Allworth Director of Investment Research Ryan Gromatzky takes a look at whether the Federal Reserve's interest rate hikes are having the desired economic impact.

The fact high inflation is still in the news reminds me of a quote by Nobel Prize winning economist, Milton Friedman, who stated, “Inflation is always and everywhere a monetary phenomenon … A steady rate of monetary growth at a moderate level can provide a framework under which a country can have little inflation and much growth.”

However, elevated levels of inflation can lead to a destruction of purchasing power which creates a wealth gap between those who are asset rich and those who are asset poor. A perfect example of this is home ownership. If an individual owns a home, the value of that home tends to increase over time. Conversely, a renter becomes poorer as his or her rent increases without the benefit of an asset to offset his liabilities.

For this reason, among others, the Federal Reserve (Fed) is tasked with a dual mandate to maintain price stability and maximize employment. To that end, for a little over a year now, the Federal Reserve has been aggressively hiking the fed funds rate to help curtail inflationary pressures. By raising rates, the Fed has been attempting to restrain demand so that demand comes into balance with supply – thus lowering inflation.

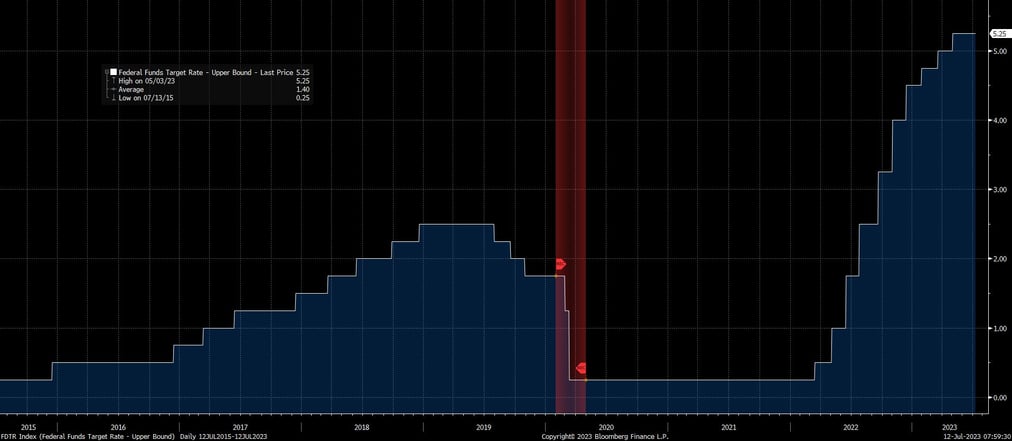

As you can see in the chart below, the Fed has now raised the fed funds rate by ~500 basis points. While the tightening of monetary policy works with long and variable lags, higher interest rates will eventually reduce demand consistent with the Fed’s mandate.

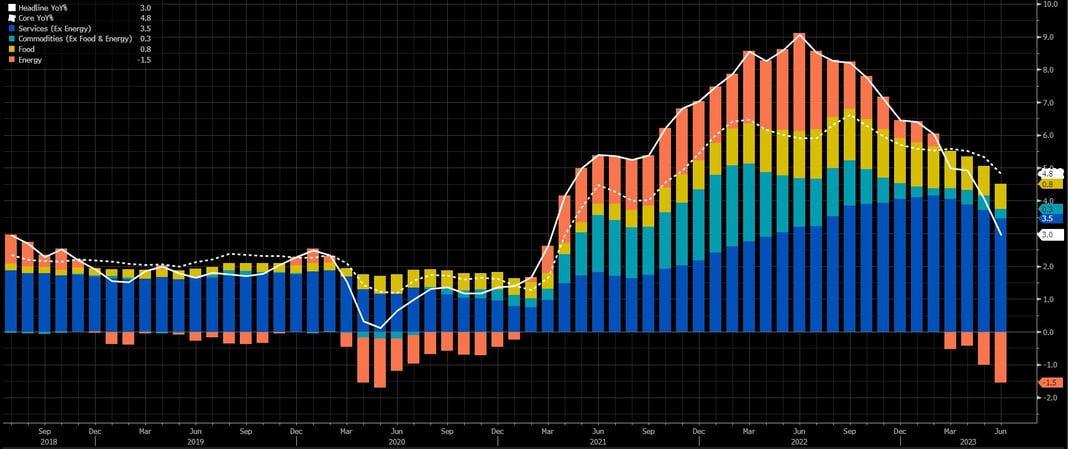

This week, we received an update on the Consumer Price Index (CPI) to determine how much progress the Fed has made since inflation hit its June 2022 peak of 9.1%.

