Allworth Chief Investment Officer Andy Stout takes a close look at the last year and dissects how the economy has been changed by the global pandemic, and what this means for you going forward.

As the realities of the pandemic set in this time last year, global sentiment couldn’t have been worse. Looking out my home office window this morning, it’s difficult to fathom that it’s been a year since the world shut down.

And yet, even though there’s been untold hardship across the country, we all largely adapted – both in our own lives and on the economic front.

The Pandemic Impact

There’s little question that the economy was in a historically perilous place this time last year. In March and April of 2020, about 22 million jobs were lost as businesses were forced to close. This sent the monthly unemployment rate to 14.8%, its highest level since this data series began in 1948.

Of course, with fewer jobs, consumer spending collapsed, and this led to the most severe quarterly economic contraction ever as the US economy fell 31% in the second quarter of 2020.

America Adapted

Despite the hardships, the economy did not completely come undone as some feared.

Instead, we adapted.

Thanks to technology, many companies were able to continue to efficiently operate by switching to remote working. And, as the economy began to slowly reopen after April, about 13 million jobs were added in the next 10 months. This still leaves us with about 9 million fewer jobs than in January of 2020, however, so there is clearly still ample room for improvement. (Furthermore, what no one knows for sure is how many of the more than 9 million people who are currently unemployed worked at jobs that are now gone forever.)

In addition to businesses adapting, so too did consumers. Rather than spending money at malls and restaurants, people spent more of their money online or on their house (either by moving or home renovation projects).

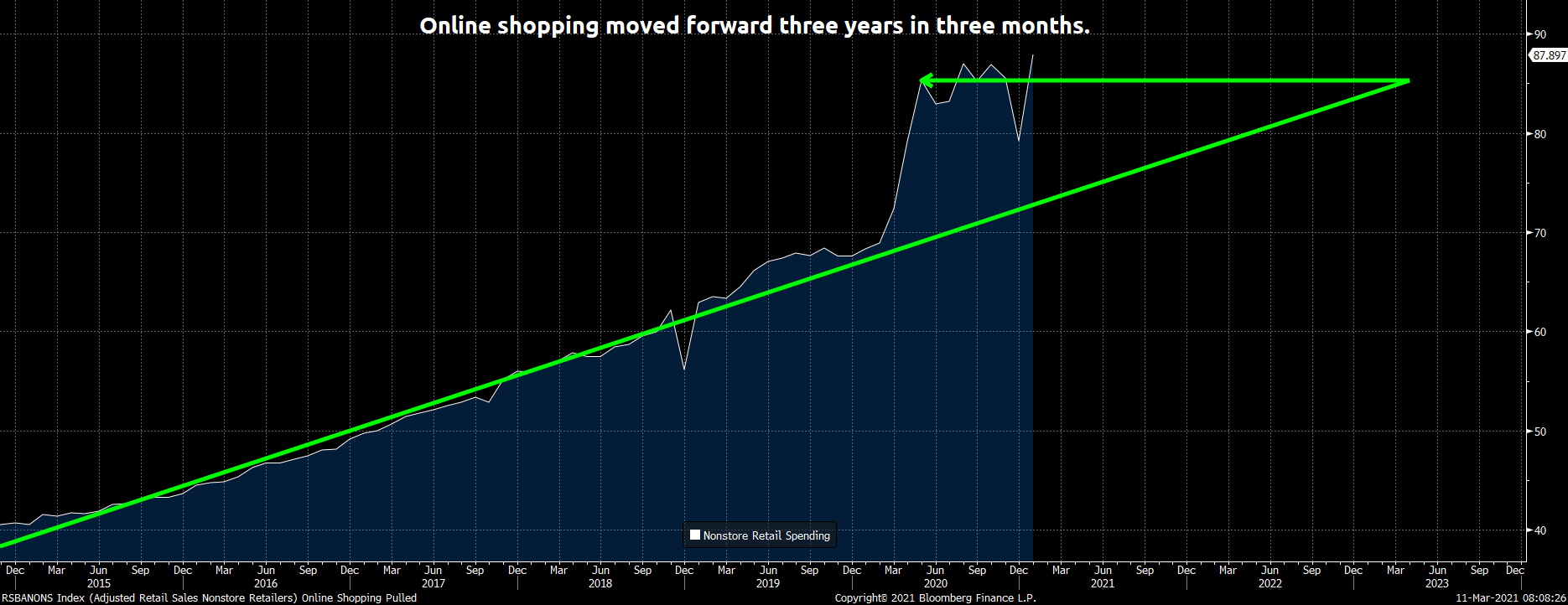

It was a secret to no one that in the years leading up to the pandemic online shopping was taking market share from brick and mortar stores. The pandemic significantly accelerated this. Had the pandemic not happened and consumers shopped online at the same pace as they had over the past five years, we wouldn’t have reached the level of online sales that we have until sometime in 2023.

As the economy reopens, consumers might reallocate their expenditures, which could result in slightly lower levels of online spending.

The Economy Today

So today, we have both a consumer with a vastly different mindset and a job market that has partially healed.

Looking ahead, while anything can happen, the economy appears to be poised for an extremely strong year. This is due in part to restrictions that are already being lifted in some areas, the number of daily virus cases being back at October levels, and the fact that roughly 20% of the population has received at least one dose of a vaccine.

