Allworth Chief Investment Officer Andy Stout discusses fiscal stimulus, why it’s needed, and what that means for our debt.

Let’s face it, with the hope that the vaccines allow us to return to normal, 2021 is a year that just about everyone is looking forward to.

If things go somewhat as planned, one of the major things I’m most excited about – besides seeing my friends and family without fear, obviously – is the 2021 Olympics.

I especially love watching track and field. (One of my favorite Olympic athletes of all time is Carl Lewis. While his infamous singing of the National Anthem during the 1993 NBA Finals was off-key, his dominance at four different Olympics [the U.S. boycotted the 1980 games in Moscow, which would have made it five] is one of my favorite memories.)

The first race of the year already happened in Georgia where Democrats won both remaining undecided US Senate seats. The Senate is now split between Republicans and Democrats, with Vice President-elect Kamala Harris holding the tie-breaking vote.

This likely means that President-elect Joe Biden will be able to push through a large fiscal stimulus package on top of the already-approved $900 billion legislation. As he outlined Thursday night, he wants this package to include, among other proposals:

- Support for state and local governments

- $1,400 checks sent to qualifying individuals (this would be in addition to the previously-approved $600 checks, for a total of $2,000)

- An extension of unemployment benefits beyond the current March expiration

- Money to facilitate vaccine distribution

This stimulus is welcome news for the economy because it comes as virus cases are surging and economic data is weakening. New daily virus cases (~250k), along with new daily death totals (~3k), are close to record levels. (The orange line in the chart below is the 7-day moving average of new cases and deaths.)

While the vaccine rollout might not be as quick as initially hoped, it’s moving forward. As of January 13, there have been 10.8 million doses administered in the US. It almost goes without saying that, until more people are vaccinated, the economy will remain under an atypical type of pressure.

We’re already seeing this in the labor market.

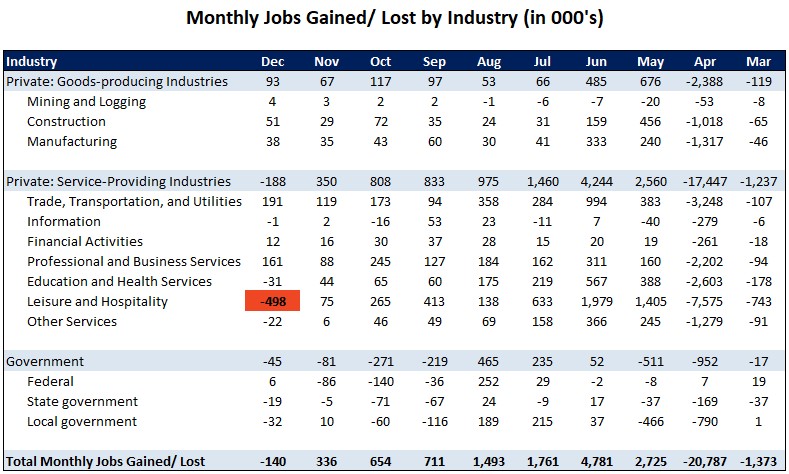

With fresh lockdowns across the country, businesses are continuing to lay off hundreds of thousands of people. There were 140,000 jobs lost in December. Job losses were concentrated in the Leisure and Hospitality industry (with some 498,000 lost jobs), with restaurants/bars reporting most of the decline (372,000 lost jobs).

The headline number of 140,000 lost jobs, however, might not be quite as bad as it looks. Many other industries reported job gains, including Construction and Manufacturing. Further, earlier, the prior two months of data were revised higher by 135,000.

The most important reason that the jobs report might be tolerable is that the already-approved fiscal stimulus, along with the expected added fiscal stimulus, are very positive for the economy. This support will keep the economy afloat until we reach herd immunity later this year (~70% of the population vaccinated).

After we reach that point, the pent-up demand should result in continued economic improvement throughout the year. Should there be a second stimulus package, as is widely expected, then the economy could grow around 5-6% this year. This would push the size of the US economy back to pre-crisis levels sometime later this year.

Understandably, there is concern that all this stimulus will further increase our country’s debt level. Yet, at this point, I would argue that the bigger risk is the lack of stimulus because that would cause the economy to recover much more slowly just as it’s reopening. A “quick recovery” early on will reduce the amount of long-term unemployed people. This is critical because the longer someone is without a job, the more difficult it could be for some to get a job in the future.

Another point on the increasing debt level is that the Federal Reserve, our nation’s central bank, has been buying a good portion of what’s being issued. This helps keep the interest paid by the US Treasury low.

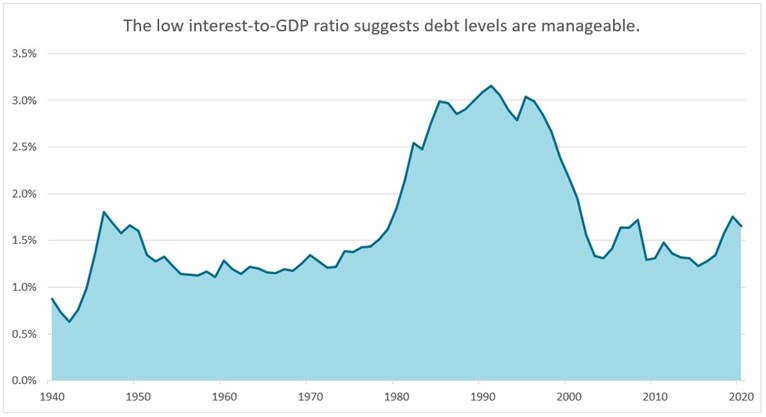

This is important because the ability of our government to service our debt is more important than the level of debt. With low rates, the debt service ability is quite manageable. We can measure this by looking at the interest-to-GDP ratio, which measures the amount of interest paid on Treasury bonds divided by the size of our economy.

This chart shows that the interest paid in 2020 compared to the estimated year-end GDP level is just 1.65%. This is lower than the 1.7% average since 1940 and the near 2% average over the past 50 years.

We expect this ratio to increase as the new stimulus will result in additional issuance of government bonds, but this shouldn’t be an issue if interest rates stay relatively low.

It wouldn’t be surprising to see slightly higher interest rates (but still historically low) because the stimulus coupled with a very high savings rate should lead to a jump in consumer spending later this year, and that could cause inflation to perk up.

However, we don’t believe that inflation will be a long-term problem because of technology improving workplace efficiency, the lack of further de-globalization, and our country’s demographics (the fertility rate of 1.8 births per woman is below the replacement rate of 2.1).

When looking at the big picture, 2021 should be much better for the economy than 2020 was; however, there will be twists and turns that need to be well navigated so you can enjoy your retirement. Some obstacles that we at Allworth Financial are closely monitoring include potentially higher taxes, inflation, interest rate levels, vaccine rollout disruptions, and a corporate earnings scare.

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

January 15, 2021

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now