Allworth Chief Investment Officer Andy Stout gives you a look at the latest economic data and explains why the Federal Reserve keeps pushing back on market expectations.

In last month’s update, we warned against expecting the Federal Reserve (Fed) to pivot toward the market’s view on rate hikes. This caution appears warranted based on the latest batch of economic data and communication from the Fed.

We’ll discuss what this means for you, but first, let’s dive into the data to get a better understanding of the economic landscape

A hot labor market

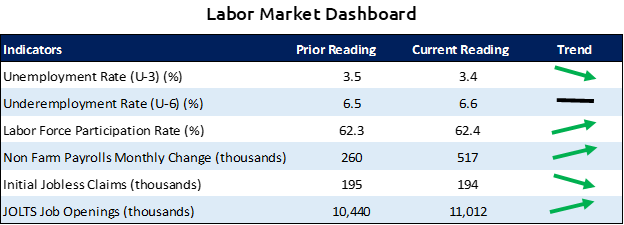

Employers added a massive 517,000 new jobs in January, eclipsing the 188,000 that economists expected. Additionally, the unemployment rate fell to 3.4%, a 53-year low. In addition to that, job openings jumped back above 11 million. Lastly, the number of weekly layoffs has reversed and retreated to relatively low levels.

When viewed together, the data suggest that workers are in a good place. But, of course, not every industry is as robust as the overall job market. For example, the technology industry has seen some of the larger companies announce significant job cuts, including Alphabet, Amazon, Dell, IBM, Meta, Microsoft, and Zoom, just to name a few.

While there are pockets of weakness, the job market’s underlying strength is something the Fed is closely watching from a positive and negative perspective. On the plus side, Fed Chair Jerome Powell is pleased with the job data, saying that it’s a good thing that inflation has decreased without hurting the job market.

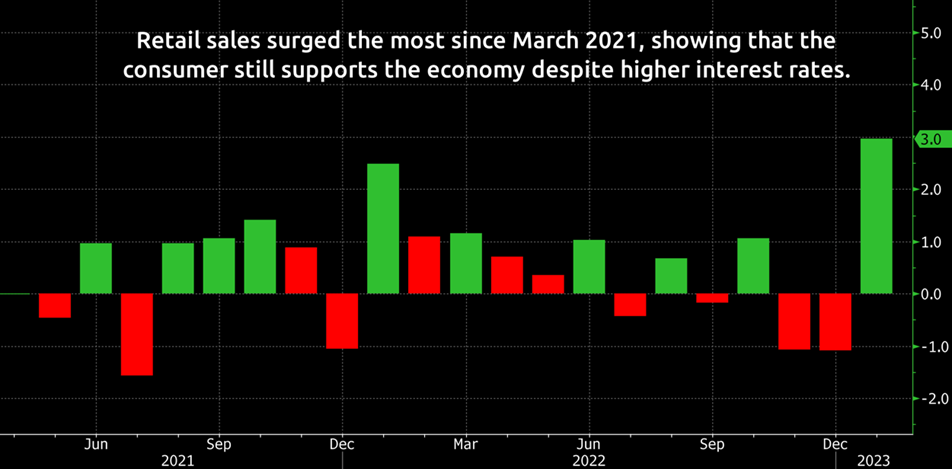

Let’s suppose for a moment that the labor market can withstand higher rates. In that case, it significantly increases the chance of avoiding a recession because more people with jobs means higher consumer spending, and that spending represents about 70% of the entire US economy. So far, spending data has held up. For example, January retail sales jumped 3%, the most in almost two years.

On the other hand, inflationary pressures can build if the job market doesn’t cool off and spending stays too strong. That would force the Fed to keep rates higher for longer to reduce inflation.

Hot inflation

The latest release showed the year-over-year change in consumer inflation (CPI) dropping from its 9.1% June 2022 high to 6.4% in January, its lowest level since October 2021. While we’re moving in the right direction, we’re far from out of the woods.

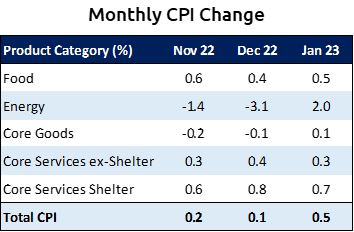

Analyzing the monthly inflation change shows that January prices bucked the trend of near-zero readings by increasing 0.5% last month. In addition, core inflation, which excludes food and energy costs, rose by 0.4% in January, matching December’s monthly change.

