Allworth Chief Investment Officer Andy Stout shares an overview of where things stand in the economy.

With financial stability called into question by the recent bank failures, and with inflation still running too hot, we want to offer our insights on the current investment climate and why it differs from 2008.

The Fed hikes

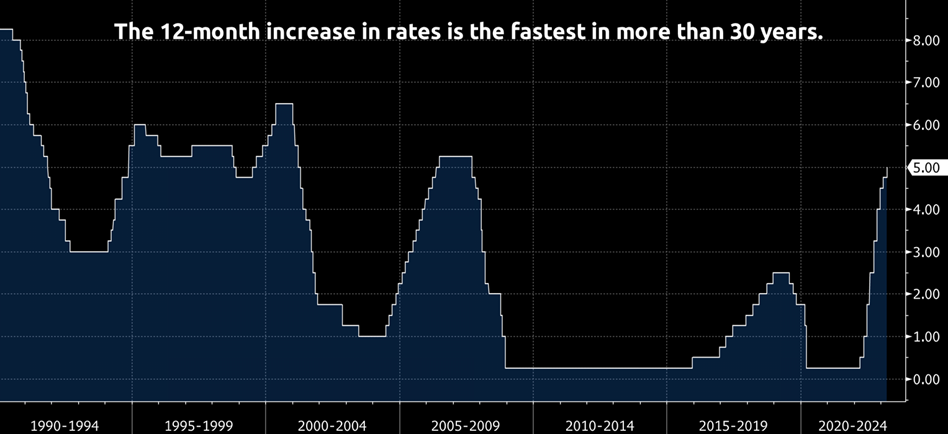

The Federal Reserve (Fed) has been laser-focused on curbing inflation, implementing one of the most aggressive rate hike campaigns ever. As a result, inflation fell from its 9.1% June 2022 peak to its most recent reading of 6%, which is still too high for the Fed’s comfort.

So, despite the recent bank failures, the Fed hiked rates by 0.25% on March 22nd to a range of 4.75% - 5%. This hike showed the central bank is more worried about inflation than bank failures. In fact, in his post-meeting press conference, Fed Chair Jerome Powell stated that deposit withdrawals have stabilized over the past week, a positive sign for the financial sector.

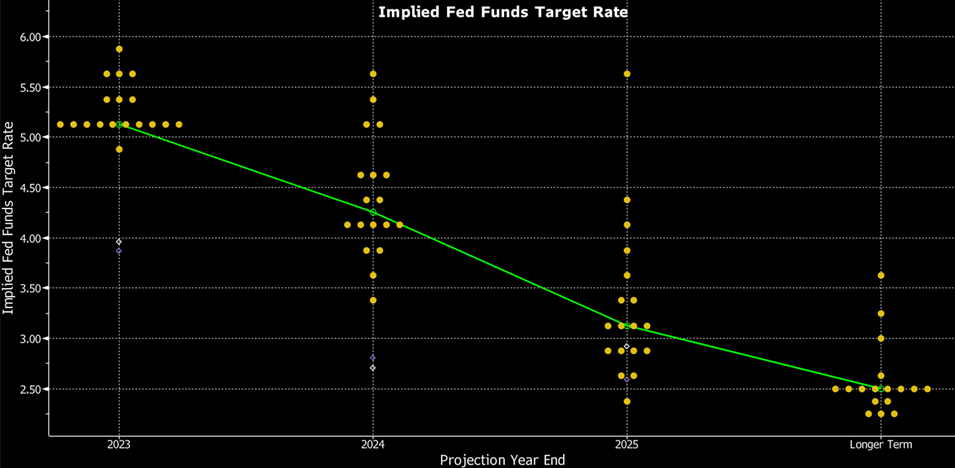

Also, at its March meeting, the Fed updated its view on where short-term interest rates are via the dot plot. The dot plot shows where each Fed member believes interest rates will be at the end of the upcoming years. The market tends to focus on the median dot (green line below), and the March update indicated only one more rate hike this year.

