022!

Looking back, the biggest economic story heading into this year was inflation, which remains the top headline as 2022 comes to a close. That’s hardly shocking because inflation was 7% at the end of 2021, and that’s just about where we are now (7.1%).

But this seeming lack of movement is not an accurate representation of how inflation evolved this year.

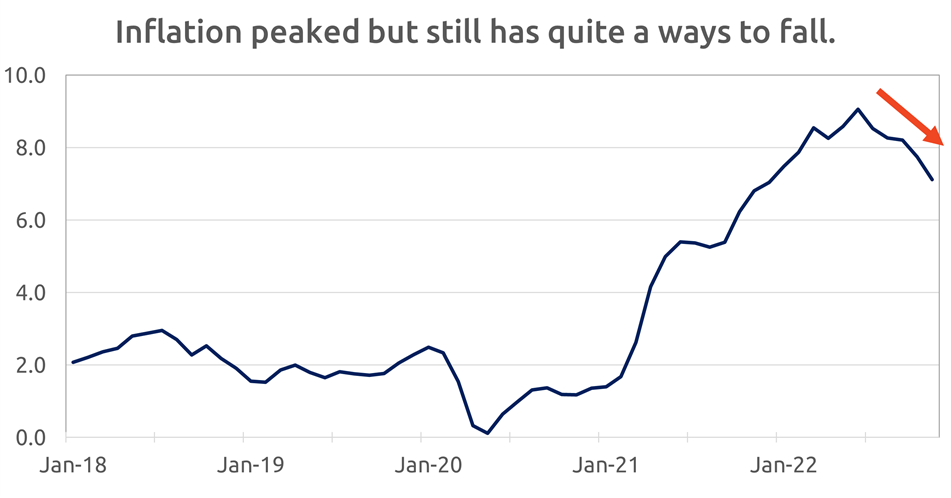

This year’s inflationary environment wasn’t a surprise to us. In the December 2021 Monthly Market Update, I wrote, “…inflation will remain elevated, but it should start to moderate in the second half of 2022.” That statement was pretty accurate, as inflation peaked in June at 9.1% and has since decreased to 7.1%.

However, inflation has been more stubborn than expected, partly due to Russia’s unjustified invasion of Ukraine, coupled with China regularly locking down tens of millions of people to contain COVID. As a result, the Federal Reserve (Fed) increased the fed funds rate much more aggressively than the market expected at the beginning of the year (the fed funds rate is the overnight interest rate the Fed controls).

At the start of 2022, the market priced in 0.75% in rate hikes for the entire year. But after this week’s increase, the Fed has lifted rates by a staggering 4.25% to try to stamp out inflation.

As we look at how inflation could progress next year, a healing supply chain should help ease price pressures. For example, manufacturers have reported that deliveries and order backlogs have improved over the past two months. In addition, China is finally shifting away from its zero-COVID policy to a reopening.

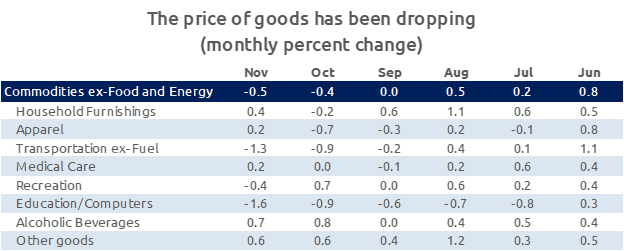

Those supply chain improvements should help continue to reduce goods inflation (the price of goods), which has already declined over the past two months. While disinflation has been widespread across industries, price drops in used cars and apparel contributed the most to a decrease in goods inflation.

However, service inflation is currently a larger concern. Fed Chair Jerome Powell noted that, “…price pressures in services have been very slow to move down.” For example, shelter costs, comprising 64% of service inflation, have increased by at least 0.5% every month since January. The Fed’s actions to lift short-term interest rates have pushed 30-year mortgage rates to around 6.5 – 7.0%. Unfortunately, it may take a few more months for shelter cost disinflation to take hold.

Another concern for the Fed is the tight labor market, especially since Powell believes higher wages directly lead to service inflation. So, with the unemployment rate near a 40-year low of 3.7%, the Fed has indicated that it will keep interest rates at elevated levels for a prolonged period.

