Allworth Chief Investment Officer Andy Stout offers a breakdown of the reasons behind the market drop, as well as reassurance looking ahead.

“It was the best of times, it was the worst of times, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair…”

The above, written in 1859, is Charles Dicken’s eloquent dichotomy from A Tale of Two Cities, but it could easily describe the current state of the markets.

While it was only about nine days ago that the stock market hit a record high, we’ve now experienced history’s fastest ever 10+% correction (when falling from an all-time high).

And, yet, despite this rapid pullback, stocks are still higher than they were five months ago.

Here’s What’s Driving the Markets

The cause of this market turbulence is fear surrounding the potential fallout from the coronavirus (known as COVID-19). The concern is that the outbreaks in Italy and South Korea will be repeated throughout the world. This could result in governments isolating large segments of the population, which could lead to supply chain disruptions, slowing economies, and stagnating earnings.

Let’s discuss what’s happened and what might be in store going forward.

*Please note that the next three sections, which delve into supply chains, economies, and earnings, are NOT predictions or even necessarily the most likely scenario. Instead, it’s an analysis of what the market is responding to. Feel free to skip to the “Looking Ahead” section for our opinion on what matters most to your retirement.

1. Supply Chain Disruptions

This virus, which originated in China, resulted in the Communist Party of China quarantining a significant percentage of its population. China is a critical part of both global growth and international supply chains. A long disruption in Chinese manufacturing could disrupt output on a global scale.

Key manufacturing provinces such as Guangdong, Jiangsu, and Zhejiang (which together account for 27% of China’s GDP and 55% of China’s exports), have “officially” seen new infection numbers come down significantly. However, many find this data to be suspect. On another potentially positive note, Bloomberg News reports that China’s economy is likely running at 60-70% capacity, up from 50-60% capacity a week ago.

2. Slowing Economies

With governments isolating large numbers of workers in China and Italy, those economies will take a hit. Many economists now believe China’s economy might grow closer to 4% in the first quarter instead of the 6% that was originally expected. This would be the slowest growth on record for China. The outbreak in Italy has resulted in the government effectively shutting down Milan, which is the economic heart of the country. This could push Italy into a recession.

The concern is that what’s happened in China and Italy will happen in the U.S.

If the coronavirus quickly spreads here, some economists fear that U.S. consumers will close their wallets. This would be a problem because consumer spending makes up about 70% of the U.S. economy. If that slows, the chance of a recession increases.

To be clear, at this time, leading economic indicators still suggest the U.S. economy will NOT slip into a recession any time soon. (Leading economic indicators are data points that move before the broad economy moves.)

Regardless, it seems likely governments will respond with fiscal and monetary stimulus. This means that, around the world, increased government spending and rate cuts are, at this point, likely.

3. Stagnating Earnings

Should the economy slow down, corporate profits would also stall. Some Wall Street analysts are already expecting zero earnings growth in 2020. This is a big part of the cause of the volatility. After all, earnings are generally considered to be the most important factor when it comes to how stocks perform over the long run.

When, as recently as February 19th, stocks were at record highs, market valuations (e.g. price-to-earnings ratios) were elevated. When there is a shock to the economy causing uncertainty, those expected future earnings become questionable. So, when starting from stretched valuations, and the future earnings picture is unclear, bouts of volatility should be expected.

Looking Ahead

What’s described above is not the most likely scenario, but an assessment of what the market is worried about.

