Written by David Klaus CFP®, MBA, CASL®, RICP®

2024 is almost here, so what better time than right now to review IRS contribution changes? Many accounts, such as 401(k)s, IRAs, Roth IRAs, and others, allow you to save for retirement while reducing your tax burden. The IRS generally sets the contribution limits for these accounts based on inflation, but they don’t always increase every year.

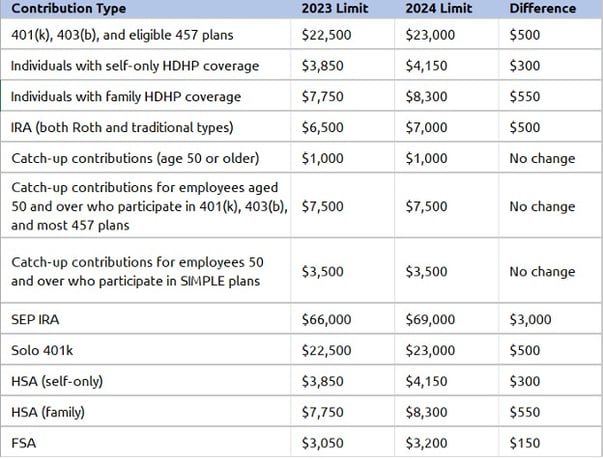

In 2022, inflation soared to 9.1% in July, which led to larger contribution limit increases for 2023. However, inflation has slowed down in 2023, so the contribution limit increases for 2024 are smaller than the previous year.

Here is a table of the most common types of tax-qualified accounts and the new 2024 contribution limit for each:

In addition to the types of accounts listed in the table above, here’s a bit more information about three specific strategies that can help shelter income and lower your tax bill.

1. After-Tax 401(k) Contributions

After-tax 401(k) contributions are a way to save more for retirement if you’ve reached the maximum that you can contribute to your 401(k) as an employee. Not all 401(k) plans allow for these contributions, but if yours does, you may be able to contribute up to the total employee and employer contribution limit for the year. For example, if you were under 50 and contributing $23,000 and your employer was contributing $20,000 in 2024, you could contribute up to an additional $26,000 as after-tax contributions to bring your total to $69,000. Keep in mind that you still have to pay taxes on the investment gains your after-tax contributions generate when you withdraw them in retirement.

2. Health Savings Accounts (HSA)

A Health Savings Account (HSA) is a tax-advantaged savings account that allows you to invest for future medical expenses while enjoying special tax breaks. Your contributions reduce your taxable income, and your money grows tax-free. Your withdrawals are also tax-free as long as you use the money on qualified medical expenses. To open an HSA, you need to pair it with a high deductible health plan (HDHP). According to the IRS, an HDHP must meet the following requirements for 2023:

-

Minimum deductible: $1,500 (self-directed) or $3,000 (family plan)

-

Maximum out-of-pocket costs: $7,500 (Self-Only) or $15,000 (family plan)

If your plan meets these requirements, you can open an HSA.

3. 2024 Flexible Savings Account (FSA)

If you don’t meet the requirements for an HSA, you might be able to open an FSA. A Flexible Spending Account (FSA) is a tax-advantaged savings account that allows you to use pretax money to pay for health or dependent care expenses. The account holder, their spouse, and qualified dependents can benefit from the account. However, FSAs are available only through a participating employer.

Please reach out to your advisor to find out how you can take advantage of these increased limits in your own financial planning to help you more effectively reach your goals. These limits and rules change every year, and we strive to keep you informed and effectively utilizing these tax-advantaged investment vehicles.