Allworth Chief Investment Officer Andy Stout discusses how we’re analyzing future inflation risk, and the importance of prudent spending in today’s uncertain economic environment.

Think back to the best high school or college class you ever took.

One of my favorite subjects was economics. That’s because, whether it was Econ 101, or a graduate-level class, we regularly discussed supply and demand.

That said, if you ever took an economics course, you’ve seen a version of this chart.

We can use the above chart to help determine what inflation might look like in the coming weeks and months.

Inflation is here, but is it here to stay?

Regardless of what’s going on in the world, the price something sells for will be where the supply and demand lines intersect. Unfortunately, there is a lot going on in the world. For just one example, COVID-19 has dramatically affected supply chains, which has led to a serious microchip shortage.

How did it happen?

First, COVID-19 caused semiconductor factories to shut down, which reduced the global supply. Then, as the world shifted to working from home, companies had to outfit their employees for the transition, so demand soared for the electronic equipment required to make that possible. Of course, this equipment requires microchips to work, and so the demand cut into the available supply of microchips for all sorts of other products. (And that, believe it or not, is one reason why there’s a shortage of new cars for sale.)

Without going through a series of shifting supply and demand charts, the takeaway is that Econ 101 tells us prices (inflation) will rise because of supply chain dislocations.

Another factor that could cause high inflation in the months ahead is increased consumer spending as the economic reopening speeds up. Over the past year, savings have ballooned thanks to the unprecedented amount of fiscal stimulus (i.e. those checks the government keeps sending out), along with the simple fact that those folks who kept their jobs didn’t have nearly as many places (or ways) to spend their money.

The savings rate currently sits at 14.9 percent. While it’s been slightly higher than this over the course of the past year, compared to most of recent history, we are in unchartered waters. Of course, with about 70 percent of Americans living paycheck-to-paycheck, much of this savings is concentrated in the upper-middle-class. Nonetheless, the amount of money sitting in bank accounts bodes well for strong consumer spending going forward.

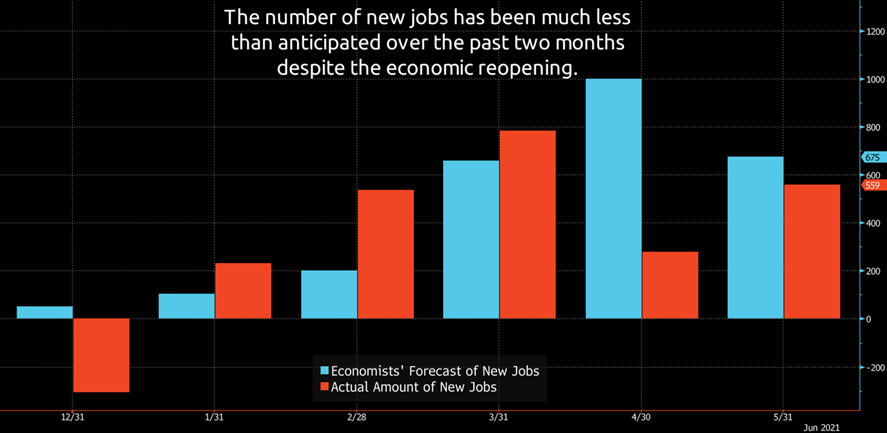

And still another factor influencing inflation is the job market. An underwhelming number of new jobs have been added to the economy over the past two months. Because of the optimism surrounding the reopening, economists were initially expecting that nearly 1.7 million jobs would be added in April and May.

Instead, there were “only” 837,000 new jobs.

Despite the relatively low number of new hires, there are almost 9.3 million job openings in the US. This is a record, which suggests employers are having a hard time finding workers.

To compensate, employers might have to entice potential workers with higher wages. And, subsequently, employers might then attempt to pass on those higher costs to you.

One reason that businesses could be having a tough time finding workers is that the federal government decided to increase weekly unemployment benefits by $300 per week, which some people believe is incentivizing people not to seek work.

As a result, there are currently 25 states opting to end this extra assistance early. For example, Texas, Florida, Ohio, and Georgia will terminate these benefits on June 26. (The states not ending the program early will see these benefits expire in early September.)

Either way, this should not be a long-term problem.

Of course, there are certainly people not working for other reasons, such as fear of the virus and child-care logistics. However, as vaccination levels rise, people will likely become more comfortable finding a job, and as more schools reopen, this should help solve the child-care dilemma.

Another factor causing higher prices today has been the increase in commodities prices. A recent study by Bloomberg showed that the rise in commodity prices has been mostly due to speculation, and not actual demand. In other words, businesses and governments aren’t buying commodities to put into projects that fuel economic growth. Nope. Instead, it’s actually Wall Street traders speculating on commodities and driving up prices.

Here’s the thing to remember – supply chain dislocations, increased spending from the reopening, speculative commodity trading, and employers paying above-market rates to employees are all temporary forces which should become less influential in the coming months.

Said another way, we expect high inflation over the next few months, with the upcoming year-over-year numbers being artificially elevated because they will be compared to a time when the economy was shut down.

However, we believe – based on today’s data – the most likely scenario is that inflation will approach more normal levels early next year.

Of course, nothing is guaranteed, however.

What we’re watching to gauge inflation risk.