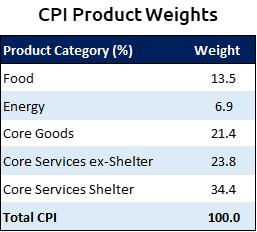

When we analyze inflation, we first break it down into the primary components: food, energy, core goods, core services (except shelter), and core services including shelter. The first thing to know is the product weights of these major categories because not every component is equal.

For example, consider the soaring price of eggs, which are up 70% in the past year. However, eggs only make up 0.2% of total consumer spending. As shown in the product weight table below, shelter costs are the most significant contributor to inflation.

Now when we look at the monthly change in these categories, you can see that food, core goods, and core services except-shelter inflation are helping to pull down total inflation. But despite higher interest rates, shelter costs have had a difficult time declining.

The fact is that monthly shelter inflation remains hot, rising 0.7% last month. However, these elevated readings aren’t surprising because there’s an inherent lag between higher interest rates and the CPI shelter component. Subsequently, we expect monthly shelter inflation to decrease in the coming months.

Adjusting to the Fed

The Fed is acutely aware of this lag, which is why Mr. Powell stated that he pays close attention to the core services ex-shelter inflation. The monthly change in this measure fell from 0.4% to 0.3%, near its lowest levels in the past year.

This trend follows what Mr. Powell said at his press conference following the Fed’s February 1 meeting, where it raised interest rates by a quarter-point to a target range of 4.5 – 4.75%. He stated that the disinflationary process has begun. At that moment, markets immediately began to price in easing monetary policy. Specifically, the expectation was we’d have only one more hike followed by two cuts this year, putting the short-term interest rates into a target range of 4.25 – 4.5%.

However, the Fed has pushed back on that pricing by repeatedly saying we should expect a couple more hikes. Those comments, combined with the improving-but-still-too-high inflation, forced markets to adjust their view. As a result, the market is trading at levels indicating rates will be in a target range of 5 – 5.25% at the end of 2023.

We believed that the markets had been mispricing the Fed for the past few months. However, now that they’ve adjusted, certain areas have become more attractive, including some fixed income. To be very clear, this doesn’t mean one should blindly buy bonds. Instead, it’s imperative to ensure you have the proper credit profile and duration that aligns with your needs.

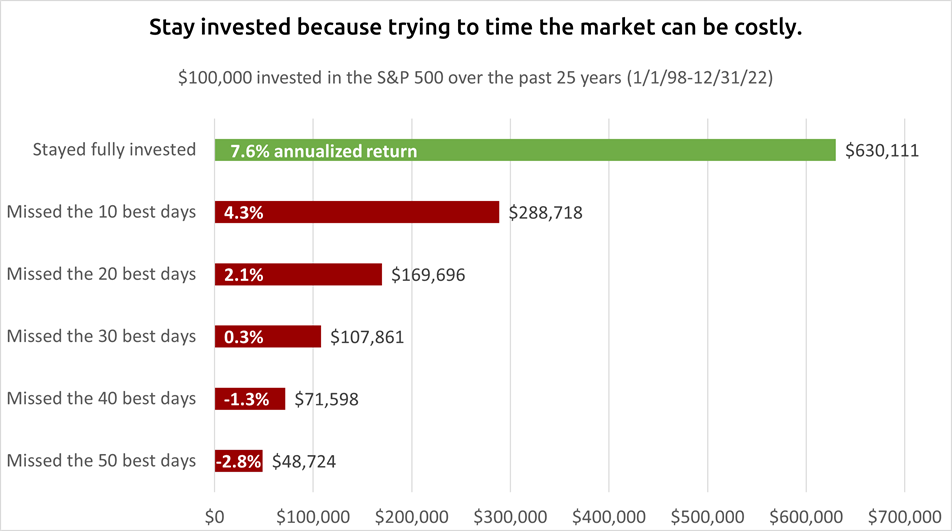

More importantly, it’s critical that you have the right investment mix so you can withstand market volatility and avoid making costly emotional decisions. Markets go up and down, and that can cause some investors to become too fearful or greedy.

Simply, it can be financially ruinous to emotionally jump in and out of the market because it all too often backfires.

It is our job to monitor and appraise not only the above factors, but virtually all relevant economic data, and then create model portfolios that we believe provide our clients with the best opportunities to reach their short- and long-term financial goals.

February 17, 2023

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now