Allworth CEO Scott Hanson shares a personal story of how resolve - and a dose of optimism - helped one of his clients weather bear markets of the past.

I’ve written this message specifically to you as a client, because, what we are experiencing—a virus wreaking havoc on both our physical, medical and financial worlds—is entirely unique.

But, by and large, the people I’ve spoken with—while deeply and understandably worried about their finances, families, and even their futures—have expressed an inspiring amount of resolve.

I think the resolve is partly because we were all somewhat “steeled” by the last big recession. Simply, many people haven’t forgotten what happened during 2008’s financial crisis and have learned from that experience.

Some 12 years back, at the height of that crisis, I met with a client that I had worked with since I first began my career as an advisor.

I’ll call him “George.”

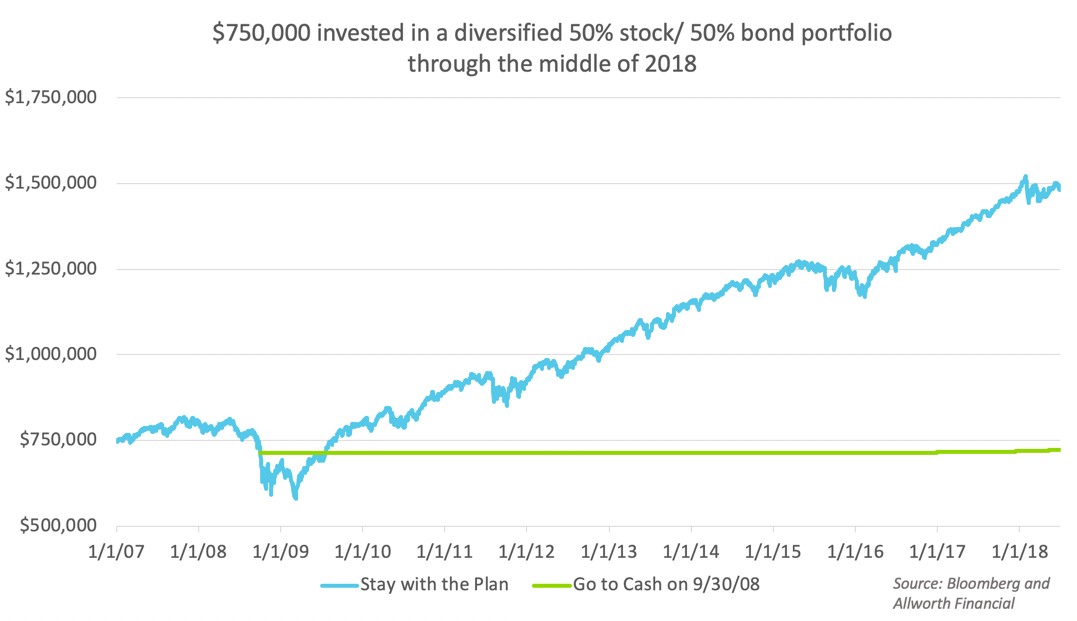

A veteran and a widower who overcame some tremendous hardships, George was an ‘old school’ type who believed hard work could cure anything. In fact, even though he was in his late 60s at the time, and had around $750,000 saved, he still planned to keep working for another year.

Continuing to work wasn’t so he’d have more money for his own retirement. Nope. George didn’t need much. In fact, outside of things like fishing poles, he almost never spent any money on himself.

The fact is that George was determined to leave as big a legacy as he could to his five children.

Because he lived a good 90 miles away, after our first decade of in-office meetings, George and I evolved into holding our advisory meetings mostly by phone.

I admit, at first, I missed our in-person visits. But year after year we went on like this, and he continued to save, invest, make me laugh, and dutifully follow the plan we’d built.

And, over the years, his portfolio grew.

Then, just when he announced he would be retiring the following year, September 29th, 2008 arrived, and the market fell by 777 points.

It had been the largest one-day decline in history.

Right then? For George, who’d seen some things, after all the work and sacrifice, he took that market slide personally. To millions of Americans—people just like you—it certainly wasn’t fair.

George was no stranger to downturns. As a client, over our nearly 15 years spent working together, be it 9/11, or the bursting of the dotcom or tech bubbles, he’d always seemed impervious to chaos.