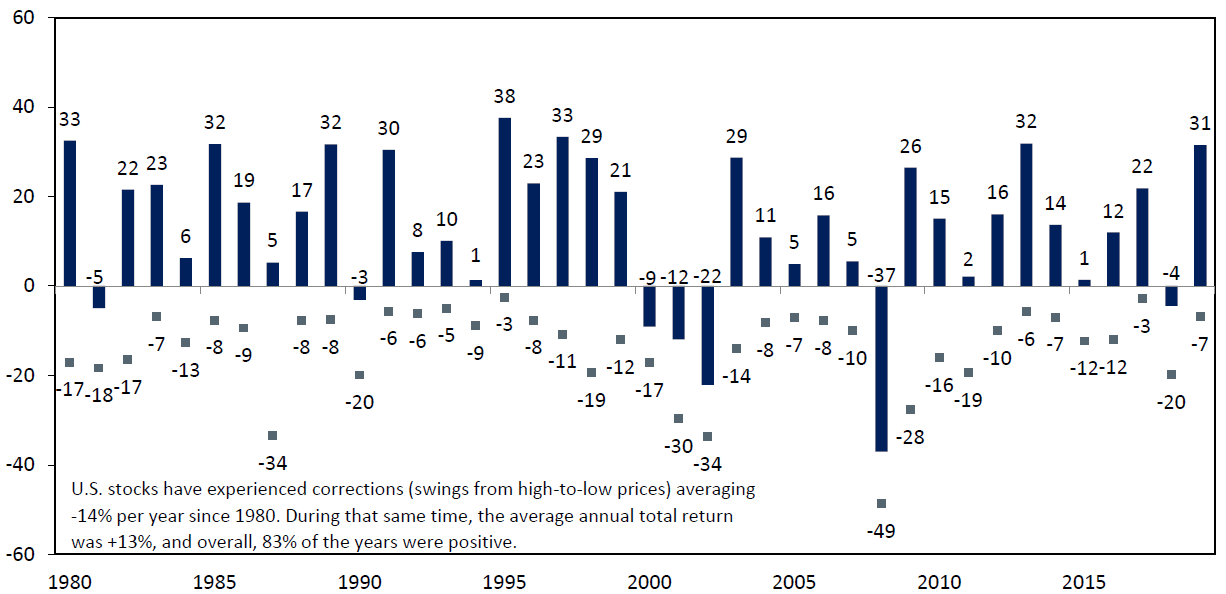

It’s possible that things might get worse before they get better. Yet, remember, the average correction is around 14% and lasts for approximately four months. In other words, we could experience more volatility; however, history suggests that we will see higher prices in the not-too-distant future.

Remember, stock market corrections are normal. Since 1980, large-cap stocks have experienced an average drop of about 14% in a given calendar year. Despite these corrections, stocks ended up higher about 83% of the time.

Annual U.S. large company stock market returns were up 83% of the time despite normal market corrections

Source: Allworth Financial and Bloomberg

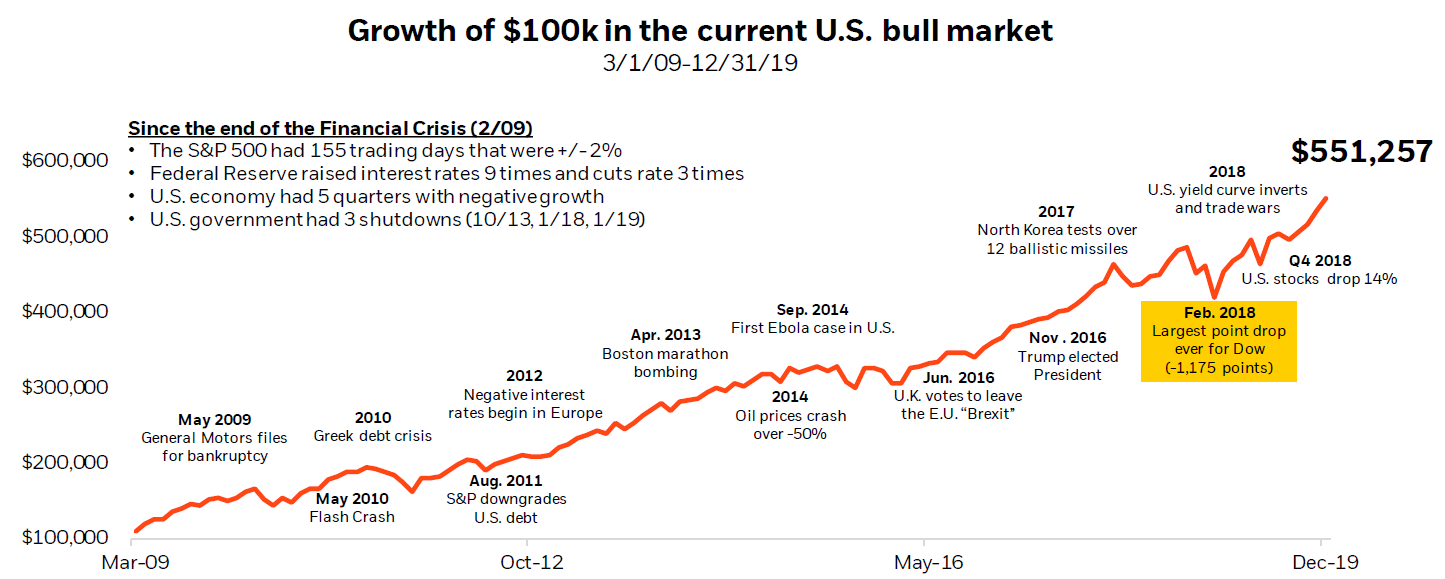

The recent volatility can be unnerving and could even have you considering reducing your stock exposure. This is a common aspect of behavioral finance. Keep in mind, however, there is always a reason to sell, but doing so would have consistently been the wrong decision over the past 10 years.

There's always a reason to sell stocks...

Source: Morningstar and Blackrock

Lastly, and of the utmost importance, if you’re a client of Allworth Financial, you should know that the investment portion of your personalized financial plan was created to balance your risk tolerance and your financial goals. This means your diversified portfolio has been created for your specific needs and designed to weather market turbulence. If you aren’t yet a client of Allworth and you aren’t 100% confident that your asset allocation is ideal for you, we suggest you immediately contact your advisor and ask them to explain your allocation.

As always, please let us know if you have any questions, or if we can be of service to you in any way.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now