Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency.

There is a lot going on in the markets and with the economy, but with all the economic uncertainty, and with two wars raging abroad, this month I’d like to discuss something that many people are starting to wonder about:

What is the status of the United States’ dollar as the world’s reserve currency?

I’m going to jump right in.

Moody’s, the bond credit rating business of Moody’s Corporation, is the last of the three major credit rating agencies to still give the US an AAA rating, as Fitch, along with Standard & Poor’s, previously lowered the US to AA+.

However, on November 10th, Moody’s placed the US credit rating on a negative watch, indicating it might downgrade the US from the gold standard of creditworthiness.

Consequently, some people have become even more concerned about the US dollar losing its status as the world’s reserve currency. However, our analysis of the data indicates these concerns over the US dollar’s demise are greatly exaggerated. Here are five big questions (and answers) to help explain.

1. What is a reserve currency?

While the concept of a reserve currency can appear complex, it’s nothing more than a currency held by various global central banks and financial institutions. These currencies are not physically stockpiled in vaults, but rather, they are mostly digital accounting entries.

Central banks and financial institutions use these currencies for things such as facilitating international transactions, to stabilize a country’s exchange rate, as an investment, as a way to project global confidence, and as a tool to manage a country’s economy.

2. Why is the US dollar considered the world’s reserve currency?

The origin of the US dollar’s dominance dates to the end of World War II. Global leaders formed the Bretton Woods Agreement in 1944, pegging the US dollar to gold, and other currencies to the US dollar.

The US government subsequently abolished the gold standard in 1971, resulting in a global move to a floating exchange-rate system.

Despite this change, the US dollar remained the primary reserve currency because of its stability, dominance in global central bank holdings, frequent use in currency transactions, and widespread use in international trade.

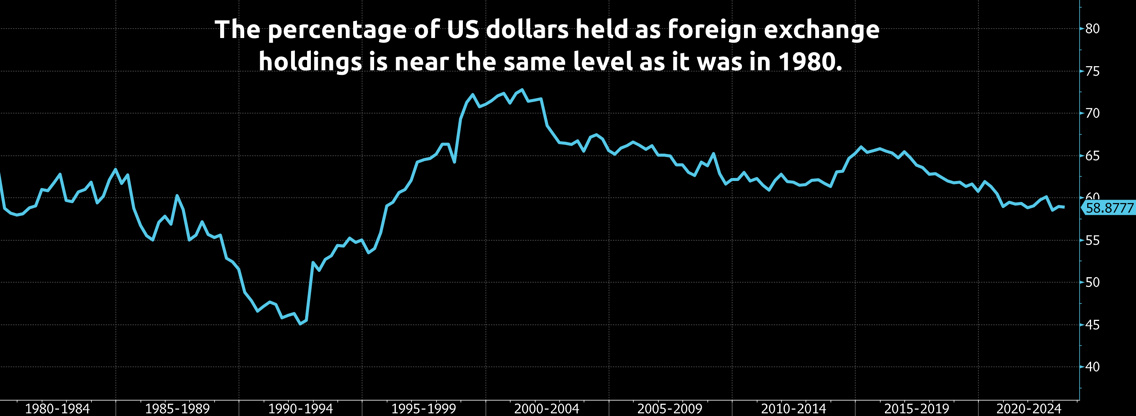

These characteristics continue to hold true today. First, the percentage of US dollars held as foreign exchange holdings is near the same level as it was in 1980.

Second, approximately 88% of all currency transactions involve the US dollar, with the Euro a distant second at 31%. (Since there are two currencies involved in a transaction, the sum of individual usage equals 200%.)

