Allworth Financial's Director of Research, Ryan Gromatzky, shares the latest update about the state of America's economic recovery from the COVID-19 crisis.

First, I hope everyone had a safe and happy 4th of July. I hope everyone had the opportunity to enjoy time with family and friends as the economy continues to reopen more broadly. I know that my family is excited about life returning to normal, and I am sure you are too.

A Return to Normal

As we have discussed over the past several months, we expect above-trend growth this year due to pent-up demand and record stimulus. This is largely due to the economy reopening and consumers becoming more confident now that the U.S. is approaching herd immunity.

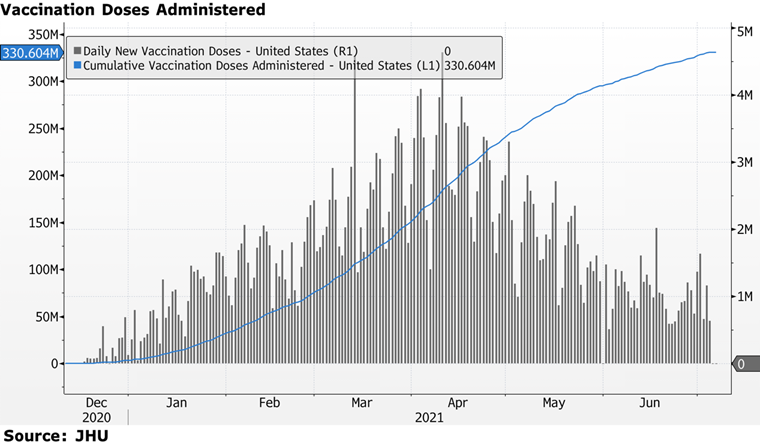

The U.S. has made significant progress in its vaccination campaign, administering approximately 330 million doses. This equates to 55.6% of the population having received at least one dose and 47.9% being fully vaccinated.

This has given consumers and governments more confidence to more broadly open the economy, and we are seeing high-frequency data confirm this trend. As an example, spending on oil, airline travel, lodging, and restaurants is back to or exceeding pre-pandemic levels.

These areas of the U.S. economy are also experiencing above-trend inflation, which is pushing CPI (a measure of inflation) to multi-year highs. Listed below are CPI components that are experiencing some of the greatest inflationary pressures on a year-over-year basis:

- Food Away from Home (Restaurants) = +4%

- Used Cars/Trucks = +29.7%

- Lodging Away from Home (Hotels) = +9%

- Transportation Services = +11.2%

- Car Rentals = +109.8%

- Car Insurance = +16.9%

- Public Transportation = +15.9%

- Airfare = +24.1%

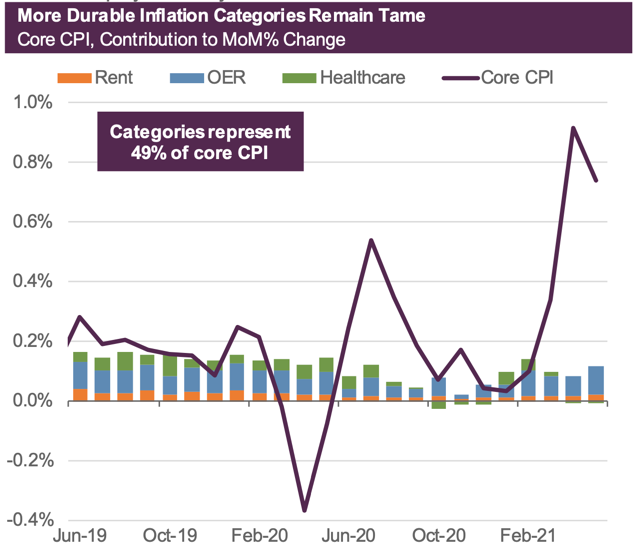

As you can see, these components of CPI are directly tied to the U.S. economy reopening and are expected to be transitory in nature, while more durable inflation categories like Rent, Owner’s Equivalent Rent, and Healthcare remain within normal ranges as seen below:

Source: Guggenheim Investments, Haver Analytics. Data as of 5/31/2021. OER stands for owner’s equivalent rent of primary residence.

