Market volatility has picked up recently, leading many investors to reassess where things stand. With sharp moves and dramatic headlines, it’s natural to wonder if now is the time to make adjustments. But it’s precisely in these moments that staying grounded and informed matters most. Whether markets are calm or clouded by uncertainty, these core principles can help you stay focused and make informed decisions:

- Your portfolio was not built to predict headlines but to weather them

- Market cycles include ups and downs; this is part of the process

- Understanding the current environment is essential

- Your Allworth team is here for you—let us know immediately if you want to talk about your investments or your financial plan

Equity markets surged on Wednesday after President Donald Trump announced a 90-day pause on most reciprocal tariffs, keeping the baseline rate at 10% for many countries and regions. Without the pause, tariffs would have jumped to 24% for Japan and 20% for the European Union. This suggests the president is willing to negotiate. In response, the S&P 500 surged 9.5%, and the Dow Jones Industrial Average jumped almost 3,000 points.

On Thursday, the Dow gave back 1,000 points for a few possible reasons: this is a delay, not a resolution; general profit-taking; and tensions with China have only worsened. China was not part of the tariff reprieve. Instead, the US raised tariffs on Chinese goods to 145%, prompting China to retaliate with a 125% tariff on US products.

Earlier this week, we laid out several game-theory-inspired scenarios to map the tariff path forward. At the time, we viewed a fragmented response as most likely, where some trade partners retaliate, others negotiate or partially concede, and the US somewhat softens its stance. That appears to be unfolding, but we understand things can quickly change.

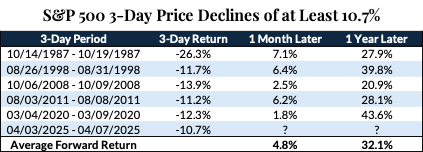

We also noted that prior clusters of sharp market declines were followed by strong rallies. The three trading days from Thursday, April 3rd through Monday, April 7th, saw the S&P 500 fall 10.7%. Since 1950, there have been ten instances when stocks fell more than that over a three-day period, occurring across five distinct groupings. To avoid double counting, only the first occurrence in each grouping was considered in the table below—with each instance ultimately leading to positive forward returns over time.

The market’s path will depend on several factors, including how tariffs impact consumer spending, corporate profits, inflation, economic growth, and our trade relationship with China. Also of extreme importance is the Federal Reserve’s response.

In theory, high interest rates fight inflation and slow the economy, while low interest rates increase inflation and support the economy. This dichotomy puts the Fed in a challenging position since tariffs can increase inflation and slow the economy. Consequently, policymakers are taking a wait-and-see approach. As of Friday morning, markets have priced in between three and four quarter-point rate cuts this year.

The S&P 500’s lowest closing value was 19% below its February 19th record high. An analysis of prior significant declines from peak levels reveals that markets tend to bounce back from sharp selloffs. Nonetheless, we would not be surprised if there is more turbulence in the near term.

As mentioned earlier this week, trying to time the market can work against your long-term financial goals. There’s a reason the saying “it’s not about timing the market, but time in the market” has stood the test of time—because it has consistently proven to be true.

It’s natural to want to avoid losses and capture only gains. However, markets don’t move in predictable patterns. In fact, some of the best days occur after broad selloffs. So, trying to sidestep the decline could mean missing valuable opportunities for recovery and growth.

Markets will continue to digest shifting trade policy, geopolitical uncertainty, economic developments, and Fed guidance. But through it all, staying disciplined and focused on your long-term financial goals remains the best approach.

If you have questions about your portfolio or the road ahead, we’re here to help.

This information is meant for educational purposes and not as direct tax or legal advice. Rules and regulations can shift anytime, so it’s always best to consult a qualified tax advisor, CPA, or attorney for guidance tailored to your specific situation.

All data are from Bloomberg unless otherwise noted. Past performance does not guarantee future results. Investments involve risks, including market, credit, interest rate, and political risks. For more information, please refer to Allworth Financial’s Form ADV Part 2.

Past performance may not be indicative of future results. Asset allocation does not ensure profits or guarantee against losses; it is a method used to manage risk. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment, investment allocation, or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Allworth Financial), will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Advisory services offered through Allworth Financial, an S.E.C. registered investment advisor. A copy of our current written disclosure statement discussing our advisory services and fees is available upon request. Allworth Financial is an Investment Advisor registered with the Securities and Exchange Commission. Securities offered through AW Securities, a Registered Broker/Dealer, member FINRA/SIPC.

February 09, 2026

Why a Single Withdrawal Rate Isn’t Enough and What to Do Instead

February 09, 2026

Why a Single Withdrawal Rate Isn’t Enough and What to Do Instead

Relying on a single withdrawal rate can leave your retirement plan exposed to market swings, but a bucketed approach helps protect short-term income …

Read Now February 03, 2026

Why a Real Financial Advisor Matters in an AI World

February 03, 2026

Why a Real Financial Advisor Matters in an AI World

AI can be a powerful tool, but when it comes to building a personalized, adaptable financial plan, there’s no substitute for the judgment, …

Read Now January 26, 2026

Funded Contentment: The True Definition of Wealth After Retirement

January 26, 2026

Funded Contentment: The True Definition of Wealth After Retirement

True wealth in retirement isn't about reaching a number, but about building a financial life that funds your values, priorities, and peace of mind. …

Read Now