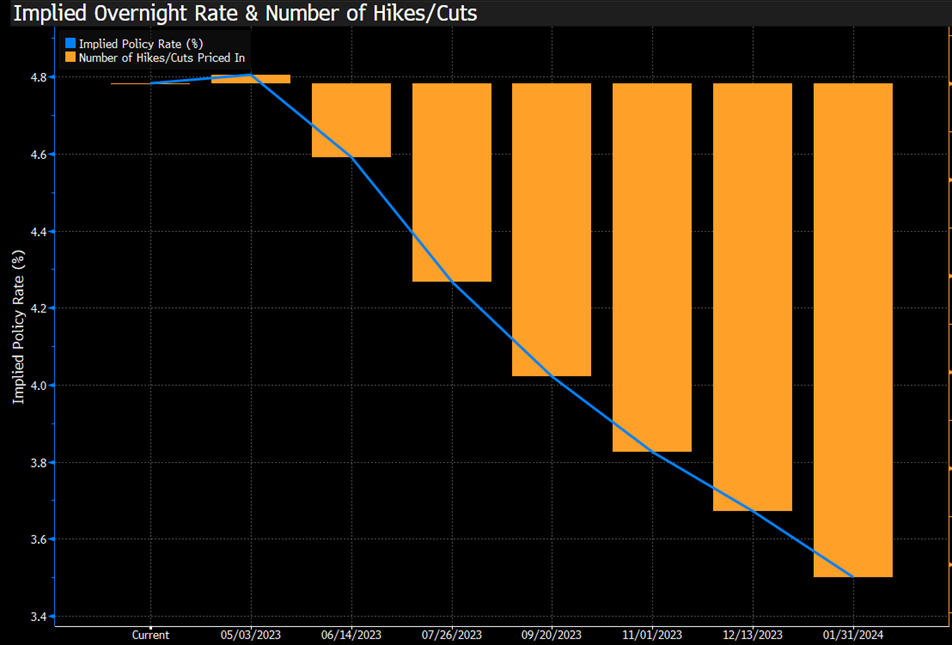

It appears the Fed is taking a wait-and-see approach to financial stability. Should more issues arise in the banking center, there is a very good chance the Fed won’t hike at its next meeting on May 3rd. In fact, the market (as measured by fed fund futures) has priced in this uncertainty by showing a 91% chance of no hike in May, but what’s more interesting is the pricing beyond that. Specifically, the market expects about 1% in rate cuts from current levels through the end of the year.

To appreciate why the market reflects an abrupt Fed pivot, one must first understand how rate hikes ripple through the economy.

How Fed rate hikes affect the economy and banking system

The first thing to realize is that rate hikes impact the economy with a 6 to 9-month lag. The Fed’s rate hike path has been rapid, lifting rates from zero to their current range in just over a year. Rate hikes totaled 3.25% in the past nine months and 1.75% in the past six months.

So, one can easily argue that many hikes haven’t made their way into the economy. In other words, there is much uncertainty regarding how the Fed’s moves will fully impact the economy and inflation.

Fed rate hikes can ripple through the economy and the banking system. As borrowing costs increase, consumers and businesses may cut back on spending, slowing economic growth and weakening the job market. A slowing economy forces a bank to write down the value of its loans, which reduces its available capital to make additional loans.

While several factors can contribute to a bank’s collapse, these lower capital buffers make banks more susceptible to failure because they may be unable to withstand economic shocks. For example, the shock that Silicon Valley Bank couldn’t handle was a slowdown in the tech start-up industry, where they had an overconcentration of clients.

There were other unique reasons for the failures of Silicon Valley Bank and Signature Bank, but one commonality was that both financial institutions had a large percentage of uninsured deposits. This led to massive withdrawals as savers became very nervous about getting all of their money back. This liquidity crisis ultimately resulted in the banks’ insolvencies and failures.

Credit Suisse’s failure appeared inevitable over the past few years because of extremely poor decisions. For example, the bank was involved in a corporate espionage scandal and widely-publicized hedge fund collapses. In addition, a data leak of 30,000 customers showed the bank was doing business with people associated with torture, money laundering, and drug trafficking. Finally, in the past month, the SEC told Credit Suisse not to release its financial statements, citing “material weakness” in its financial reporting. And that’s just in the past four years!

Needless to say, customers had lost confidence in the 167-year-old bank. As a result, withdrawals surged over the past few months. But savers’ anxiety skyrocketed last week because they believed the bank failures in the US would spread to Credit Suisse, and that pushed the company over the edge. Consequently, UBS purchased the historic bank for just $3.2 billion or about $0.85 - $0.95 per share.

Why 2008 was much different

When you hear a name like Credit Suisse being taken over for less than a dollar, it’s easy to think of Lehman Brothers and Bear Stearns. However, today’s environment is different from 2008 for many reasons:

- Housing is not supported by loans to subprime borrowers

- We know what’s on banks’ balance sheets

- Those balance sheets are much stronger

- Bank leverage is significantly lower

- The government (likely) won’t repeat its mistake of acting too slowly in the event of a sudden crisis

Fortunately for investors, slowing inflation momentum and the approaching end of rate hikes are generally positive for both stocks and bonds. But even though 2023 is not 2008, other banks could experience problems, such as Deutsche Bank. That’s why it’s crucial to have a deep understanding of capital markets and the behind-the-scenes financial plumbing when building a well-diversified portfolio to support your financial goals.

March 24, 2023

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now