Allworth Chief Investment Officer Andy Stout analyzes the economy as it stands today and looks at where it might be heading in the coming months.

“Super bad feeling.”

That’s the phrase Elon Musk used to describe how he feels about the country’s economic outlook. One of the reasons he and others have expressed concern is that the steps to reduce inflation could very well cause the economy to slow.

Our nation’s central bank, the Federal Reserve (Fed), is tasked with keeping inflation under control. But with inflation raging at a 40-year high, that’s far from happening. So, the Fed will keep raising short-term interest rates to reduce aggregate demand and thus slow inflation. The challenging part for the Fed will be finding a balance between higher interest rates and positive economic growth.

In other words, the committee wants to slow down the economy to reduce inflation; however, it doesn’t want to slow it down so much that we fall into a recession. Some investors are understandably concerned because, historically, the Fed doesn’t have a great track record of engineering a so-called "soft" economic landing.

Where we are today

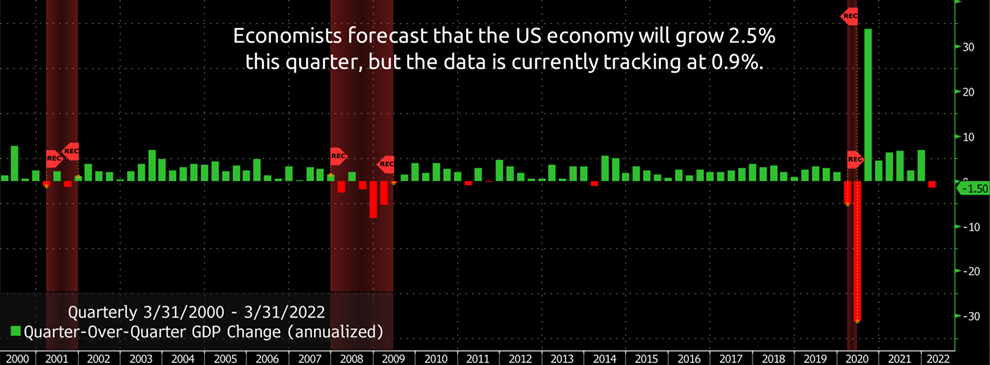

A rule-of-thumb when diagnosing a recession is two consecutive quarters of negative economic growth. With the economy shrinking by 1.5% in the first quarter of 2022, negative growth in the second quarter of the year would, by definition, trigger the application of that rule.

However, technically, two straight quarters of a shrinking economy is NOT the definition of a recession. The National Bureau of Economic Research (NBER) is the official arbiter for deciding if we are in a recession. The NBER defines a recession as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

Pretty generic.

Currently, economists expect the US economy to grow by about 2.5% in the second quarter. However, the economic data that’s been released so far suggests economic growth is tracking at a relatively slow 0.9% rate this quarter.

So, there is a risk of a rule-of-thumb recession because second-quarter economic growth is tracking close to zero. However, if that were to happen, it most likely would be shallow because of robust consumer spending.

What leading indicators suggest

We regularly analyze leading economic indicators because they shed light on where the economy could land in the coming months. A leading indicator is a piece of economic data that corresponds with a future movement or change in some phenomenon of interest. These indicators can help to predict and forecast future trends in business, markets, and the economy. However, instead of simply looking at one or two indicators, we analyze several to get a more complete picture of the economy.

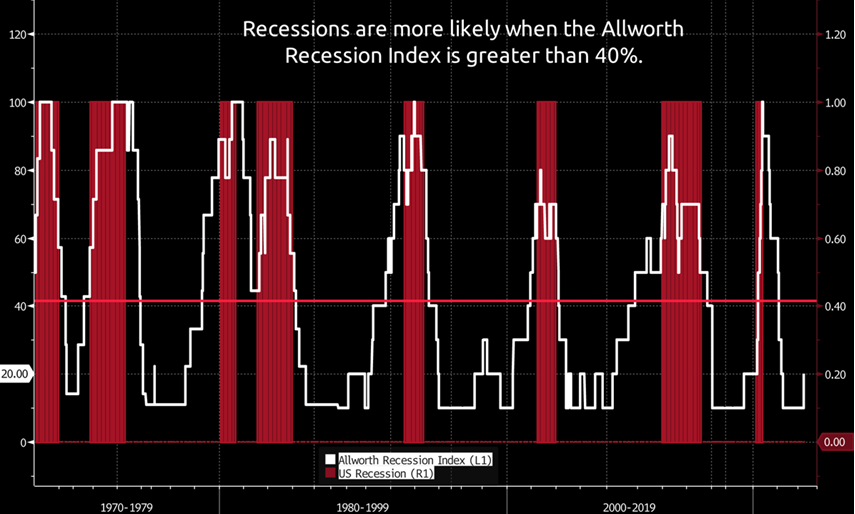

As a result, we created the Allworth Recession Index, a powerful combination of 10 indicators representing various parts of the economy. Presently, only two of the indicators are pointing to a slowdown. This suggests that recession risk remains low over the next six or so months.

