You’re part of history.

The U.S. economy has now been growing for over 10 years, making it the longest expansion, ever.

This, perhaps understandably, has a lot of people talking “recession.”

While we’re certainly not predicting that a recession is (or is not) about to happen, let’s analyze what the next downturn could look like, then analyze our leading economic indicators to get an idea of not only what risks we’re facing, but why we believe that the next recession will be different from the last.

When people think “recession,” they typically reference 2007-2009, which was the biggest financial crisis since the Great Depression.

With a perfect storm featuring a housing market crash, numerous bank failures, and double-digit unemployment, the next recession could certainly be worse in new and heretofore unseen ways, but it’s unlikely that it will mirror what we experienced in 2008.

Let’s analyze why.

Housing

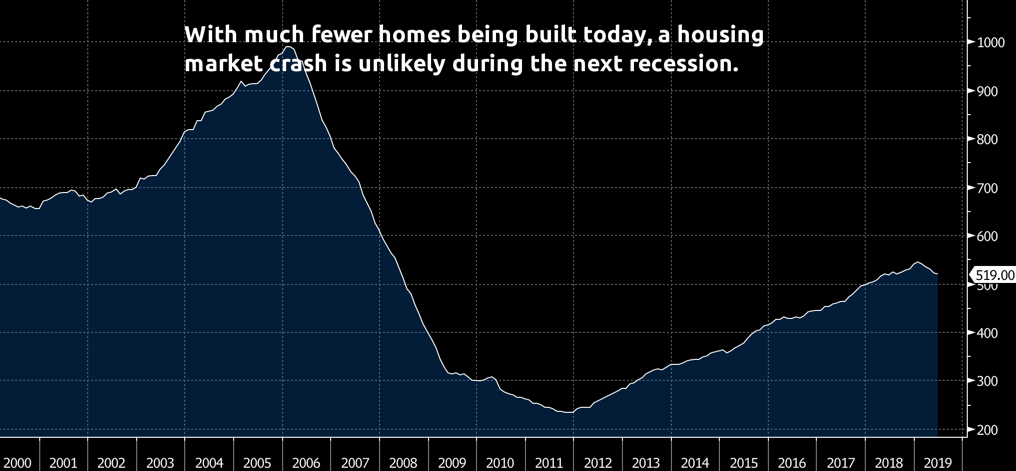

In 2006, prior to the Great Recession, new home construction reached a record high of 990,000.

Today, there are just 519,000 homes under construction.

What’s more, there were approximately 1.4 million new homes sold per year before the financial crisis, while there are now only about 650,000 annual home sales.

The bottom line is that housing will probably weaken during the next recession, but with far fewer homes currently under construction, along with fewer home sales, any decline in housing likely won’t be as bad as it was during the financial crisis.

Banks

Banks failed left and right during the Great Recession.

Most of these were smaller banks, but large financial institutions like Lehman Brothers and Bear Stearns no longer exist.

While a big part of this was because banks were making too many ultra-high-risk loans, bank leverage was also to blame, as major Wall Street institutions had debt-to-equity-ratios of about 30-to-1.

Following the crisis, new legislation limited the amount of leverage to 15-to-1.

That means that banks, having less leverage flexibility, are unable to make as many risky loans, so when the next recession hits there should be significantly fewer bank failures.

Jobs

While we believe that the next recession likely won’t have as big a housing market crash or as many bank failures as the Great Recession, there will almost certainly be a major drop in consumer spending.

This is a concern because the economic expansion that began in June 2009 has been largely fueled by spending due to an unemployment rate hovering near a 50-year low.

Typically, low unemployment means more spending.

But during a recession, companies lay workers off, and this causes the unemployment rate to rise and consumer spending to fall.

One odd-positive may be that since 2009, many businesses have automated, so the next economic downturn may not see unemployment rise as much.

Of course, tragically, any time there’s a recession, people will still be forced out of work. But because the savings rate has risen from 3.6% in 2007, to its current rate of 8.1%, those who are laid off should theoretically be in better shape to weather the storm than they were 12 years ago, so spending should not decrease as much as 2008.

Putting all this together suggests that the next recession might not be as severe as the last.

How would the government fight a recession?

If the economy heads south, what tools does the government have to fight a recession?

A common assumption is that we won’t have the firepower to end any recession quickly because interest rates are already so low and government debt so high.

This is partly true.

On average, the Federal Reserve (Fed), our nation’s central bank, cut short-term interest rates by 5.75 percentage points during the past three recessions.