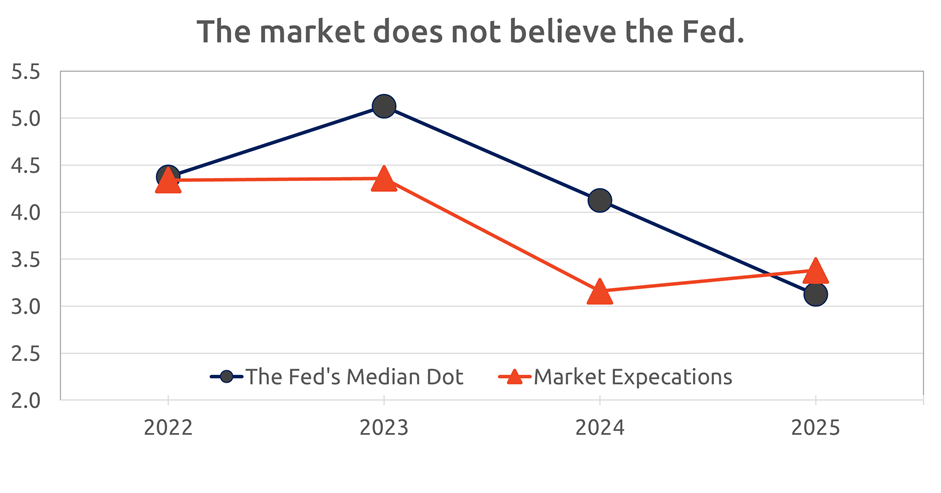

Known as the dot plot, every three months, the Fed provides a projection of where each member believes the fed funds rate will be at the end of upcoming calendar year. Market participants look at the median dot to get an idea of what the Fed, as a whole, is thinking.

The December dot plot pointed to the fed funds rate being 0.75% higher than it currently is by the end of 2023, lifting it to a range of 5.0% - 5.25%. However, the market isn’t buying into the Fed’s higher-for-longer interest rate posturing.

The market expects about 0.5% in rate hikes in early 2023, followed by rate cuts in the second half of the year. This action would result in the fed funds rate being at the same level at the end of the year as at the beginning of the year.

We have good reason to distrust what the Fed says. After all, this time last year, the Fed indicated short-term interest rates would have only increased by 0.75% for all of 2022, not 4.25%. Besides the Fed’s poor track record regarding its dot plot, there are economic reasons the market has different expectations.

Some leading economic indicators are suggesting that an economic slowdown lies ahead. For example, the 2-10 year yield curve is inverted, meaning short-term interest rates are higher than long-term interest rates. This often precedes economic weakness because the bond market prices in the Fed cutting interest rates to support the economy.

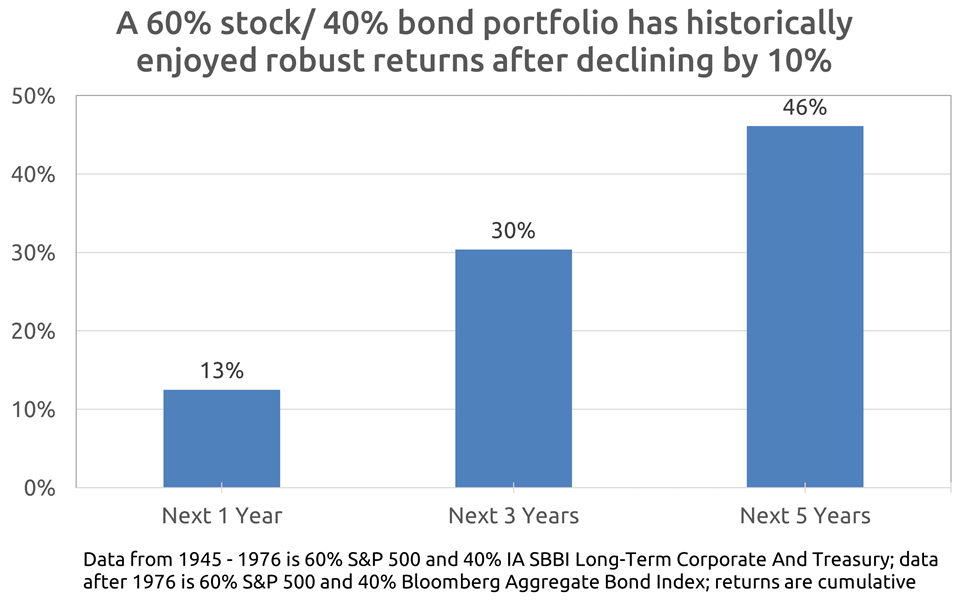

So, with this economic uncertainty as a backdrop, it’s not atypical to ponder whether you shouldn’t invest in either stocks or bonds, especially because of the declines you’ve already experienced this year. But, ironically, that’s exactly why you should invest.

Of course, there could be more market turbulence in the coming months. That would not be surprising. However, when a diversified investor has suffered losses in the past, positive returns were often the reward for remaining patient. This chart shows returns over the next 1, 3, and 5 years for a hypothetical 60/40 portfolio when that investment mix experienced a decline of at least 10% when looking back at the prior 12 months.

Just like this year, 2023 will present its own challenges, but if you have the proper investment mix to support your financial plan, you should be able to use that personalized plan to navigate all future uncertainty. That doesn’t mean you should “set it and forget it.” Instead, we believe you can benefit from active tax-loss harvesting and strategically positioning your holdings to take advantage of the ever-changing economic environment.

December 16, 2022

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now