Of course, we don’t pretend to have a crystal ball, so we analyze other economists’ models, as well. For example, Bloomberg economists estimate recession risk to be about 25% over the next 12 months.

There are two primary reasons recession risk hasn’t materialized in leading economic indicator data:

- A strong labor market: There are 11.4 million job openings, which is almost double the number of unemployed. This suggests that companies may not be able to cut thousands of jobs, something you normally see during recessions.

- A healthy consumer: The household debt service ratio, which measures debt relative to income, is at an extremely low level of 9.3%.

But there are caveats. The savings rate has dropped to 4.4% of disposable income, the lowest level since 2008. And, as consumers deplete their savings to pay for the rising costs of goods and services, they will need to enter the labor force to find a job.

There would be multiple effects to a growing labor force, some positive and some negative. On the negative side, the unemployment rate would move higher. But, on the positive side, wage inflation could drop as labor supply increases.

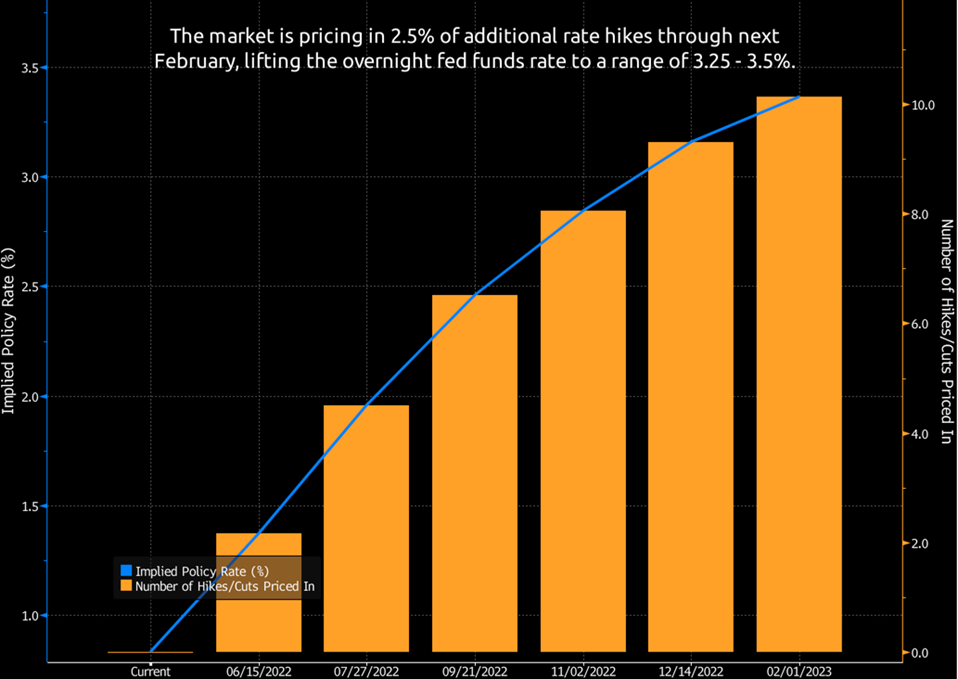

We would not expect wage inflation to drop enough to deter the Fed from its aggressive rate-hike path. The interest rate the Fed adjusts to try to control inflation is the fed funds rate, which is the overnight interest rate of the money that banks lend to each other. Many other interest rates, like CDs and new mortgage rates, generally move in a similar manner to the fed funds rate.

To determine what the market expects the Fed to do, we analyze fed fund futures. These securities show that the Fed will hike by 0.5% at its next four meetings. Over the next six meetings, through February 2023, market pricing suggests a total of 10 separate quarter-point rate hikes or an additional 2.5%.

Unfortunately, higher interest rates will negatively affect the previously mentioned debt service ratio. But because households are, generally speaking, in such good shape right now (9.3% debt service ratio), they have a bit of a cushion to withstand higher rates. Additionally, elevated interest rates will slow down spending because borrowing money will become more expensive.

The Fed will try to avoid hiking us into a recession as the committee intentionally slows down the economy. But, while it might not happen this year, because it’s a part of the normal business cycle, at some point in time, we will fall into a recession. After all, there have been 17 recessions in the past 100 years, which means they are hardly rare occurrences. Fortunately, after every recession, the US economy has emerged stronger than ever.

As you can likely guess, the financial plumbing that connects markets and the economy is much more complex than the high-level view I’ve described in this brief analysis. That’s why we at Allworth Financial constantly monitor numerous indicators to determine the chance of a recession, the depth of any potential slowdown, and how to best position your investments against the widest range of potential outcomes.

June 10, 2022

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now