Allworth Chief Investment Officer Andy Stout gives you a look inside the latest inflation data to explain why there are signs it could finally be cooling off.

With the Thanksgiving holiday right around the corner, it’s time to reflect on things for which we’re grateful. My list includes my family, friends, work that I love, and, yes, my beloved dog.

Conversely, you probably won’t be surprised to hear that down at the bottom of the list of the things that I love is inflation.

After all – and no matter how many times I read it as I prepared this column, it still seems difficult to fathom – but we’re all paying 20% more for a Thanksgiving meal this year than we did last year. (And compared to 2020? The cost of that feast is a staggering 37% higher.1)

But while the cost of food is actually eating into our wallets, there are signs that inflation is finally beginning to slow.

Cooling inflation

The latest inflation report showed that October’s consumer prices (CPI) rose 0.3% for the month, pushing the year-over-year change to 7.7%. And while that’s still an eye-popping number, it’s sharply lower than September’s 8.2%.

But even more encouraging was the drop in core inflation, which excludes food and energy prices (as they tend to be more volatile and can be misleading when developing a view of the inflationary landscape). The monthly change in core inflation slowed to 0.3%, resulting in the 12-month change unexpectedly decelerating to 6.3%.

Economists had forecasted a 6.5% change in core inflation.

We find it beneficial to separate core goods from core services. Core goods prices dropped 0.4% in October. It’s interesting to note, that while prices declined in several categories (including furniture, apparel, and computers), the drop in used car prices contributed the most to this deflation.

Looking ahead, core goods could continue to see price declines because of, first, a recovering supply chain, and second, a strong dollar. Supply chain progress is evident in the latest ISM manufacturing survey, which showed improved order backlogs and supplier deliveries.

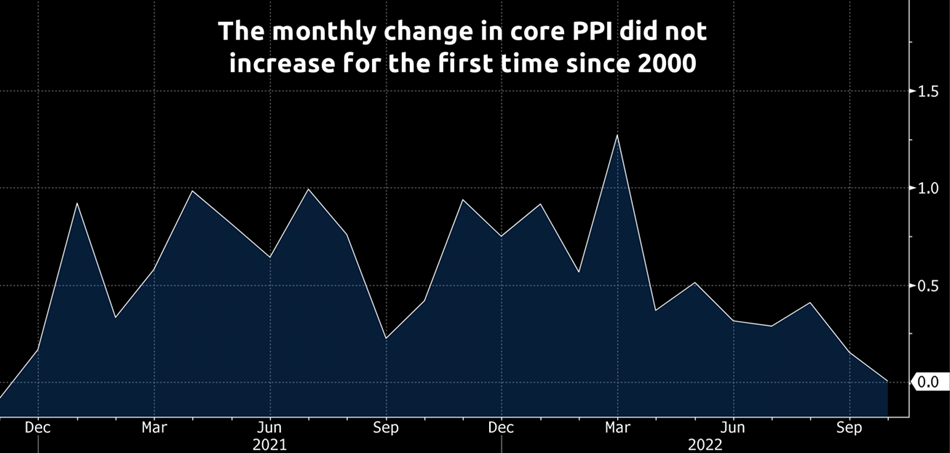

As a reminder, a strong dollar helps reduce inflation because it makes imports less expensive, and that directly feeds into the cost of goods. And the fact is, that we may have already begun to see this impact on manufacturing. For example, the last producer inflation (PPI) release showed core PPI was unchanged over the past month.

Shifting to core services, we see that even though core services experienced monthly inflation of 0.5%, that was a step down from September’s increase of 0.8%. Further, there are a few reasons to expect that core services will face disinflation in the coming months.

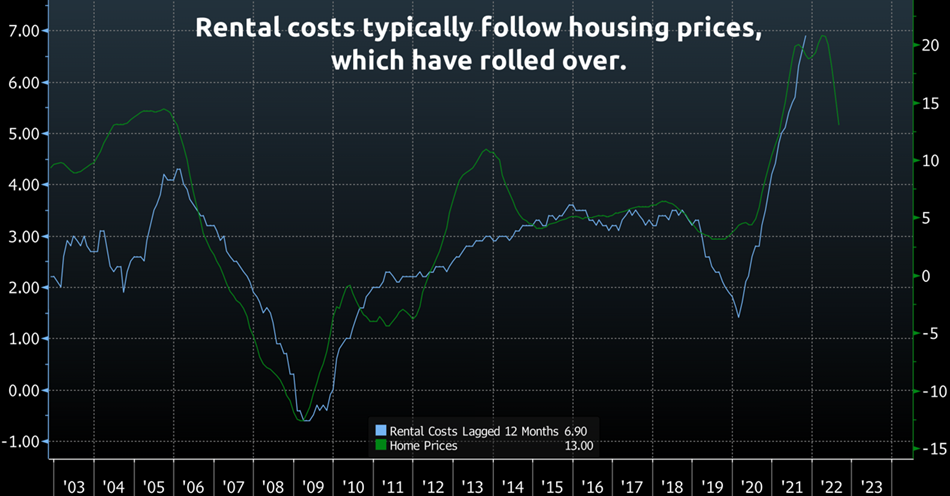

First, there are early signs that rents, comprising 57% of core services and 32% of all inflation, are about to roll over. For instance, rent prices have historically lagged behind housing prices by roughly 12 months, and housing prices rolled over earlier this year. So, rents could start to fall soon.

