Allworth Chief Investment Officer Andy Stout discusses what the record-low interest rates means for you and what might eventually push them higher.

Over the past 10 years, I’ve taught corporate finance at a few different universities. One of the first topics we cover is how a company decides to invest its money. In other words, what projects will be the most profitable. There are a few different ways to perform this analysis, but one of the best methods is to calculate the present value of future cash flows.

Once we know (or estimate) the future cash flows, we can find their present value based on a discount factor, which is heavily related to interest rate levels. The bottom line is – without going into the weeds – that those future cash flows are worth more today when interest rates are low.

We can use the exact same principle in valuing stocks. This is a critical concept for stock investors because low interest rates now mean a company’s future earnings are more valuable than they would be if rates were higher.

So, it was good news for the stock portion of your investment mix when the Federal Reserve (Fed), our nation’s central bank, decided to cut rates to almost zero and told us rates will stay near zero for the foreseeable future.

To be fair, when the Fed is forced to cut rates to zero, it probably means there are plenty of economic risks. This is the case today because of the uncertainty surrounding the coronavirus. (The Fed lowers interest rates to encourage bank lending and support the economy.)

How long could rates stay near zero?

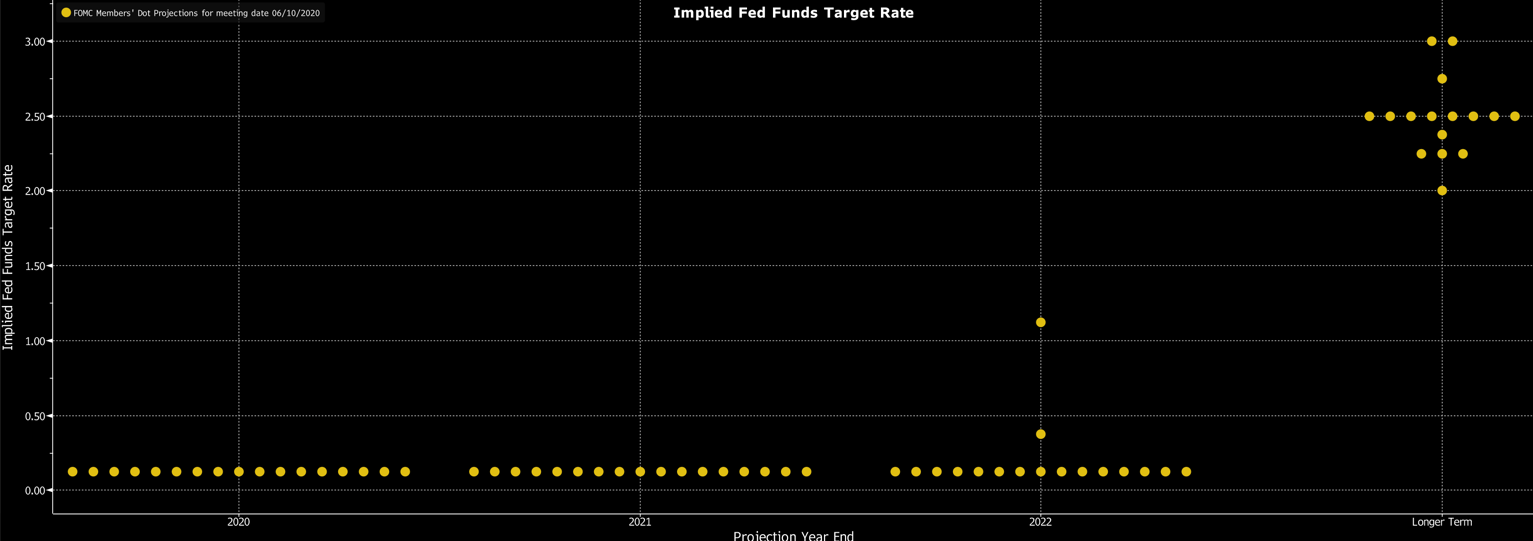

The Fed believes that short-term interest rates will be at these levels for at least a couple of years. The Fed shares its views each quarter on where rates will likely be in the future via the “dot plot.” Each dot in the chart below represents a Fed member’s opinion on rates. As you can see, 15 of the 17 Fed members believe rates will remain at current levels until at least the end of 2022.

Fed Chair Jerome Powell backed up this view in his last press conference when he said, “We’re not thinking about raising rates. We’re not even thinking about thinking about raising rates.”

The effect on bonds

Low interest rates also impact your bonds. It’s true that you’re receiving less income on your bonds than you did a few years ago. However, your bonds have benefitted from the decline in rates, as well. That’s because interest rates and bond prices have an inverse relationship. In other words, when rates drop, bond prices rise.

Another benefit of bonds is that when stocks experience a sharp selloff, it’s common for bonds to increase in value. In a diversified portfolio, bonds act as a shock absorber to offset some of the stock market turbulence.