On top of that, the $900 billion in fiscal stimulus passed last December, combined with the $1.9 trillion bill just signed by President Biden, should have a very positive effect on economic growth.

How positive?

The stimulus now has many economists expecting economic growth of 6% or higher for 2021, and predictions that the unemployment rate will drop to around 4-4.5% by the end of the year.

Rising – but Manageable – Inflation

Many of the same reasons that there’s economic optimism are also why some people are fearful of inflation. The year-over-year inflation numbers will likely move higher in the coming months, but this is partially due to easy comparisons to 2020 data when the economy was virtually shut down.

But other factors will cause inflation to move up as well. Specifically, there will be more demand for products and services during the reopening, and input costs are also moving higher (because of broken supply chains).

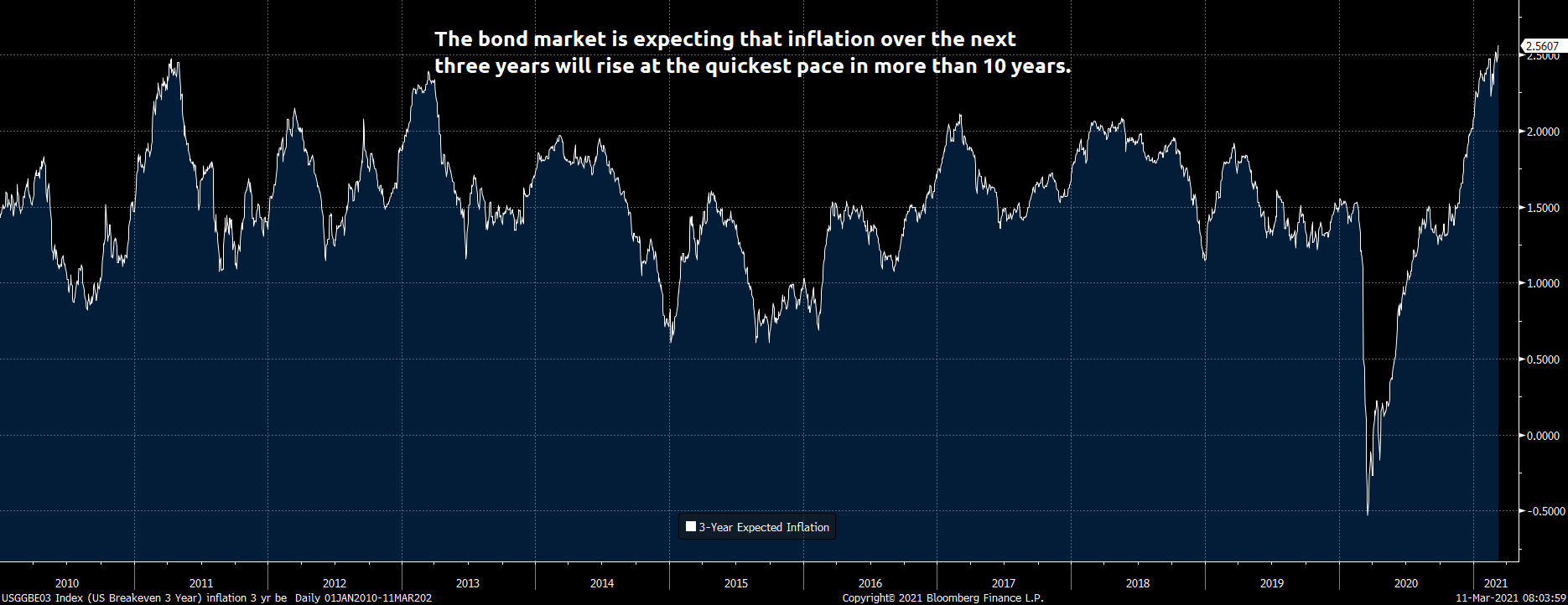

This has resulted in the bond market pricing in inflation over the next three years at almost 2.6%. These inflation expectations are the highest in more than a decade.

The fear of inflation has pushed long-term interest rates to their highest level in more than a year. (Interest rates move up when there are inflation concerns because lenders demand more money due to expected loss of future purchasing power from the fixed interest income they’ll receive.)

With inflation expected to rise, the market is pricing in the expectation that the Federal Reserve, our nation’s central bank, will raise short-term interest rates up from zero sometime in late 2022. (This is more than a year before the Fed itself suggested they would raise rates.) The Fed could very well start to raise rates late next year (or early 2023) should the unemployment rate fall to about 4% and inflation remain above 2% for several months.

Regardless, inflation at this expected ~2.6% level is not overly concerning. We don’t see inflation as being on the cusp of becoming a problem in the near term because of poor demographics, workplace efficiency, and a lack of deglobalization. Additionally, most workers will not be in the position to demand higher wages in the coming months.

In other words, the risk of wage inflation is low.

Of course, while things appear promising for the economy, that doesn’t mean it will all be smooth sailing. For one, the forward-thinking stock market seems to have already priced in this good news. In fact, what could end up driving the market in the future is how the economy performs relative to what’s already expected.

As always, we are here to answer any questions you have pertaining to the market, retirement, investments, your taxes, estate planning, inflation, and more.

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now