Allworth Chief Investment Officer Andy Stout analyzes the stock and bond markets' rough start to the year and explores what may lie ahead.

So far this year, there’s been nowhere to hide, as both stocks and bonds have struggled amidst a sticky inflationary environment.

We could oversimplify the reason for the turbulence as the markets coming to grips with a Federal Reserve (Fed) that’s repositioned itself over the past few months to be more aggressive to fight inflation. That’s because when the Fed attempts to lower inflation, it employs policies designed to slow down the economy.

Of course, there are other reasons for volatility, but those too can be tied back to inflation and its effects on economic growth. (Two primary examples are Russia’s unjustified war and China’s zero-tolerance COVID policy.)

A look at fixed income

Historically, bonds have provided protection when stock market volatility has risen. However, this year, the decline in bond values is one of the primary reasons that stocks have dropped.

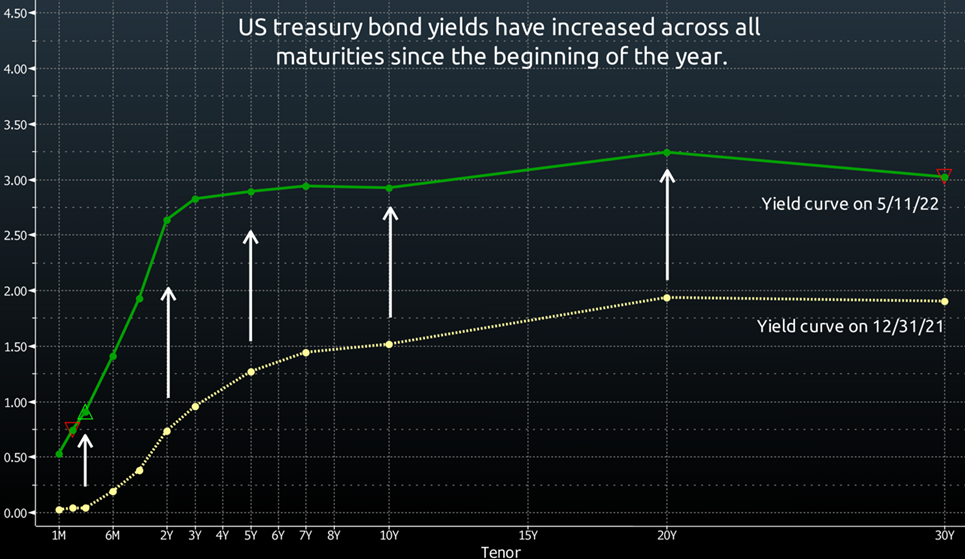

The bond selloff occurred partly because, at the beginning of the year, the market expected the Fed to hike the fed funds rate by “just” 0.75% for the entirety of 2022. But now, the market has priced in 2.75% in rate hikes this year (including the 0.75% in hikes that have already occurred). Subsequently, interest rates have moved substantially higher across all maturities. (As a refresher, interest rates and bond prices move in opposite directions.)

As a result of the upward shift in the yield curve, bonds have experienced their worst start to the year since the Aggregate Bond Index’s inception back in 1977. With a decline of 8.5% through April, this has also been the second-worst 12-month period for the bond index over that span. (Fortunately, a look back also suggests that bonds should indeed recover.)

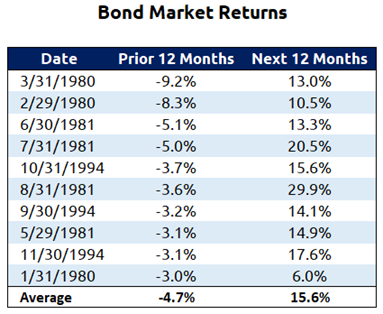

The following table shows the 10 worst 12-month returns (excluding this year’s data) and subsequent performance. While the results are clustered in the early-1980s and mid-1990s, the data clearly shows that when bonds suffered large declines, strong rallies followed.

