Allworth Chief Investment Officer Andy Stout breaks down the market’s expectations for interest rates this year and explains why the job market is currently a double-edged sword.

As an analytical person, each January, I like to take time to look back and reflect on how much the world has changed.

I like to think that looking back will provide me with, not only perspective, but some random breakthrough or first-of-its-kind insight.

But, each year, like clockwork, I find myself reciting a quote that was first used by French writer Jean-Baptiste Alphonse Karr (and, later, by pretty much everyone I have ever met in my life), which once again rings true this year: The more things change, the more they stay the same.

Indeed, much changed over the past year, but an awful lot has remained exactly-the-same.

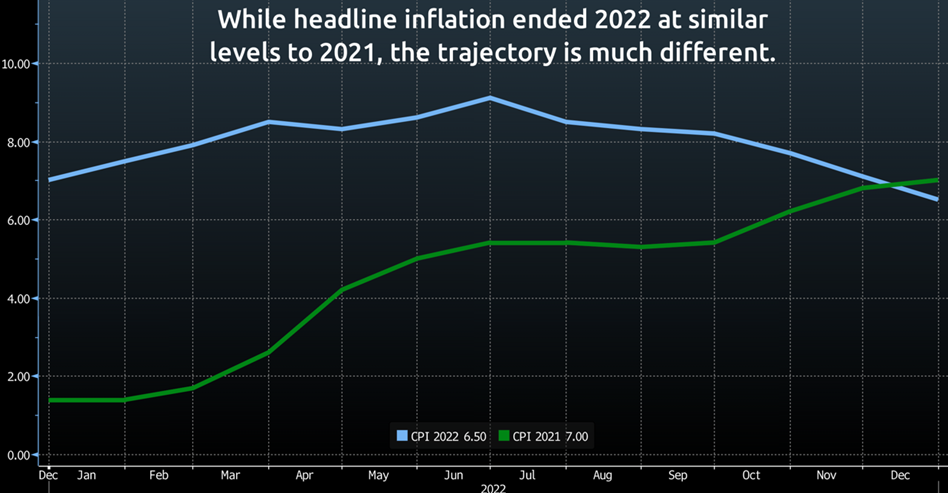

Case in point, inflation is still elevated, but now it is trending lower. Heading into 2022, the Federal Reserve (our central bank) acknowledged some inflation risks, but now the committee is very worried about inflation sticking around.

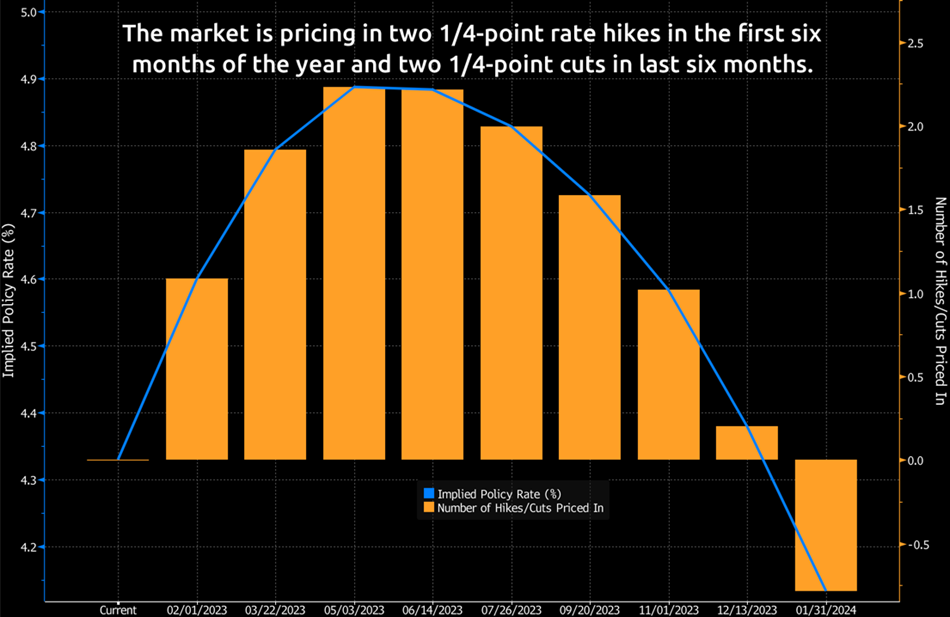

Because inflation, as you no doubt know, quickly spiraled out of control, and in response, the Fed went on one of the most aggressive interest-rate hiking campaigns in history, raising the fed funds rate by 4.25%. The market now expects the Fed to increase short-term interest rates by a total of 0.5% in the first half of this year, followed by 0.5% in rate cuts in the final six months of 2023.

But this does not mean that the Fed will cut rates later this year just because the market currently expects it. On the contrary, last year, the market regularly hoped for the Fed to pivot away from its aggressive rate hikes, which resulted in brief stock market rallies. However, the Fed stood by its guns every time, and those gains, which were built on hope, quickly faded.

To be fair, the Fed’s intent was to lift rates into restrictive territory, and it certainly took some time to get there. But now that we are seeing that higher interest rates have in fact achieved the Fed’s desired effect, the committee probably won’t increase those rates much more.

That said, all this does not mean that our central bank will decide to actually cut rates this year, either.

