Allworth Director of Investment Research Ryan Gromatzky gives you a look at where the economy currently stands – and shares a reminder about the tightrope the Federal Reserve continues to walk.

Nobel Prize winning economist Milton Friedman once famously stated, “Inflation is always and everywhere a monetary phenomenon…”

This means that inflation is a by-product of increasing the money supply at a rate at which demand outpaces supply.

It’s also a perfect illustration of the inflationary pressures we are experiencing right now.

As a reaction to the COVID-19 pandemic, the Federal Reserve lowered interest rates to a range of 0% - 0.25% and resumed quantitative easing (QE) via unlimited purchases of treasuries and mortgage-backed securities. Additionally, the federal government enacted unprecedented fiscal stimulus measures that amounted to approximately $5.2 trillion.

Simply, they pumped an incredible amount of cash into the system.

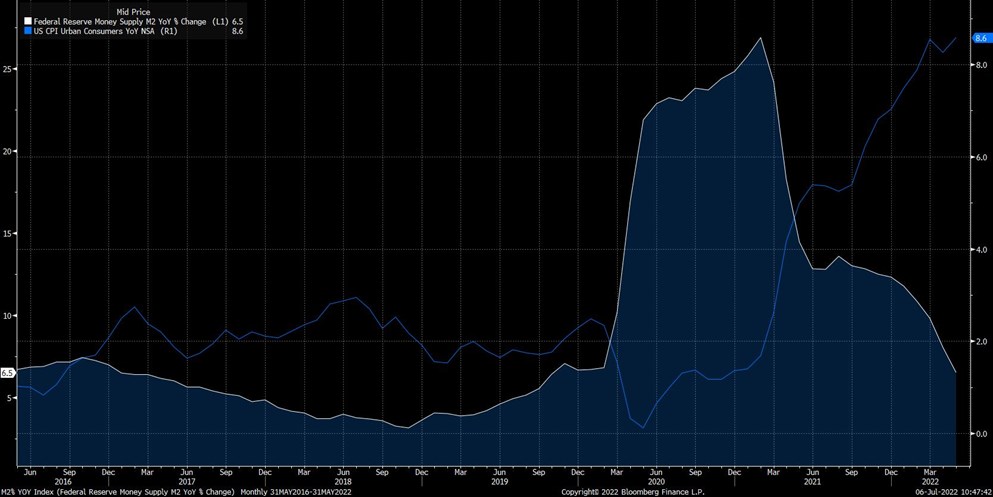

Combined, the above policies resulted in the money supply (M2) increasing 26.9% year-over-year at its peak in early 2021. In combination with supply-chain disruptions, the increase of M2 coalesced to create a supply/demand mismatch which fueled inflationary pressures. This dynamic can be seen in the chart below.

Fed to the rescue?

The Federal Reserve is tasked with a dual responsibility of maintaining price stability and maximizing employment. To that end, the Federal Reserve is now aggressively hiking the fed funds rate to help curtail inflation. With inflation at 40-year highs, the Federal Open Market Committee (FOMC) has been very transparent about its intention to further raise rates. However, in response to inflation reaccelerating in May to 8.6%, the FOMC surprised markets with a 75 basis points increase in the fed funds rate instead of the anticipated 50 basis point increase.

Markets quickly reacted to the surprise and uniformly sold-off.

In the FOMC’s announcement, Chairman Powell stated, “The committee seeks to achieve maximum employment with an inflation rate of 2 percent over the longer run…and anticipates that ongoing increases in the target range will be appropriate.”

The above referenced statement perfectly illustrates the tightrope that the Fed must navigate. In essence, the Fed must raise rates quickly enough to reverse inflationary pressures while not throwing the economy into recession.

From a historical perspective, the Federal Reserve has a poor track record in this regard.

Slowing Growth…

Consensus estimates for real GDP in Q2 remain optimistic at approximately 3% (quarter over quarter). However, based on recent weak economic data, we view this consensus estimate as optimistic. In fact, JP Morgan released their revised estimate for Q2 real GDP last week at 1%. In addition, the Federal Reserve Bank of Atlanta’s GDP tracking model has turned negative for Q2 – so risks of a recession are rising. These risks were evident within credit markets in June as credit spreads widened substantially during the month – especially within high-yield.

That being said, recent survey data from the Institute of Supply Management (ISM) remains in expansion territory, although slowing. (The ISM report is generally considered a good barometer of the overall economy.) The survey of purchasing managers includes five components: new orders, production, employment, supplier deliveries, and inventories. A level above 50 indicates expansion, while a level below 50 indicates contraction.

As you can see in the illustration below, the recessionary periods coincide with the ISM index falling below the neutral reading of 50.

For the month of June, the ISM slid to 53 – its lowest level in two years. While still nominally in expansion territory, the reading was consistent with a slower pace of growth.

The good news is that the survey included multiple signs that supply constraints were easing. However, weakness on the demand side pulled the overall index lower.

