Allworth Chief Investment Officer Andy Stout explains why you need to review your investment mix now despite our positive economic outlook.

Like many of you, I’m excited to see these government-imposed restrictions being lifted. I’m most looking forward to watching more of my kids’ sporting events, and, of course, date nights with my wife.

But with the easing of the lockdowns and the (warranted) economic optimism, it’s easy for investors to become complacent. But now is not the time for that. Now is the time to be diligent and make sure that your investment mix is where it needs to be, so you are well situated for the next crisis.

Why we’re optimistic about the economy

More evidence continues to present itself that the reopening is setting the stage for 2021 to feature the best economic growth rate in more than 30 years. With roughly 58 percent of adults having received at least one dose of a vaccine, daily new cases in the US are at their lowest level in nearly seven months. This has allowed state and local governments the leeway to ease the restrictions that have held back the economy.

This easing has already resulted in a labor market recovery, but the latest jobs report did fall short of expectations for 1,000,000 new jobs. The 266,000 jobs added in April still pushed the total new jobs in 2021 to 1.8 million. In total, there have been 14.1 million jobs added over the past year; however, that leaves us 8.2 million jobs shy of where we were before the pandemic began.

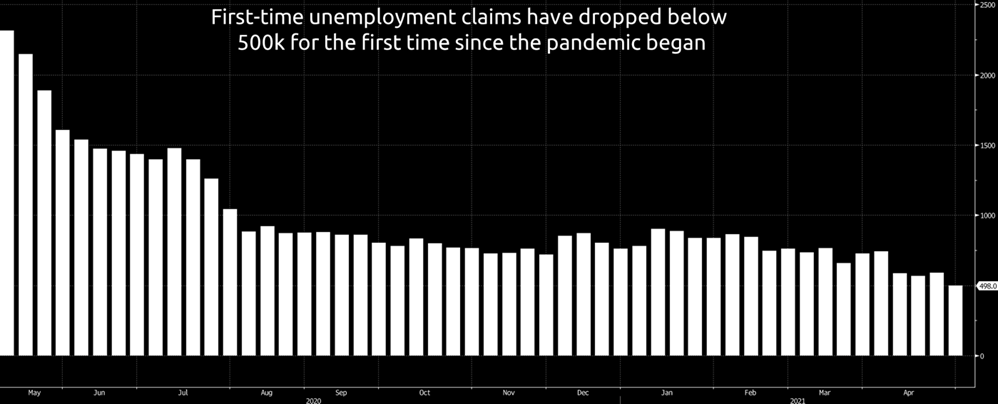

While the April jobs report wasn’t as good as hoped for, there are plenty of silver linings in the labor market. There were an impressive 331,000 jobs added in the leisure and hospitality industry (think restaurants). Another bright spot is a post-pandemic low in weekly initial jobless claims, which measure people filing for first time unemployment benefits because they’ve lost their job.

As the labor market continues to slowly heal, spending should improve even more than it already has. Currently, discretionary consumer spending is being dominated by the upper middle classes, as they’ve been the biggest beneficiaries of the stock market rally, rising home prices, and the fact that a higher percentage of these folks kept their jobs.

Their spending should result in more hiring because companies will be forced to bring in more people to meet demand. The additional hiring will unleash the pent-up appetite to spend across all income levels, likely pushing economic growth north of seven percent for the year.

Why our optimism isn’t unchecked

There are, of course, risks that investors need to appreciate. One real risk is inflation. The two primary causes of inflation are “demand-pull” and “cost-push.” Unfortunately, both are putting upward pressure on prices.

The demand-pull inflation could make itself known through robust consumer spending. This spending is poised to soar in the months ahead because millions of unemployed are finding new jobs, the savings rate is at a staggering 28 percent, and, frankly, people are itching to get out of their homes and do something.