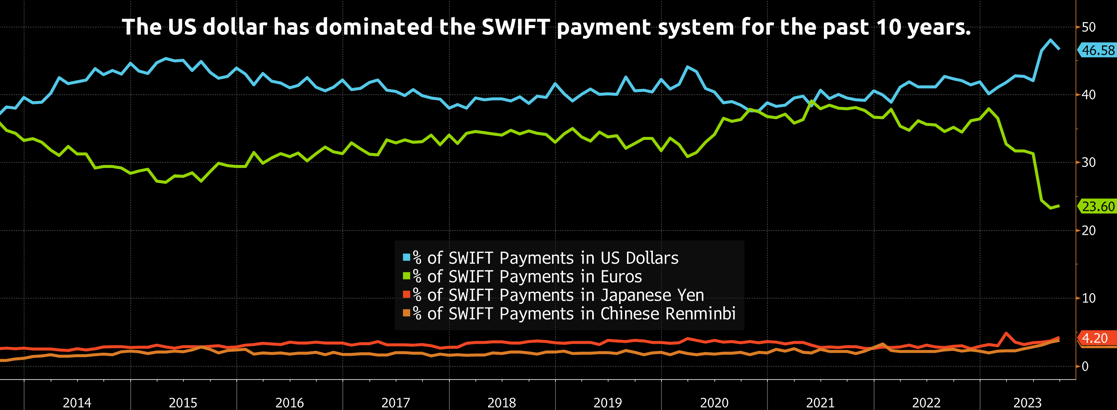

In addition, according to SWIFT, the Society for Worldwide Interbank Financial Telecommunication, about 42% of the transfer of funds involve the US dollar. (SWIFT is a system that allows companies and financial institutions from different countries to exchange payments when conducting transactions.)

Finally, most of the world’s oil conducts trades in US dollars, resulting in constant demand for dollars because everybody needs energy.

3. Are there any real challengers that could replace the US dollar as the world’s reserve currency?

Based on today’s data, the Euro would be the most likely replacement. This could be challenging because the member nations of the EU are quite often divided on key political and economic issues.

Another contender is the Chinese Renminbi; however, it falls short today for many reasons, including overly tight controls on currency flows, the exchange rate does not freely float, significantly underdeveloped financial markets, and concerns about the country’s political stability.

Now, a recent challenger has emerged, and that is cryptocurrency. But here, again, there are material drawbacks, as well. First, there’s virtually no regulation (which could be good in some instances), there’s extreme volatility, an uncertainty about which cryptocurrency will win out (Bitcoin, Ethereum, etc.), and, last but not least, a lack of broad acceptance or even understanding about how it actually works or what gives it value.

4. What are the implications if the US loses this reserve status?

While nothing would happen overnight, without the built-in demand from being the world’s reserve currency, the US dollar would likely decline in value. To be fair, a weaker dollar by itself is not a terrible outcome because it makes the goods we sell outside of the US less expensive. The flip side is that imports would become more expensive to us.

There would also be less demand for US treasuries from foreigners, which could increase interest rates here in the US, adversely affecting bond prices and possibly stocks as well. The higher cost of borrowing for the government would likely mean less fiscal spending and slower economic growth.

Additionally, many international contracts would have to be renegotiated, causing increased trade uncertainty. Relatedly, global financial stability would become a concern because there are no alternatives as stable and predictable as the US dollar.

Of course, there are many other implications, such as the effect on commodity prices, how banks do business, and ripple effects beyond the economic realm into the geopolitical sphere.

But you get the idea: This is no easy or obvious choice or way to transition away from the US dollar at this time.

5. What is the possible fate of the US dollar?

Currently, the US dollar dominates the foreign exchange market, global trade, and central bank holdings. Furthermore, as shown above, there isn’t a viable alternative that could replace it. These reasons indicate that the US dollar will retain its status as the world’s reserve currency for quite some time. After all, it took multiple decades for the US dollar to replace the British pound as the world’s reserve currency back in the first half of the 1900s.

But in all likelihood, it probably won’t remain this way forever.

In our estimation, any dethroning of the US dollar would almost certainly have to play out over at least a decade, if not much longer. But when and if it does occur? It would likely happen with the dollar gradually relinquishing control to a group of currencies.

November 17, 2023

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now October 20, 2023

October 2023 Market Update

October 20, 2023

October 2023 Market Update

Allworth Chief Investment Officer Andy Stout gives you a closer look at when you should - and shouldn't - consider cash as an 'investment.' One …

Read Now