Allworth Chief Investment Officer Andy Stout explains why we believe in sticking with your investment strategy, even as markets continue to struggle.

When I was returning from vacation this summer, there was a two-hour backup on the interstate because of construction. Fortunately, or so I thought, my “smartphone” instructed me to take a detour to reduce the delay to an hour.

I followed my device’s directions and was greeted by an extra 3.5-hour delay.

Clearly, I should’ve stayed the course.

Aside my travel adventure, we believe that staying the course is also the best advice for today’s investors. We understand that in times like these you might wonder if you should change directions. After all, it’s been a tough and sometimes scary year for all investors, with both stocks and bonds struggling.

But these struggles are exactly why you should block out the impulse to take shortcuts. Here's why.

Staying the course

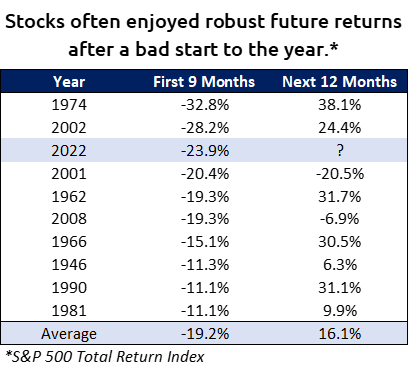

The stock market’s 24% drop this year is the third-worst start to the year since 1945. Fortunately, returns over the next 12 months show why staying the course makes sense.

The average 12-month return was an impressive 16.1% for the nine other worst starts to a year. Of course, there is never a guarantee that the future will repeat itself, but historically, it always has.

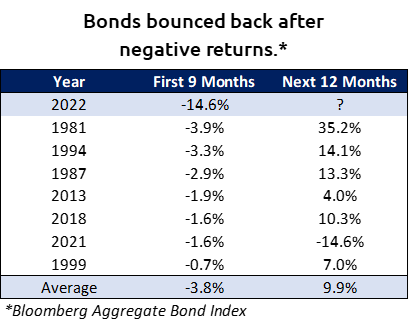

On the bond side of the equation, 2022 has definitely been the worst start to the year since the Bloomberg Aggregate Bond Index began in 1976. There were seven other years where the bond market posted negative returns in the first nine months. But, like stocks, returns over the next 12 months were undeniably positive, averaging almost 10%.

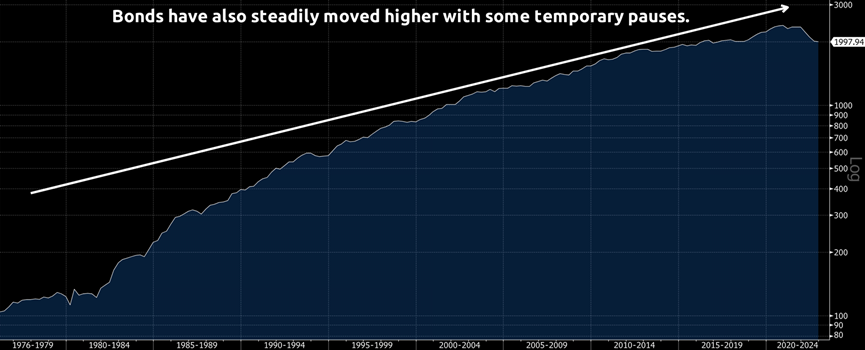

To be absolutely clear, we would not be surprised by additional short-term market turbulence in either stocks or bonds. However, history suggests that staying the course will ultimately be profitable. You can see this in the tables above and by looking at any long-term charts of stocks and bonds to see how they have historically moved higher.

What matters the most for the economy

Economists currently believe that the US economy rebounded to grow about 2.5% in the third quarter. But what matters the most is the Federal Reserve’s actions to tame inflation. The latest CPI (Consumer Price Index) report showed that total consumer inflation increased by 8.2% over the past year.

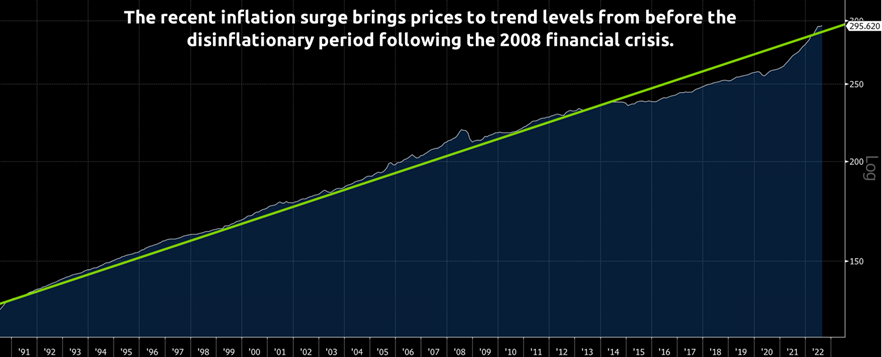

Interestingly, a chart of total inflation shows that the recent spike has lifted prices to levels where we might have ended up had it not been for the Great Recession. Following that crisis, we entered a period where inflation was lower than what the Fed desired, which is why interest rates were near zero for so long. Now, prices are up to their 30-year trend level.

Despite the total inflation level, the Federal Reserve is most worried about the current inflation rate of change. Even though the current 8.2% year-over-year change is lower than June’s 9.1%, it’s nowhere near comfortable levels.

As a result, we expect the Fed to remain aggressive in its fight against inflation. The committee will probably increase short-term interest rates by 0.75% when it meets on November 2. That would be the fourth consecutive 0.75% rate hike and would lift the fed funds rate to a target range of 3.75% - 4.0%.

The Federal Reserve has been able to hike interest rates this abruptly because of the still-strong job market. Specifically, September’s unemployment rate fell back to 3.5%, a 40-year low. (The Federal Reserve has a dual mandate of stable inflation and full employment.)

However, a few labor market cracks have appeared. Specifically, the number of job openings unexpectedly fell from 11.1 million to 10.1 million, indicating employers are hiring fewer people. Additionally, a recent survey showed that manufacturers had pulled back on hiring. Finally, the number of layoffs has started to move up.

Unfortunately, the Federal Reserve likely won’t pause in its rate hikes until it sees consistent evidence that inflation is falling. Herein lies the risk. Monetary policy (i.e., rate hikes) works with about a 6-12 month lag, so, in that sense, the Fed actually doesn’t have a strong indication of the economic effects of the actions it’s already taken.

Putting it all together

A problem with veering off course is that it can be challenging to get back on track. The reason for that is emotions can take over. For example, it seems easy to bail out when things look scary, but when do you get back in? There is no all-clear signal the market can give you.

In fact, it’s quite the opposite, because when the economy and market appear to be at their worst, it’s often an excellent opportunity. (You can see this in the tables at the beginning of the article.)

We recognize that anxiety about the economy and the market are high and that it’s been a challenging year for all investors. However, we also acknowledge that markets move higher over time, and staying invested has benefited countless patient investors. Of course, navigating this terrain can be challenging, but understanding the numerous capital market interactions can help ensure your investments are prudently positioned for long-term success.

October 14, 2022

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now