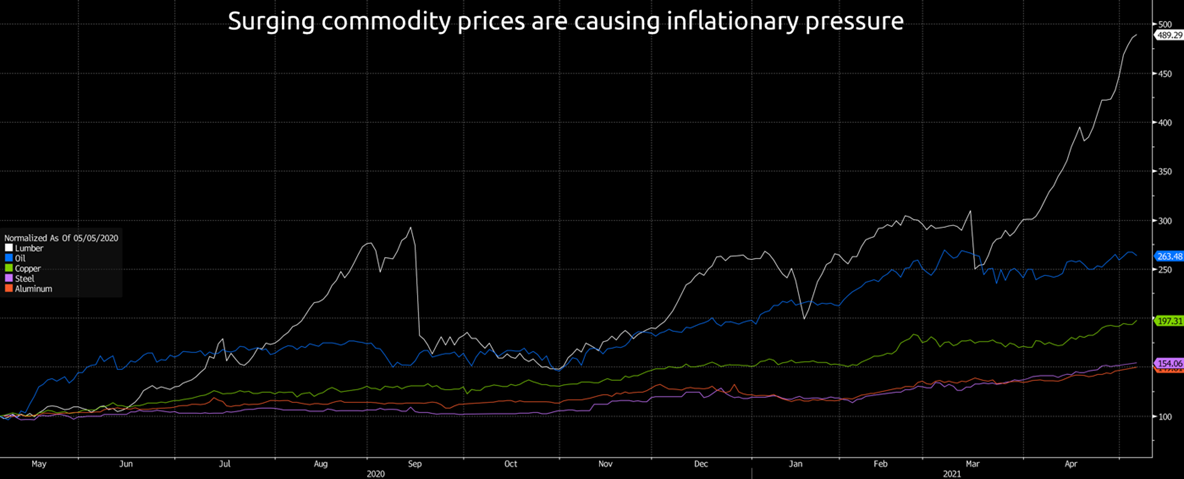

On the flip side, we’re seeing evidence of cost-push inflation in the higher prices of raw materials. A driver behind this is supply chain disruptions caused by the virus. The most obvious example is the price of lumber, which is almost 400 percent higher this year over last. But it’s more than just lumber. Almost any commodity that goes into the supply chain is up in price over last year. The chart below shows the dramatic rise in lumber, oil, copper, steel, and aluminum (all prices have been normalized to 100 for easy comparison).

We fully expect inflation readings over the next few months to be some of the highest readings we’ve seen in the past 10 years. Should high inflation persist beyond 2021, the Federal Reserve (our nation’s central bank) might be forced to raise short-term interest rates earlier than it wants to. (The Federal Reserve is currently estimating that it won’t have to raise rates until at least 2024.)

To reiterate, this is something important to keep an eye on.

The Federal Reserve, for its part, believes inflation will be transitory. A few of the reasons that inflation could be temporary are poor demographics, technological efficiency, lack of deglobalization, and the fact that many of the newly hired workers have not had enough time on the job to demand higher wages.

To be clear, many other risks need to be closely monitored, as well. These include virus mutations, geopolitical tension with China, a further spike in interest rates, and stock market valuations, just to name a few.

Why our tempered optimism shouldn’t affect your investment mix

Some investors look at the positive outlook for the economy and get more aggressive and increase their stock exposure. But, it’s important to remember that the economy and stock market don’t always move in the same direction, especially in the near term.

While stocks do move higher over time, timing the market can lead to a decision that can put your retirement in jeopardy. Numerous studies show investors often hurt themselves when they jump in and out of the market or go “all in” chasing the latest returns.

So, if you have a well-defined financial plan, stick to it. If you don't, get one.

While the huge market drop in March of 2020 might seem like a distant memory, investors need to remember that turbulence is a regular occurrence. Case in point, since 1980, the average calendar year market drop has been an uncomfortable 14 percent.

The takeaway to all this is that you don’t want to get greedy after a strong market rally, or for that matter, you don’t want to be frightened during the next inevitable market drop. Simply, you need to review your investment mix right now, and not when the economic world feels like it is crashing down around you.

Having the proper asset allocation will help you stay invested during the bear markets so you can enjoy the bulls… and your retirement.

May 7, 2021

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now