Second, private sector reports show rents peaked in July. For example, Realtor.com’s October Rental Report showed that rent prices fell for the third straight month.

All this data suggests inflation will continue to fall in the months ahead: however, we likely won’t see inflation down around 3% until at least the second half of next year.

Falling inflation and the Fed

Our nation’s central bank, the Federal Reserve, is responsible for stable inflation and full employment. The Fed tries to bring down inflation by hiking short-term interest rates. Higher interest rates reduce demand by making it more expensive to borrow. This lower demand helps ease inflationary pressures.

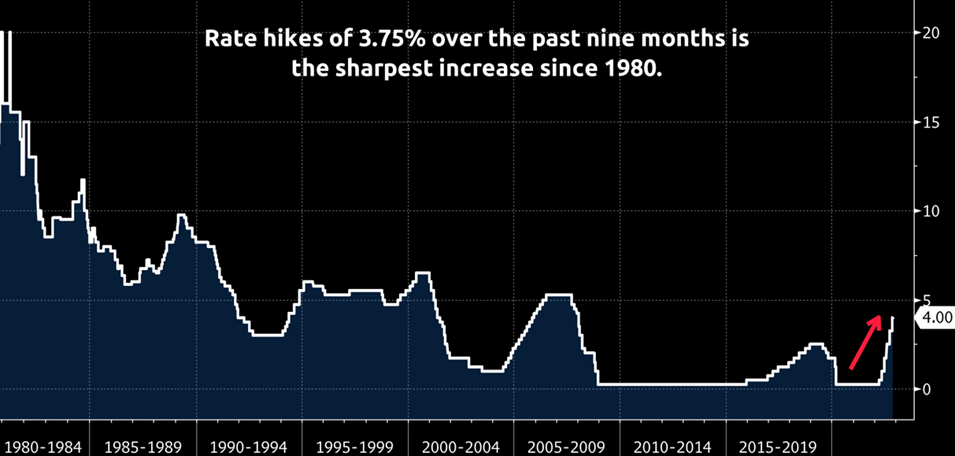

Unfortunately, historically, rate hikes don’t have much of an economic impact until about 6-12 months after the fact. But with inflation at a 40-year high, the Fed can’t just sit on its proverbial hands and wait to see how effective its rate hikes have been. So, the committee has increased interest rates this year at the quickest pace since 1980.

As you may recall, the Fed began its rate hike cycle with a typical 0.25% increase in March, followed by a relatively large 0.5% hike in May. Then, the Fed became even more aggressive, and executed four massive 0.75% hikes over five months. The fed funds rate is now in a range of 3.75 - 4.0%

With some signs of slowing inflation making their way into the data, the market expects the Fed to lift rates by 0.5% at its next meeting on December 14th.

It’s becoming less clear what the Fed will do in 2023.

With the above signs of slowing inflation, coupled with the yet-to-be-felt economic impact of this year’s rate hikes, some economists fear that the Fed has already gone too far, and that the result will be a moderately deep recession. Others argue that the tight labor market, combined with strong consumer demand, will result in further wage pressures, so the Fed should remain aggressive to bring inflation down. And yet, still others believe that if the Fed shifts early next year, the US economy could see inflation continuing to improve while the economy experiences only a slight hit. Should that occur, it would easily be the Fed’s most successful maneuver ever. (But unfortunately, that outcome also has the lowest probability.)

We believe the economic path won’t be as clear cut as you might read in the financial press. Part of the reason is that in addition to analyzing our central bank, one must also consider global central bank actions, including those in Europe, the UK, China, and Japan. As a result, with all these central banks trying to reduce inflation, while simultaneously avoiding a recession, there is an increased risk of a policy error.

With the backdrop of elevated economic uncertainty, it’s critical that your portfolio be properly positioned based on your unique situation. I cannot stress enough the importance of personalized allocation. That’s because, in addition to having the right investment mix to protect your money, value can be added to your portfolio by taking advantage of tax-smart strategies, such as tax-loss harvesting.

November 18, 2022

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

1 https://www.fb.org/newsroom/farm-bureau-survey-shows-thanksgiving-dinner-cost-up-20

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now