Allworth Chief Investment Officer Andy Stout discusses why currencies matter to you, what drives this volatile market, and whether they’re a fit for your portfolio.

Are you interested in the currency markets? How trading them works, and what are the best and the worst times to strike?

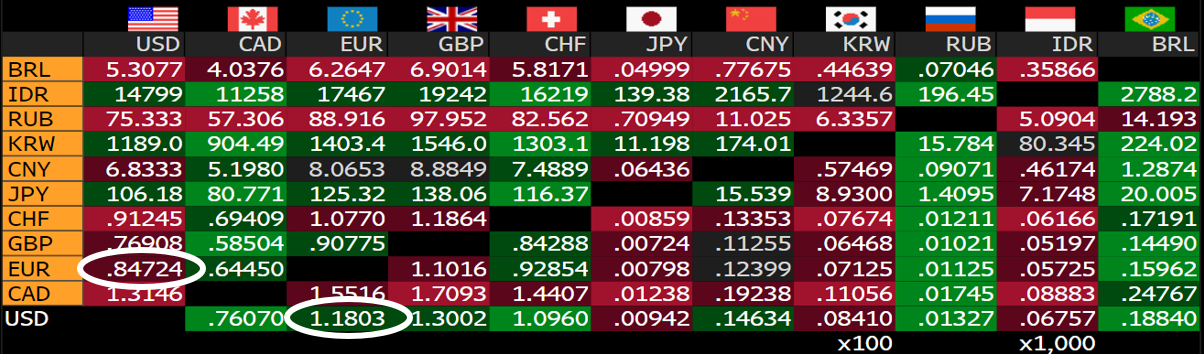

One of the first things I do each morning, besides make strong coffee, is analyze the currency markets. I perform this task by pulling up what’s called a “currency matrix.” The illustration below shows where some of the major currencies trade in relation to one another.

To understand this matrix, it’s necessary to know that any pair of currencies can be interpreted two ways. For example, here’s how to read the relationship of the U.S. dollar to the euro (USD and EUR in the matrix above):

- One U.S. dollar can be exchanged for 0.84724 euros

- One euro can be exchanged for 1.1803 U.S. dollars

It might not be obvious in this example, but these exchange rates are the multiplicative inverse of one another (1 divided by 0.84724 equals 1.1803). This is necessary to make the exchange rates identical whether you are exchanging U.S. dollars into euros or euros into U.S. dollars.

Why currencies matter to you

Currencies are what’s called a zero-sum game, meaning, as one gets stronger, another gets weaker. Contrary to popular belief, a weak currency isn’t necessarily a bad thing. In fact, it can be quite beneficial for investors and the economy.

For U.S. investors of international stocks, a depreciating currency is generally preferred. This is probably best understood through a simple example:

Let’s say that you – a U.S. investor – bought a German stock on January 2nd for €100 and it’s risen to €110 today. That’s a 10% return.

Over that same time period, the U.S. dollar depreciated by about 5.4%. On January 2nd, you would’ve spent $111.72 in dollar terms to buy that stock. Then to convert that new €110 back to dollars, you would get $129.83 (110 * 1.1803). So, because the U.S. dollar weakened, what would’ve been a 10% return, increases to 16.2%.

Of course, the opposite is also true.

If the U.S. dollar strengthened by 6%, you would’ve earned just about 4%. If the U.S. dollar would’ve risen by a little more than 10%, you would’ve lost money on that original investment even though the stock increased in value by 10% in local currency terms.

The same premise carries over if you are buying mutual funds or exchange-traded funds (ETFs) that invest in international stocks. A depreciating currency benefits the international holdings in your portfolio, while an appreciating currency decreases the value of those investments.

From an economic perspective, a declining U.S. dollar is mostly beneficial for the U.S. economy. This is because when the U.S. dollar falls in value, it makes our exports less expensive to the rest of the world. This means our goods and services are more attractive to those outside of the U.S.