Lower interest rates encourage consumer spending, which is important because consumer spending makes up about 70% of the total U.S. economy.

Today’s short-term interest rates are only around 2.25%, so the Fed won’t be able to lower rates as they have in the past.

But the Fed has other tools at its disposal. As it did during the financial crisis, it can increase the size of its balance sheet by purchasing bonds (Quantitative Easing), which puts money into the economy and should help it recover more quickly.

Other ways the government can help the economy is through infrastructure spending or via tax cuts.

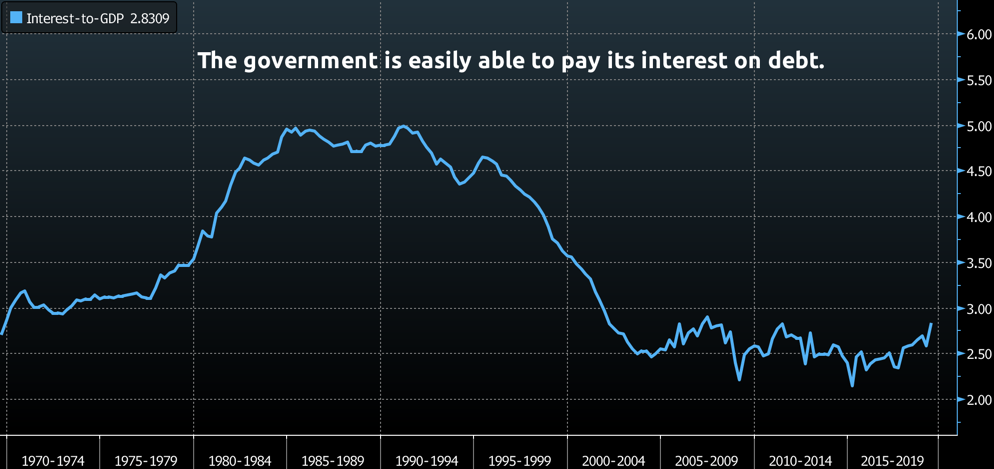

Spending on projects can put people to work very quickly, but the amount of government debt is a concern. The government’s debt-to-GDP ratio is high at 78%.

However, even that is manageable thanks to low interest rates, which means the government can easily pay the interest on its outstanding debt. In fact, we are in a better position to pay back debt today than in previous years. That’s because the ratio of interest paid-to-GDP is at 2.8%.

For perspective, it was near 5% in the 1980s, and is currently below its 50-year average of 3.5%.

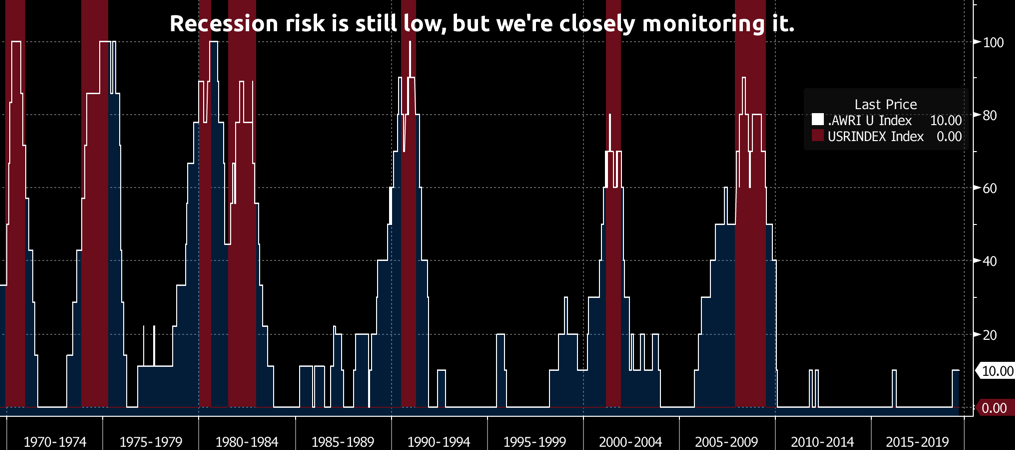

In closing, very few leading economic indicators are suggesting an economic slowdown in the next six months. The Allworth Recession Index is at 10, meaning that only 10% of our major leading indicators are flying a red flag.

For perspective, historically, when this index rose above 40, recessions followed about eight months later.

We believe the best way to get through a recession is by having a personalized financial plan.

That’s because a comprehensive and well-crafted plan takes into consideration market ups and downs, periods of economic expansion and contraction, your personal financial information, and so much more.

All data from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

August 16, 2019

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now