Allworth Chief Investment Officer Andy Stout succinctly explains some of the biggest must-know facts about the national debt.

Each day, I’m asked various economic questions, ranging from concerns about a potential recession to intriguing opportunities like artificial intelligence. But, without a doubt, the most common topic that people want to ask about is our national debt, which currently sits just shy of $33 trillion.

In response to these many inquiries about our nation’s debt, and how it could impact you, I’ve compiled the following FAQ, which I believe you’ll find extremely informative and useful.

1. What is the US national debt?

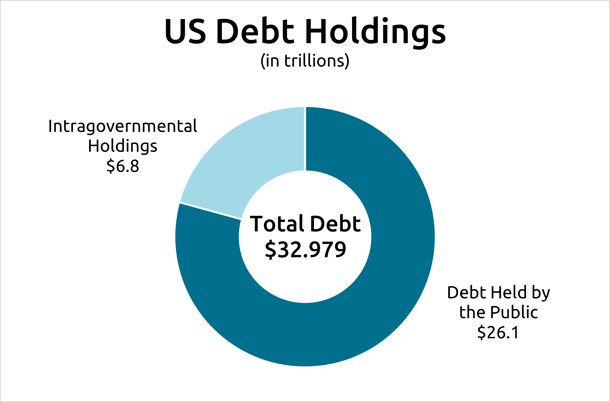

Our national debt is the total amount of money the US government owes to its creditors. The obligations the government must repay are various types of treasury securities: bonds, bills, notes, inflation-protected securities (TIPS), floating-rate notes, and savings bonds. The government issues debt because spending deficits force the government to increase its borrowing. This portion makes up 79% of our total debt.

The remaining 21% of the $33 trillion debt burden comes from money the government owes itself, known as "intragovernmental holdings." Examples are money the Treasury owes to the Social Security and Medicare trust funds. While some people consider these as just accounting entries, they are legal obligations the government must pay, and they are investments in treasury securities.

2. Should I be concerned about our debt?

The debt level has rapidly increased over the past few years, rising to nearly $33 trillion. We expect it will likely continue to climb, especially as the Treasury is forced to issue more debt due to the planned $1.3 trillion fiscal spending from the recently approved Bipartisan Infrastructure Act, Inflation Reduction Act, and the Chips Act.

In addition, the government has run a deficit of more than $1 trillion in the last three fiscal years (October 1 – September 30) and is on pace to do that for the 2023 fiscal year. In fact, the last time our government had a surplus was in 2001.

However, we need to put the data into proper context to understand if it’s truly a problem. I do this by analyzing the aspects of our debt relative to the size of our economy. The first way is by studying the amount of our debt to nominal Gross Domestic Product (GDP). (I use nominal GDP, which is not adjusted for inflation because the debt is also in nominal terms.)

A lower ratio suggests that a country has a stronger ability to repay its total debt than a country with a higher ratio. It also indicates a country is more likely to have stronger economic growth. Unfortunately, as you can see in the following chart, our country’s debt-to-GDP ratio is 122%, meaning we have more debt than the size of the economy.

The second and arguably more critical method I use to analyze the risk associated with debt is to look at interest payments relative to nominal GDP. (Remember, the government’s debt, just like an individual who has credit card or mortgage debt, accrues interest.) Similar to the prior ratio, a lower number is better and signals better growth prospects. One can argue that this ratio is more important than total debt-to-GDP because we know that, unlike you or me, the US will never pay off its debt, so we need to know what the economic burden is for the interest we are legally obligated to pay.

Due to the increased debt level coupled with higher interest rates, this ratio has climbed to the highest level since 1999. The following chart displays a sizeable move over the past couple of years, and we expect it to continue to rise over the next two years. However, this ratio is still much lower than the 20 years from 1980 through 1999, when it averaged 4.5% and reached 5.0%.

In other words, we’re not at levels suggesting interest payments will create a material economic drag. However, that could change if this ratio climbs and remains much higher than 5-6% for an extended period. The government may need to implement policies to reduce the debt burden, such as spending less or raising taxes. These policies may be necessary, and they would be a drag on future generations, but it’s unlikely to be a genuine concern for at least the next 5-10 years if it ever gets to that point.

Another concern that some people have is that the US will go bankrupt because of this debt. But as you can see from the previous data, this isn’t currently a material concern. Furthermore, there isn’t a real risk of bankruptcy because the US could always print money to cover its obligations. Of course, that would be a poor course of action because printing massive amounts of money could lead to a hyperinflationary environment and a complete loss of credibility in the US government.

3. Who owns our debt?

Much has been made about who owns our debt. Specifically, some people worry that we’re beholden to China. China indeed holds a relatively large amount, $835 billion. However, that represents only 2.8% of the total US debt, meaning they can’t really use it as a financial weapon to hurt the US.

Moreover, Chinese ownership of US debt has already decreased about 30% over the past five years, as they trimmed about $330 billion, and there hasn’t been a material impact on the US even as China drastically reduced its holdings.

In reality, the largest holders are government trust funds like Social Security, the Federal Reserve, and US institutional investors, including Vanguard and Fidelity.

As the US is forced to issue more debt, these investors will continue to buy our treasuries for a few reasons. First, treasuries are the safest securities in the world, and investors will flock to them during heightened periods of uncertainty.

Second, the US dollar is the world’s reserve currency, meaning many international transactions take place with the US dollar as the medium, creating an inherent demand for US dollars and treasuries. While some people are worried that the dollar will lose this status, it’s extremely unlikely anytime in the next decade because there are no other legitimate alternatives.

4. What's the best way to protect my money in light of the debt situation?

While you don’t have control over the government’s debt, you can make sure your financial affairs are in order. Investors sometimes see the fear-mongering financial headlines and think a permanent collapse is just around the corner. There will certainly be volatility and recessions in the future, but investors who have carefully planned for these cycles with thoughtful allocations can enjoy financial peace of mind.

Regarding the US debt level, we will continue to analyze it, along with myriad other trends and data. Additionally, we’ll continue to monitor leading economic indicators, valuations, and technical factors to position your portfolio for the various economic environments you will face in the uncertain years and decades ahead.

September 15, 2023

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now