The Federal Reserve Begins to React

The Federal Reserve (Fed), our nation’s central bank, met last month and noted that higher inflationary pressures had gained momentum. While the committee left the fed funds rate (overnight interest rates) unchanged, the Summary of Economic Projections (SEP) did experience significant revisions. Most notably, the Fed boosted its 2021 forecasts for growth from 6.5% to 7.0% and inflation projections for this year from 2.4% to 3.4%.

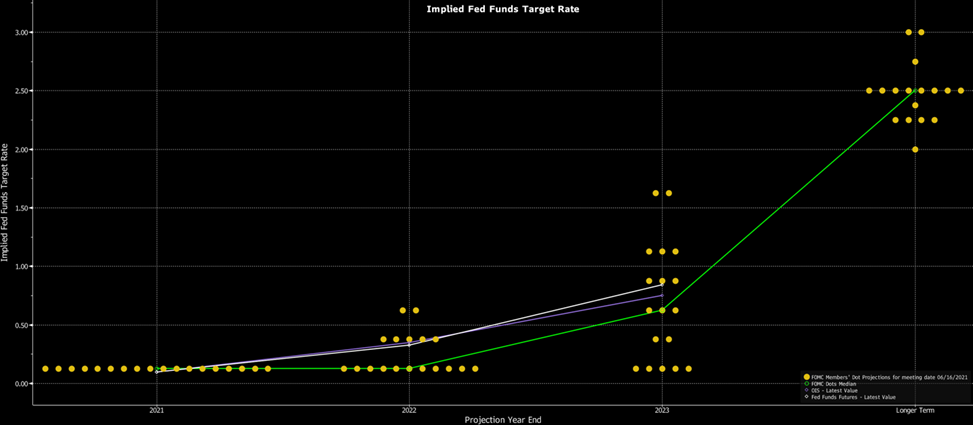

In combination, these two factors led to important changes within the Fed’s “dot plot,” which is Fed members’ forecasts for the fed funds rate. The updated “dot plot” indicated that 7 of its 18 members now expect overnight rates to be higher by the end of 2022. In addition, 13 members expect these rates to be higher by the end of 2023. These shifts pushed the median projection to two rate hikes (from zero) by the end of 2023.

Below is an illustration of the Fed’s “dot plot."

Overall, the Fed still sees inflationary pressures as temporary. However, the committee is acknowledging the higher costs associated with reopening, and these, coupled with higher growth expectations, could cause inflationary pressures to remain elevated longer than expected.

Additionally, with higher growth expectations, the Fed has begun “talking about talking about” tapering its bond purchases. While asset purchases will remain at current levels of about $120 billion per month, the Fed is looking to slowly remove this accommodation. As such, a reduction of asset purchases will be their first step in doing so. The Fed will provide additional clarification about its plans as it gets closer to tapering. The committee will attempt to be transparent about its plans to reduce bond purchases so as not to disrupt the orderly functioning of markets.

The Bottom Line

Markets experienced a bout of volatility last month as investors adjusted to renewed fears of inflation and what impact that might have on Fed policy moving forward. The bottom line is that while the Fed still considers the current level of inflation to be transitory, inflation risks remain skewed to the upside due to the U.S. economy reopening and higher growth.

Fed Governor James Bullard of St. Louis added to anxieties after making remarks on June 18th stating that the first increase to the fed funds rate could be in 2022. Markets are currently pricing in a 67% probability of at least one hike by the end of 2022.

However, it is important to remember that small increases in the fed funds rate don’t materially affect economic growth. Historically, it is the aggregate effect of multiple rounds of Fed tightening that slows growth in combination with an exogenous shock that leads to recessions – not the initial tightening measures that we are discussing today.

Rest assured that we continue to closely monitor the many factors that can impact the economy. Periods of market turbulence, like the one experienced last month, are normal and reinforce the need to maintain a diversified portfolio as part of your overall financial plan.

July 9, 2021

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now