The bottom line…

The Federal Reserve must reduce aggregate demand for inflation to normalize at lower levels. It’s important to remember that monetary policy that is enacted by the Federal Reserve works with a lag, so we are beginning to see the effects of past interest rate hikes in current economic data.

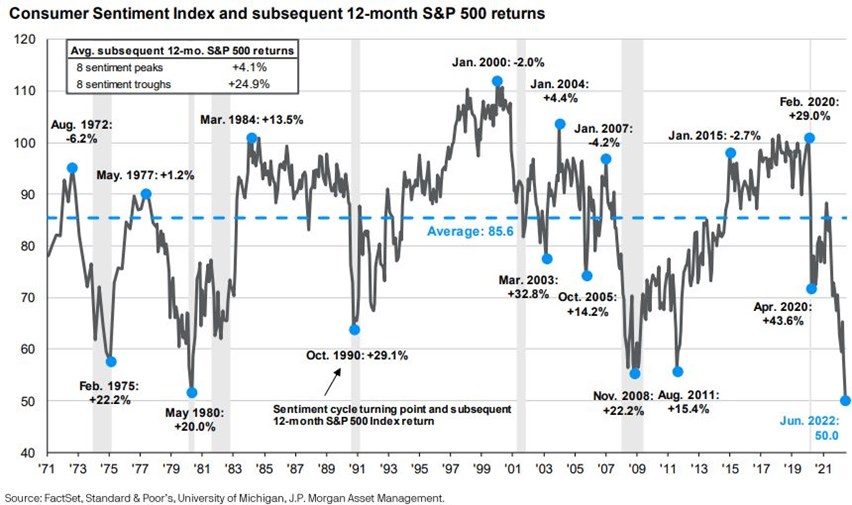

At the same time, some slowing of economic activity can be attributed to lower consumer sentiment. In June, consumer sentiment hit a record low as inflationary pressures continued to weigh on consumers’ purchasing power. On a positive note, prior lows in consumer sentiment have been followed by strong forward returns in the S&P. In fact, as evidenced in the chart below, the last 8 troughs in consumer sentiment were followed by an average S&P return of 24.9%.

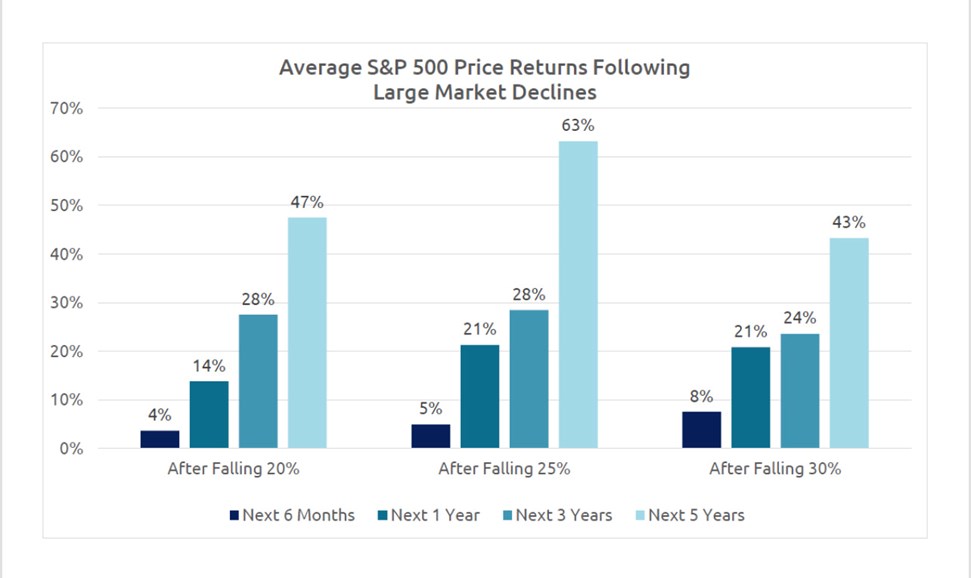

Currently, market expectations are only projecting approximately a 30% chance of a recession in the short-term. If a recession does come to fruition, the average recession since WWII has lasted approximately 11 months, and, as seen below, returns coming out of large market declines have historically been robust.

In conclusion, current economic data remains mixed, but is weakening. There continues to be areas of strength, such as employment, in which a near record 11.25 million job openings remain. This strength should continue to support consumer spending which accounts for approximately 70% of the U.S. economy. However, some economic data, like the ISM, is well off its highs and trending downward.

The economic landscape will remain complex as the Federal Reserve continues to fight inflation which puts additional pressures on business profit margins. While we don’t expect inflation to fall rapidly, anything resembling a change in its trajectory could result in a relief rally within equity and credit markets. Equity market valuations have already fallen off their highs and forward P/Es currently sit at 15.9x, which is below their 25-yr average of 16.85x.

July 8, 2022

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now