Over the past year, Federal Reserve Chair Jerome Powell repeatedly discussed the mistakes of the 1970s Fed, when it relaxed monetary policy too soon, making the early 1980s inflationary environment significantly worse. Chair Powell does not want to repeat that mistake. So, it seems he is willing to keep monetary policy restrictive until he’s confident inflation will remain low.

What about the labor market?

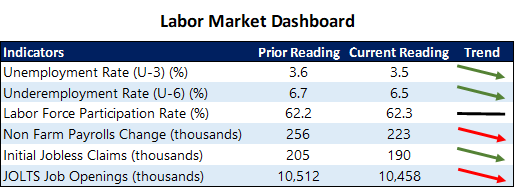

The labor market is one of the most significant areas the Fed analyzes to determine inflation risks. The reason is that workers in high-demand occupations can command higher wages, and rising wages can make it more difficult to get rid of inflation. This presents a double-edged sword: a strong job market is good for the economy, but it also forces the Fed to keep interest rates high, which is bad for the economy.

Additionally, the labor market is a lagging economic indicator (as opposed to a “leading” one), meaning, for good or ill, that the broad economy moves before the job market does. So, if the labor market remains robust at the same time as the other areas of the economy weaken, the Fed risks overtightening and causing a recession. That is the landscape we face today. Specifically, manufacturing and housing are facing significant headwinds while the job market remains healthy.

Our Labor Market Dashboard shows most indicators are trending toward strength. Payrolls (or new business hires) and job openings are weakening, but they are still relatively strong.

The robust job data suggests that the Fed might not cut interest rates as the market expects. If the Fed keeps rates high as the economy weakens, the chance of a recession becomes possible. But remember, recessions are a normal part of the economic cycle. After all, there have been 17 recessions over the past 100 years.

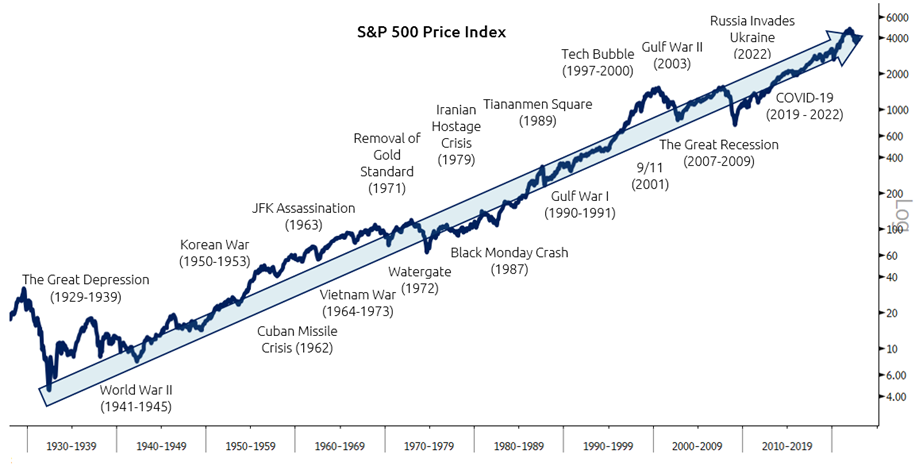

If the Fed makes a policy error and keeps rates too restrictive for too long, investors could experience additional market volatility. While markets often exhibit a random walk, they tend to move higher over the long term, even in the face of regularly occurring events that are troubling, including economic slowdowns.

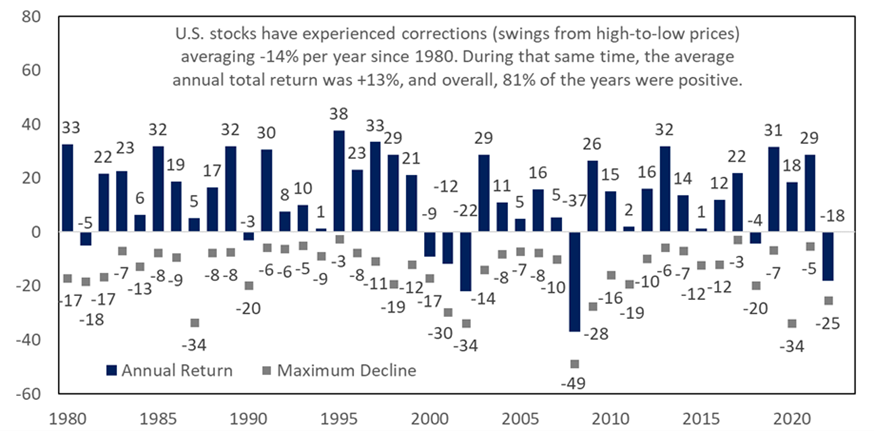

Further, as you can see from the chart below, the market has enjoyed a robust 13% average annual return since 1980, in-spite-of frequent double-digit drawdowns.

Historical data clearly shows that turbulence and economic rough patches are normal, but fortunately, the markets and economy have overcome every setback. However, that does not mean we will not position and update your investment portfolio for the constantly evolving economic landscape.

With that in mind, just some of the moves we have made over the past year to help protect your money include an overweight to value stocks, improving the credit quality of your bonds, and regular tax loss harvesting.

But in the end, when (or if) a news headline about the economy threatens to keep you up at night, just try and remember that the more things change, the more they stay the same. As in, economic downturns and various cycles happen, but the market has always come back stronger.

We will, of course, continue to monitor your investments and make changes that we believe will help support your financial plan.

January 20, 2023

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now