On the other hand, a falling dollar also makes the imports we buy more expensive, which encourages U.S. businesses and consumers to switch to “Made in America” goods and services.

However (especially in the short term, at least), that’s often not possible.

When a consumer or business is unable to substitute a local input for a foreign one, a weaker currency will force them to buy the higher-priced foreign good or service. So, a weaker currency can lead to inflation.

Regardless, a declining U.S. dollar usually has a net positive effect on our gross domestic product (or GDP).

Why exchange rates fluctuate

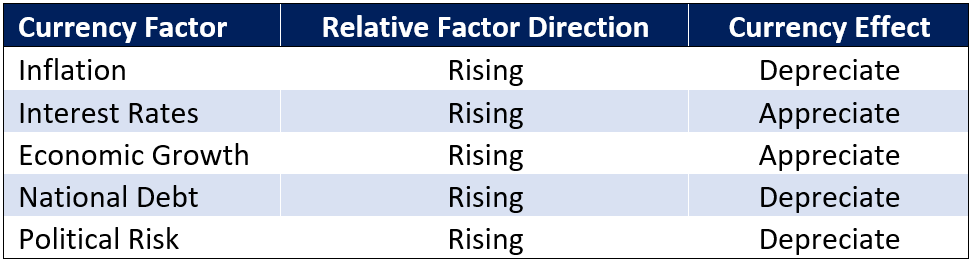

There are numerous elements that affect an exchange rate between two countries. The more important aspects are inflation, interest rates, economic growth, national debt, and political risk. (Please keep in mind, that these factors are relative of one country to another.)

If the relative factor direction moves in the other direction, so should the currency effect. For example, if relative inflation declines for one country, then that country’s currency should appreciate (keeping everything else equal).

Importantly, because there are so many other factors that could have an impact, the above general relationships don’t always hold. For example, if a bunch of currency traders make too many large speculative bets, currency movement could be very sporadic.

There are also situations where a government, such as China, will go against the free market and set its own rate in relation to other currencies. This is very expensive, and most countries are not able to afford this for a prolonged period.

What individual investors should do

Attempting to “time” the currency market can be costly. Having an extremely deep comprehension of the intricacies of exchange rates is necessary before you should even consider adjusting your portfolio by increasing or decreasing exposure to certain currencies.

To be clear, there are many more factors you would need to take into consideration that are well beyond the scope of this article (e.g. how currencies trade, the U.S. dollar’s status as the world’s reserve currency, spot versus forward pricing, swap lines, etc.).

Simply, currencies are complex investments. It’s no accident that entire sections of study at some of the world’s best business colleges, and numerous think tanks comprised of some of the brightest economists in the world, are entirely devoted to studying them.

Even those who gain a deep understanding of currencies don’t necessarily have success trading them.

Whether investing, or preparing for retirement, it’s our fervent belief that you’re better off focusing on a carefully conceived and holistic financial plan where your short and long-term goals, your risk tolerances, and your personal time horizon (along with numerous other economic factors), are all taken into consideration.

All data unless otherwise noted is from Bloomberg. Currency charts are as of 9/9/20. The Allworth Recession Index is made up of leading economic indicators, which are data points that have historically moved before the economy. The index value is calculated as a percent of the indicators that are sending signals that suggests recession risk is elevated. When the index value is greater than 40%, we believe there is a greater chance for a recession in the next six to nine months. All data begins by 1971 unless noted below. The indicators that make up the Allworth Recession Index are the 3-Month Government Bond Yield, 2-Year Government Bond Yield (beginning in 1976), 10-year Government Bond Yield, BarCap US Corp HY YTW – 10 Year Spread (beginning in 1987), Conference Board Consumer Confidence, Consumer Price Index, NFIB Small Business Job Openings Hard to Fill (beginning in 1976), Private Housing Authorized by Building Permits by Type, US Federal Funds Effective Rate, US Initial Jobless Claims, US New Privately Owned Housing Units Started by Structure, and US Unemployment Rates.

Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

September 11, 2020

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now