So, currently, the bond market expects 2% more in short-term rate hikes. (Future bond returns may depend on whether the Fed is more or less aggressive than that.) For example, let’s suppose that the Fed only hikes interest rates by 1.5% for the remainder of the year. Under this scenario, it’s quite likely that bonds will generate positive returns, even though short-term rates increase because today’s market expectations would have proven to be too drastic.

A look at equities

The stock market has also taken a hit, with the S&P 500 dropping about 13% through the end of April. Unfortunately, the decline has extended through the first few days of May. Other stock market indexes have suffered more. For example, the Nasdaq is down 21%, and small-cap stocks fell 17% through the first four months of the year.

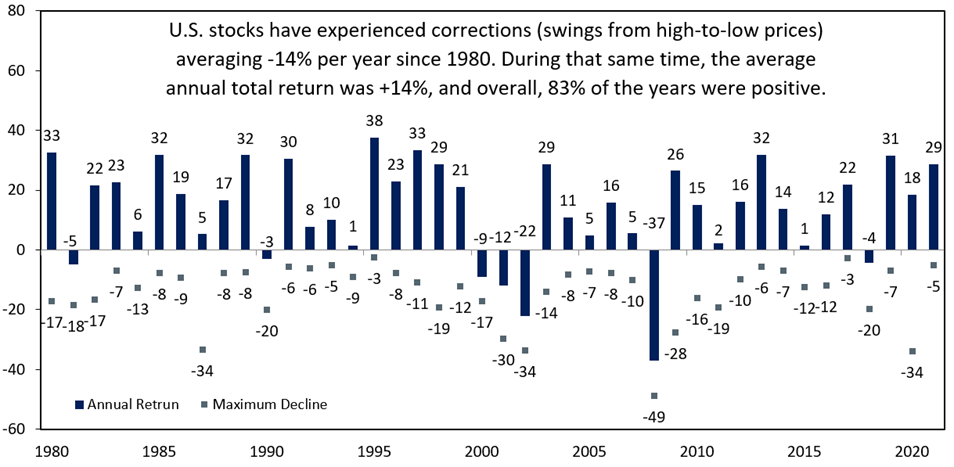

While turbulence like this is uncomfortable and can increase anxiety, it is actually quite normal.

Since 1980, the average drawdown from high-to-low is 14% in any given calendar year. Despite regular corrections, the market gained 14% on average, and achieved positive annual returns 83% of the time.

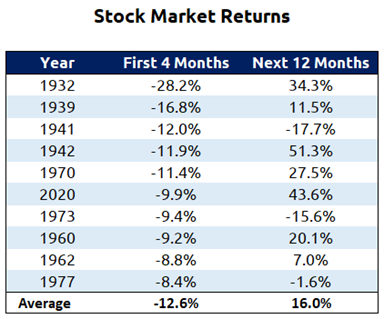

The S&P 500’s drop to start the year is the third-worst ever. Fortunately, a look back at history shows that the trend often reversed over the next 12 months. The following table shows the ten poorest starts for the S&P 500 (not including dividends) going back to 1928. On average, stocks enjoyed gains of 16% during the following year.

This is not to say that stocks or bonds will immediately bounce back. On the contrary, it may take some time to get through this rough patch, especially because of the uncertainty surrounding the Fed’s path toward higher rates. Nonetheless, investors who stayed invested during prior corrections have been rewarded every time.

Further, if you were waiting for a pullback to invest some money you set aside, then this could be a good opportunity. After all, you’re buying the same companies you wanted to buy a few months ago but at lower prices.

Lastly, another strategy we like to employ during turbulence is tax-loss harvesting. This is where we take advantage of a market decline to lower your tax bill. (Speak with your advisor and your accountant to ascertain if tax-loss harvesting is a good strategy for you.)

As Einstein said, “In the middle of a difficulty lies opportunity.”

Remember, we’ve all been here before, and we will all be here again.

As always, our recommendation is to remain unemotional, work with your fiduciary advisor, and if you have any concerns or questions, don’t hesitate to give us a call.

May 13, 2022

All data unless otherwise noted is from Bloomberg. Returns were calculated using the Bloomberg US Aggregate Bond Index and the S&P 500 Price Index. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now