But this time, when the market fell, and with his retirement closing in, an entirely unfamiliar “George” emerged.

The day after that 777-point slide he called me three times before 8:00 AM.

When I called him back, he sounded angry and afraid.

Now, I know a big part of his worry had to do with the fact that, after nearly 50 years of non-stop work, he was about to retire.

To be clear, not only is there no one who wants to take a financial hit at age 68, even under ideal circumstances there’s nothing unusual about feeling anxiety as you head into retirement.

I’ll never forget seeing him pacing the lobby. It seemed like we were the only two people in the building. I took him into my office and after offering him a chair three times, he finally sat down.

We went to work evaluating best-and-worst case scenarios and peeling back the layers of George’s financial situation. We talked through a hard and emotional 90 minutes.

One thing that had happened was that talk radio shows were blaring how the crash of 2008 was the end of the financial system as we knew it, and that people should take all their money and buy gold.

His brother had even told him he should move everything to cash.

None of these things was a good idea then, and none of them is likely a good idea now.

Overall, based on his age and personality, George’s investments were appropriate, and by every measure, he was still fine.

And, eventually, as you likely know, after about nine more months of turmoil, the markets began to recover and the longest bull market in history began.

As for George, he never retired. Instead, he kept working until the day he died in 2018.

I really believe that’s what he wanted all along.

As for all of us, the combination of an unfamiliar virus and its uncertain future impact on the economy is frightening. It’s unique and unknown, and you are probably not in the same financial situation you were a month ago.

To make matters worse, there’s absolutely no one—not me, not anyone—who can tell you with any degree of certainty what is going to happen tomorrow.

When it comes to finance, no one likes to feel out of control.

Truthfully, I can’t tell you not to worry. Lots of experts believe we are in for an extended and difficult ride.

What I can offer you is our perspective. Our nearly 30-year history of navigating market crashes and corrections and recessions.

We’ve been through this. And, frankly, when you chose to work with us, I believe it’s times like these, and the aftermath of times like these, that the importance of your decision to work with us becomes most apparent.

Two things: First, here is a link to our Bear Markets Fact Sheet. It’s a quick list I hope you’ll take a moment and scan that should give you some good insights into what we are facing, and how we as a country have dealt with somewhat similar situations in the past.

The second thing I’d like you to review is the chart below that shows George’s allocation in the lead up to and the aftermath of the financial crisis. While this is not typical, my experience has been that it’s not exactly atypical, either.

This graph is for illustrative purposes only and not intended to be investment advice.

By the time you read this, Congress will have passed a sweeping stimulus bill. The impact of the stimulus on you (which I examine in a separate article) should be helpful in both the short and the long-term, but that doesn’t mean it’s going to solve all our problems.

While it should help, what it’s really intended to do is to keep the economy afloat until everything can begin in earnest once again.

We still have a long way to go. Yet, looking at the dollars and the energy and the intention of this stimulus, and its importance to so many people, I’m reminded of a famous speech made by British Prime Minister Winston Churchill on November 10th, 1942, after the British had achieved a key victory against the Nazis in Africa during WWII.

I very much think these words apply to the situation we all find ourselves in today. There is always reason for optimism, but there is also a long road ahead.

“Now this is not the end. It is not even the beginning of the end.

But it is, perhaps, the end of the beginning.”

-Winston Churchill

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

November 01, 2024

Should you be using a Donor-Advised Fund for charitable giving?

November 01, 2024

Should you be using a Donor-Advised Fund for charitable giving?

Learn more about a charitable giving strategy for high-net-worth investors that offers flexibility and significant tax benefits.

Read Now September 24, 2024

Alternative investments: The need-to-knows

September 24, 2024

Alternative investments: The need-to-knows

Are alternative investments right for your portfolio? Allworth Partner Advisor Victoria Bogner, CFP®, CFA, AIF®, helps you answer the question.

Read Now May 23, 2024

How underspending (yes, underspending) can ruin retirement

May 23, 2024

How underspending (yes, underspending) can ruin retirement

Allworth co-founder Scott Hanson tackles a problem that you wouldn’t think would be an issue: Not spending enough money in retirement.

Read Now