Allworth Chief Investment Officer Andy Stout gives you a closer look at when you should - and shouldn't - consider cash as an 'investment.'

One enduring financial lesson from my childhood occurred when my parents dropped me and a few friends off at a festival. I quickly spent the $20 my parents gave me at the arcade, leaving me to watch my friends enjoy games and rides for the rest of the day.

That was a valuable lesson about the importance of long-term thinking and not just focusing on short-term possibilities.

I bring this up because it’s eerily similar to today’s investment opportunities, but I’d like to provide a brief economic overview before I connect all the dots.

And, of course, it all begins with inflation.

An economic snapshot

It’s no secret that inflation is still too high, and while it is decelerating (a good thing), it’s doing so at a modest pace. The Federal Reserve (Fed), our nation’s central bank, has increased interest rates in an attempt to slow down the economy and bring inflation under control. Despite one of the quickest rate hike campaigns ever, consumer spending has remained remarkably resilient.

So, even with the mortgage, auto loan, and credit card interest rates at decade highs, people continue to spend. In fact, it’s been so robust that economists estimate that the US economy grew by an impressive 4% in the third quarter (the actual release is on October 26).

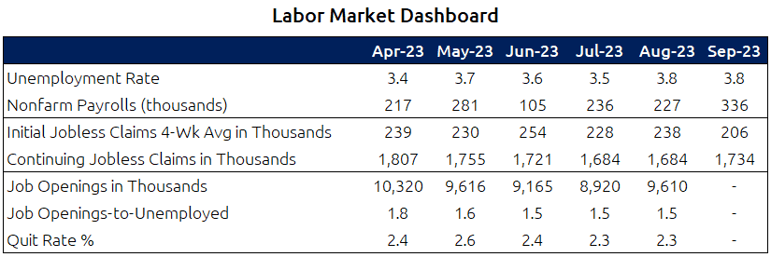

To be fair, a few one-off events propped up spending last quarter, such as two blockbuster movies and two massive concert tours. While the lack of these events could cause a moderate drag in spending, it’s likely to be offset by a still-healthy labor market, as evidenced by factors such as an unemployment rate that is near 50-year lows, weekly initial jobless claims, and employers still looking to hire employees at a relatively rapid clip.

Looking ahead, though, there are economic risks we’re carefully analyzing, such as Middle East turmoil, declining consumer savings, and the Fed keeping interest rates elevated. Additionally, the recent stock and bond market volatility has increased anxiety for some investors.

That turbulence, coupled with cash interest rates around 4-5%, could cause some long-term investors to jeopardize their financial futures by moving to cash. In other words, the attractive short-term possibilities could come at the cost of long-term success.

When cash might not be a good investment option

“There’s no such thing as a free lunch” has been a critical economic concept for centuries. It essentially means that there are costs or trade-offs when you think you’ll receive something for “free.”

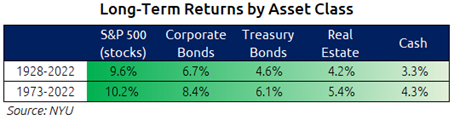

One of the most considerable costs you could incur when investing in cash is missing out on long-term returns. While anything can happen in the short term, history has shown that cash is inferior to other investments over the long run.

Related to lower returns, some investors contemplate shifting their long-term investments to cash because they worry about an imminent market decline due to macro events like wars or recessions. Unfortunately, this short-term thinking can easily backfire.

There are a few fundamental reasons why that strategy doesn’t work, such as possibly higher taxes, knowing when to get back in, emotions causing poor decisions, and stocks having increased about 90% over every five-year period when looking back over the past 50 years.1

Furthermore, independent studies from Morningstar2 and Dalbar3 showed that when investors “time” the market, they end up underperforming by 1-3%.

The second material cost is that cash has barely outperformed inflation, which has averaged 3.0% since 1928, and 4.0% over the past 50 calendar years.

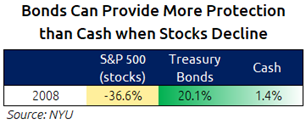

A third cost can occur if you use cash to replace your bonds. Because cash investments can’t provide the same level of protection that bonds, especially treasury bonds, can when stocks experience sharp declines.

When equity volatility rises, investors often seek safety and buy bonds, driving up bond prices. This increase can help offset stock declines, but there is no corresponding increase in value with cash; you only get the yield. A perfect example of this occurred during the financial crisis.

To recap, three of the more significant potential costs associated with investing in cash are:

- Lower long-term returns

- Barely keeping pace with inflation

- Lacking protection during stock selloffs

When you should consider cash as an investment

Of course, there are ideal times or situations to invest in cash. The decision often comes down to your financial timeframe. It goes without saying that you should keep some of your assets in cash for everyday expenses and unexpected emergencies.

It’s also prudent to have assets in cash-like investments if you have a large planned outlay in the near term, such as setting money aside to pay taxes after selling a business. This approach protects you from short-term market volatility that could force you to tap additional funds to cover your planned expenses.

A second reason you might want to invest in cash is if your bank pays you a low interest rate on your checking and savings accounts. Many banks are still paying you less than 1-2% despite what you can earn elsewhere, and you may have better options where your money is still FDIC-insured.

Besides a shortened timeframe, you might want to think about investing in cash if something has changed in your financial plan, like a new unplanned expense.

So, consider investing your money in cash-like securities when:

- You need the money in the not-too-distant future

- Your bank isn’t paying you market-level interest rates

- Something has materially changed in your financial situation

For this latter issue, you’ll want to discuss any updates with your financial advisor because there could be obvious and not-so-obvious effects on your personalized financial plan.

How you should think about cash investments within your portfolio

Investing in cash is now a viable option because interest rates are at their highest levels in decades. In some circumstances, it’s prudent to invest in cash, but it may pose a risk to your financial future in other situations. It often hinges on your time horizon.

If you need the money in the near term, cash investment vehicles might make sense. Our approach to cash management is driven by practicality and informed decision-making, and we have plenty of options for you based on your unique needs.

However, if your money is meant for your long-term financial goals, it’s likely more advantageous for you to align with your financial plan's recommendation regarding the allocation of stocks and bonds.

October 20, 2023

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

The S&P 500 is 500 of the largest stocks in the US; Treasury Bond returns are based on the 10-year Treasury yield; Corporate Bond returns are Moody’s BBB corporate bond yields; Real Estate is based on home price data provided by Robert Shiller, which is now the Case-Shiller Index; Cash is based on the 3-month Treasury yield; Inflation is the Consumer Price Index for All Urban Consumers.

- Data calculated by Allworth using the S&P 500’s total return monthly data over the past 50 years through 9/30/23.

- https://www.morningstar.com/lp/mind-the-gap

- https://www.dalbar.com/Portals/dalbar/Cache/News/PressReleases/QAIB23PR.pdf

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now