Remember, all investments contain risk, but there are many types of bonds you can invest in to earn yield that is higher than what government bonds are producing. We continue to like investment grade corporate bonds. These are bonds with credit ratings that are considered relatively safe but not virtually risk free (like government bonds).

By investing in these investment grade corporate bonds, you can probably earn about 1-2% more income than government bonds. Some examples of companies that have issued investment grade bonds include Procter & Gamble, AT&T, and Walmart.

Investing in high-yield (or non-investment grade) bonds is one of the most common ways to potentially earn even more income. High-yield bonds are issued by companies with a higher chance of going bankrupt. They can be a solid investment over the long run, but when the economy falls into a recession, these bonds become much riskier, especially in the shorter term. (This is why we currently prefer investment grade bonds over high-yield bonds.)

Some investors have also been looking for income from CDs. Unfortunately, low interest rates have made CDs relatively unattractive. The national average interest rate for a 12-month CD has dropped to 0.23%, which is the lowest level since early 2017, which means its yields are lower than investment grade bonds.

Why inflation matters

While the Fed has told us that it plans on keeping short-term interest rates near zero for the foreseeable future, that of course doesn’t mean rates will always stay here.

Once the coronavirus scare is behind us (and yes, it will pass), interest rates could rise as the economy improves and inflation increases.

As the economy recovers, there is the potential that inflation could gain a footing sometime next year, but that’s not guaranteed. The possible higher taxes (to pay for our deficits), and the aging demographic (less people working) of our population, could combine to keep inflation in check.

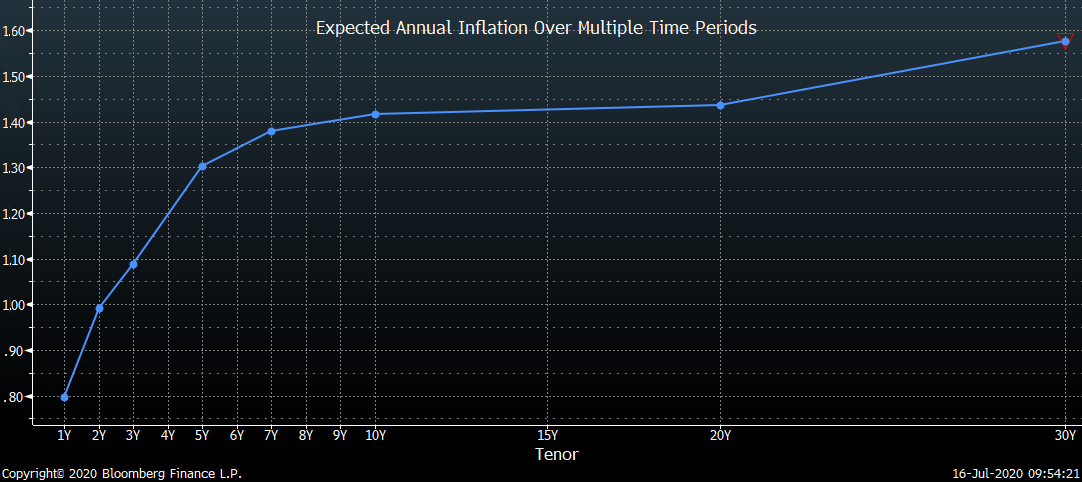

The Fed prefers that inflation stay around 2%, and that doesn’t seem to be a problem for the foreseeable future. In fact, the bond market isn’t expecting to see a 2% inflation rate anytime over the next 30 years!

This chart shows the average expected inflation over multiple time periods.

Low interest rates have some clear benefits for investors, and they could stay here for a while. However, rates will eventually increase. (And rising rates can create additional challenges if you’re ill prepared.)

Remember, bond prices fall when rates rise. And a stock’s future earnings become less valuable when interest rates are higher. In short, to protect your retirement, you need to have a well-defined investment plan to be able to manage all that risk.

All data unless otherwise noted is from Bloomberg. The Allworth Recession Index is made up of leading economic indicators, which are data points that have historically moved before the economy. The index value is calculated as a percent of the indicators that are sending signals that suggests recession risk is elevated. When the index value is greater than 40%, we believe there is a greater chance for a recession in the next six to nine months. All data begins by 1971 unless noted below. The indicators that make up the Allworth Recession Index are the 3-Month Government Bond Yield, 2-Year Government Bond Yield (beginning in 1976), 10-year Government Bond Yield, BarCap US Corp HY YTW – 10 Year Spread (beginning in 1987), Conference Board Consumer Confidence, Consumer Price Index, NFIB Small Business Job Openings Hard to Fill (beginning in 1976), Private Housing Authorized by Building Permits by Type, US Federal Funds Effective Rate, US Initial Jobless Claims, US New Privately Owned Housing Units Started by Structure, and US Unemployment Rates.

Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

July 17, 2020

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now