Have you wondered how long the good economic times will last?

With Memorial Day kicking off the start to summer, now is a great time to look back at how the economy has fared so far this year, and what that means for long-term investors.

At the beginning of 2019, just about everyone was nervous that we were about to slip into a recession.

But that hasn’t happened. The Great Recession ended in June 2009, and if the economy grows until July, it’ll mark more than 10 years of steady growth, which means we are now nearing an impressive milestone: this would be the longest economic expansion in our nation’s history.

But fear, and the almost unbelievably long-duration of this strong economy, have meant that dire predictions make good copy and, let’s face it, what goes up must come down.

But we aren’t there yet.

With that in mind, here are three popular worries from late last year which didn’t materialize.

That:

- The Federal Reserve (Fed), our nation’s central bank, would raise short-term interest rates too aggressively, and push us into a recession.

- The U.S. economy would shrink in the first quarter of the year.

- Corporate profits would fall off a cliff.

Let’s review these and examine what happened, and then take-a-look ahead.

1) The Fed

Late last year, the Fed indicated that two additional short-term interest rate increases were likely in 2019 (after they’d raised them four times in 2018). The Fed has since moved to the sidelines.

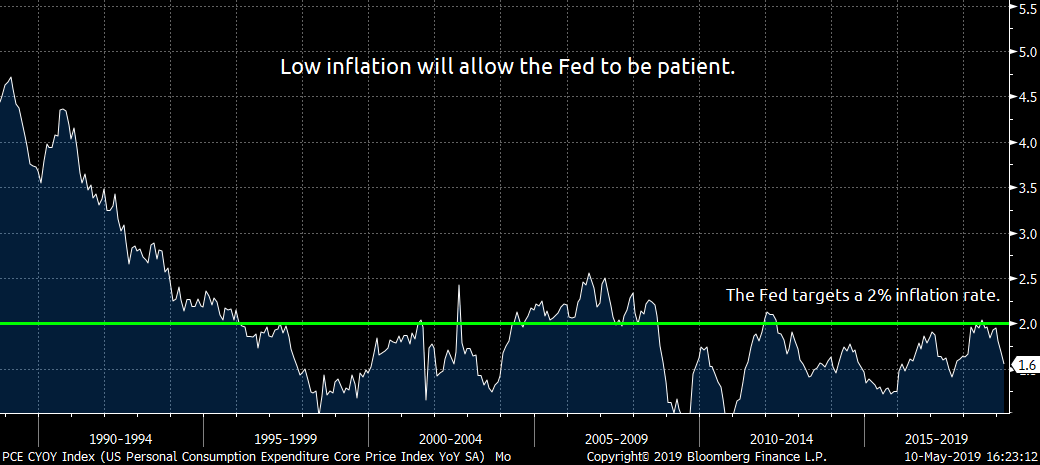

The Fed’s two main goals are full employment and stable inflation. One could easily argue that we’re at least near full employment since the current 3.6% unemployment rate is at a 50-year low. However, inflation is running well below the Fed’s 2% target.

The Fed’s preferred inflation measure shows that prices are only 1.6% higher over the past year. This lack of inflation is one reason the Fed is in no hurry to raise short-term interest rates this year.

2) The Economy

The U.S. economy grew 2.9% in 2018, and this was tied for the best growth in 13 years. Going into this year, some economists thought consumer spending would stall out in the first quarter, causing the broad economy to decline.

In fact, consumer spending was very weak in the first two months, but spending rebounded nicely in March. Also, the job market bounced back in March from a poor February. This helped the economy grow 3.2% in the first three months of the year.

To be fair, it will be tough for the economy to sustain that pace. Economists currently expect growth to be about 2% for the remainder of the year.

At Allworth Financial, your investment team pays close attention to leading economic indicators, which are data that move before the broad economy. When these leading indicators start to decline, the risk of a recession in the next six to nine months rises.

Based purely on those leading economic indicators, it would appear that a recession is not imminent.

3) Corporate Profits

Wall Street analysts thought corporate earnings would decline around 4-5% in the first three months of the year. These fears were based on a slowing economy and projected poor consumer spending. But fears of a steep drop in profits appear to have been greatly overstated.

Instead of a sharp decline, earnings are basically unchanged over the past year. Profits from healthcare companies have been strong while energy companies have reported a decline in earnings. It isn’t surprising that energy companies are showing a drop in profits because the average price of oil in the first quarter of 2019 was about $55, which was nearly 13% lower than the $63 average price of oil in the first three months of 2018.

Looking Ahead

Just because the fears from the beginning of the year were misguided, doesn’t mean you should expect smooth sailing. There are always challenges when investing, but time and time again, the U.S. economy and markets have overcome those obstacles.

We believe that:

- The Fed will be very patient when it comes to its next interest rate move.

- The U.S. economy will grow in 2019 with a fairly low risk of recession.

- Corporate profits may be flat in the second quarter (April, May, and June), but could have solid growth in the second half of the year.

What we do know, is that focusing on short-term economic worries can lead to costly emotional investment decisions.

In other words, some investors become concerned about the economy or the markets, and these investors then decide to sell their investments and move to cash.

We strongly feel you should instead focus on the long term with your personalized financial plan as a guide. Your financial plan matches your financial needs and risk tolerance, which we believe will help you achieve your goals and enjoy your retirement to the fullest.

Source: Charts and data referenced here come from Bloomberg.

Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may effect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

May 17, 2019

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now