The good news is that year-over-year CPI dropped to 3.0% in June, which is slightly better than the consensus’ estimate of 3.1%.

However, core CPI (which excludes food and energy) remains a much more robust 4.8%. This is because lower energy costs have been the primary driver of lower headline CPI (down -16.7% year-over-year) – which is historically volatile.

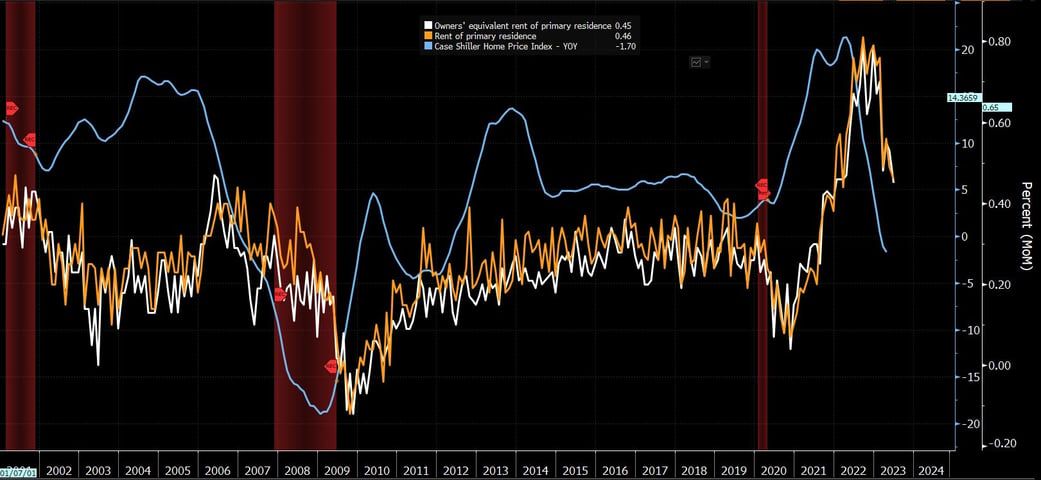

A more enduring reduction in headline CPI would necessitate a reduction in the services component. Within the services component of CPI, shelter costs remain the biggest sub-component. In turn, the shelter component is comprised of (1.) Rent of primary residence, and (2.) Owner’s equivalent rent. In total, shelter costs make up approximately 35% of headline CPI and almost 60% of services.

In June, the shelter component of CPI continued to run hot at 0.4% month-over-month and 7.8% year-over-year. As such, to make meaningful progress on inflation, shelter inflation will need to moderate. The good news is that this is beginning to occur.

Historically, shelter costs have a high correlation with home prices – which makes sense. However, the way the data is aggregated results in a lag between declining home prices and a corresponding decrease in shelter inflation. This lag is historically about 12 months, and this is what we are seeing now. As you can see in the chart below, home price growth peaked in the first three months of 2022 (Q1-22), and subsequently began moving lower. The current year-over-year change in home prices is -1.7% - compared to its peak of 20% in Q1-22. As such, we are beginning to see shelter inflation begin to move lower (as seen below).

This week’s softer-than-expected data indicates the Fed is beginning to have some success on the inflation front. However, it may be some time before the Fed is able to bring inflation down to its 2% mandate as year-over-year numbers become more difficult to beat moving forward. In fact, it is plausible that inflation could move slightly higher in the coming months.

As such, sticky inflation like shelter, combined with a resilient labor market, should keep the Fed committed to a higher-for-longer monetary policy framework. After all, the last thing the Fed wants is a reacceleration of inflation.

July 13, 2023

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now