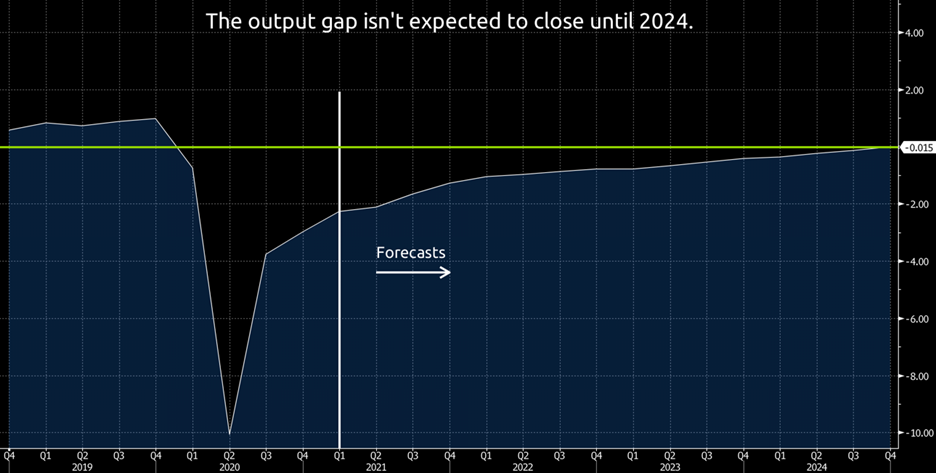

To get an idea of the risk that inflation could become more permanent, we will be watching a few specific data points. One is called the output gap. This compares potential GDP with actual GDP. If this gap narrows faster than expected, the risk of inflation staying elevated becomes much more real.

The slack in the labor market (7.6 million fewer jobs than February 2020) suggests the output gap won’t be closing earlier than expected.

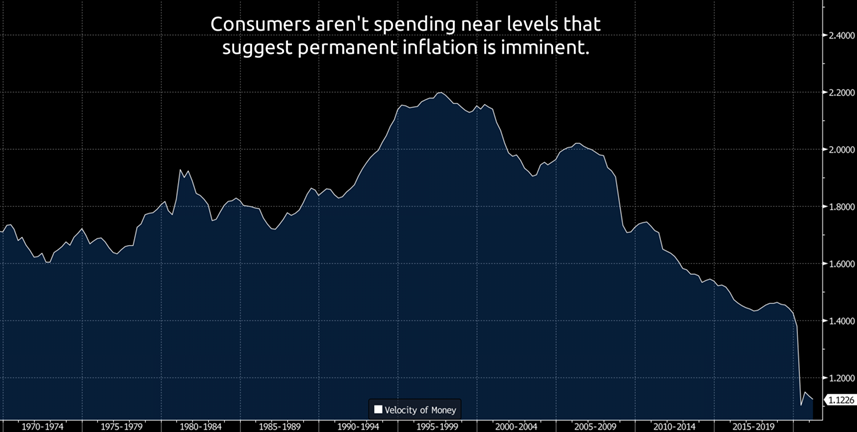

Another data point we are closely monitoring is the velocity of money. This is the ratio of GDP to the money supply. It essentially tells us how quickly money is being spent. It’s currently near record lows. While it will likely pick up over the remainder of the year, there is a lot of room to run before it becomes problematic.

What the market and the Fed think about inflation.

We’re not alone in our belief that inflation is temporary. The fixed income market is pricing in a similar scenario. We observe this by deconstructing the inflation breakeven curves to isolate different periods. This analysis shows that expected inflation is 3.3 percent over the next 12 months and is just 2.3 percent for months 13-24.

The implications of transitory inflation are significant, especially for the Federal Reserve (Fed), our nation’s central bank.

The Fed is primarily concerned with stable inflation and full employment. If the big brains at the Fed think inflation will drop next year, they can look through these temporarily high readings and focus on the labor market. Since there are 7.6 million fewer jobs than there were when the pandemic began, the Fed is justified in keeping short-term interest rates near zero.

The Fed has previously indicated it wouldn’t raise rates until at least 2024. The market thinks the Fed might need to move a little sooner – but not much. Fed fund futures are trading at levels that imply there will be about two rate hikes by the end of 2023. (Fed fund futures are instruments to speculate on when the Fed might raise or lower interest rates.)

This is important because the Fed has an ominous track record of hiking us into a recession. They would raise rates to cool down an overheating economy; however, the Fed typically didn’t stop until it was too late.

Should inflation become more permanent, nuanced adjustments to your investment mix may be warranted. Historically, equities, certain commodities, and TIPS have been good inflation hedges. The right types of securities to invest in will depend on many economic and investment factors at specific points in time, including interest rate spreads and the volatility term structure (difference between short-term and long-term implied volatility).

Lastly, don’t let today’s economy cause you to make spending decisions that could hurt your retirement.

This unusual economic environment caused by the pandemic has resulted in consumers adjusting their spending habits, often in an impulsive manner.

People have been stuck in their homes, and they are eager to get out… and spend money. Also, some people are worried that prices will exponentially increase, so they are spending out of the fear that goods and services will soon become even more expensive.

But the most likely outcome is that inflation normalizes, and life returns to some semblance of normal.

So, we urge you to be prudent with your spending. Don’t cash out your 401(k) (and then get forced to pay taxes and an IRS penalty) to buy a second home or even an investment property (which is certainly happening).

Instead, spend at or below your means. Remember, smart spending now will better enable you to enjoy your money and your retirement for many years to come.

June 11, 2021

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now