Andy Stout, Allworth Chief Investment Officer

“This great nation will endure as it has endured, will revive and will prosper. So, first of all, let me assert my firm belief that the only thing we have to fear is fear itself.”

–President Franklin D. Roosevelt

Even as I write this month’s update from home, merely looking out the window, it’s easy to see and feel the effects of the coronavirus. Obviously, everyone is impacted.

Still, we owe it to ourselves and our loved ones to prepare for the future and focus on what’s ahead. Because even though it’s still relatively early in the pandemic, as difficult as it is to believe, this will pass.

Fortunately, since our founding in 1993, we have continued to believe that steady wins the day. In deference to that, we build (and have always built) investment and retirement plans to minimize periods of uncertainty and volatility, and to help protect the people who’ve placed their trust in us.

That said, we do expect the market to remain volatile in the near term (at least until there is some real economic clarity (likely, once new infection rates begin to decline)).

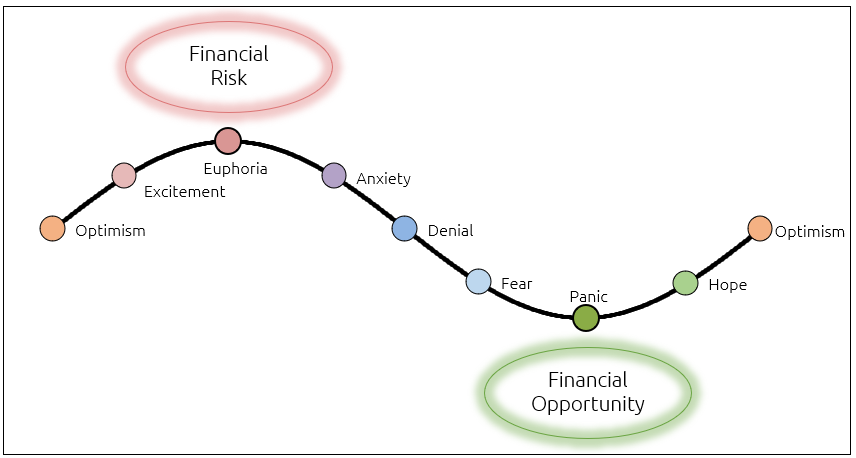

One factor that is easy to overlook is that the market is not the economy. This is crucial because stocks have historically recovered well before the economy.

To recount, since 1950, stocks have usually begun to climb five months before the end of a recession. In other words, it is important to remember, that when things look (and feel) their worst, markets have historically been a good investment.

"Be fearful when others are greedy, and greedy when others are fearful." - Warren Buffett

"Be fearful when others are greedy, and greedy when others are fearful." - Warren Buffett

When Allworth Financial’s Investment Committee convened this week, we of course focused on the impact of the coronavirus on the economy, the markets, and you. Here are the key takeaways:

- The economy has experienced a sudden, economic stop. The recovery will depend on the speed and success of the fight against the coronavirus.

- The government is in the process of putting together stimulus packages.

- When we emerge from this pandemic, the money the government has pumped into the economy should help us recover.

- We expect short-term market turbulence because of the unknown economic impact of the coronavirus and the disorderly trading in the fixed income markets.

- Our investment portfolios are a function of our disciplined investment process and represent risk levels from conservative to aggressive. The particular portfolio to which we allocate client accounts is dictated by the financial plan that our clients and their advisors have mutually constructed, and are based on individual financial goals, cash flow needs, and risk tolerances.

- Over the past year, we’ve taken steps to improve the credit quality in fixed income portfolios and will continue to closely monitor credit quality. We will also monitor and analyze client investment mix, the evolving economy, reach out to fund complexes, and do what we believe will help serve client interests and goals.

- The middle of a crisis such as we are currently experiencing is NOT the time to shift investment strategy.

While it is a stressful moment in our history, we will get through this. From world wars, to terrorism, to social unrest, to the Great Depression and several ensuing recessions, America has experienced countless other challenges, and each time we have emerged stronger than ever.

Please let us know if you have any questions.

With an increase in communications and outreach due to the virus outbreak and turbulence in the markets, it’s time for something new.

To provide you with insight into how we are assessing the key issues facing the economy and markets today (and, because we thought it would be interesting), what follows are some relevant highlights taken from this week’s Allworth Financial Investment Committee meeting.

1. Capital Markets Overview and Discussion

1.1 Coronavirus, Oil, and the U.S. Economy

The U.S. economy is slowing and, in the near term, could be headed into a recession. Our economy’s emergence from the slowdown will be contingent on the effectiveness of our medical response.

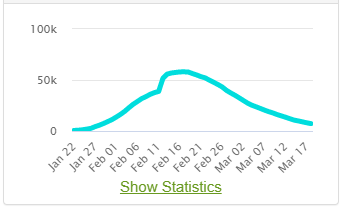

If China’s cases are a guide (and if the numbers originating from there are somewhat accurate), then one could surmise the peak of the coronavirus in the U.S. could occur around mid-April to mid-May, which is roughly a couple of months after the virus began to take hold.

Total cases as a percent of China’s population are at 0.006%. It’s estimated that 80-85% of workers are back at work, up from about 60-70% a couple of weeks ago.

China's Active Cases

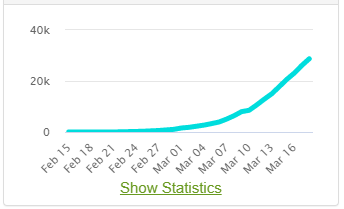

If Italy’s statistics are a better representation of what’s in store for the U.S., then it’s unknown when the data will turn favorable here.

As a percent of the Italian population, total cases are currently 0.068%. That is 10X greater than China’s proportion. The severity in Italy shows no signs of abating. The concern is that the rate in the U.S. will more closely mirror Italy’s than China’s. If that is the case, then near the end of March, the U.S. would have about 150,000 active cases. (This may not be realistic because, overall, Italy’s population density is about 6X greater than that of the U.S.)

Italy's Active Cases

As a result of the increase in cases, Italy has locked down most of the country, ordering non-essential shops and services to temporarily close. This will push the country into a recession. The EU Commission is now expecting EU GDP to come in at -1% for 2020 instead of the +1.4% previously forecast.

The U.S. is following Italy’s lead in terms of containment, as governments, businesses, and other institutions are implementing widespread measures.

It’s important to note, that it’s not necessarily the absolute number of cases that become an economic problem, but, instead, the “containment measures” being imposed that will disrupt the economy. Businesses will experience loss of income and layoffs.

In prior instances of sudden economic stops, restarting the economy took a coordinated effort. However, sudden economic stops usually occurred in emerging economies (or occurred because of natural disasters). The policy response was often currency devaluation.

Key point: Given the coordination of containment efforts, it seems plausible that once a level of medical progress has been achieved (a decline in active cases or a vaccine), economic progress could quickly ramp up as restrictions are lifted.

Our belief is that once consumer confidence returns, we will emerge from the slowdown. Fortunately, the liquidity measures being put into place by the Federal Reserve, along with the low, long-term interest rates, will be instrumental in exiting the slowdown. Additionally, consumers have an economic lifeline because the economy was in very good shape through the first two months of the year, as evidenced by 273k jobs added in February, along with expansion in the manufacturing and service sector. Also, the savings rate was near a multi-year high of 7.9%.

1.2 Monetary and Fiscal Policy Response

The Federal Reserve is trying to ease the financial strain that is caused by fears surrounding the coronavirus. The Fed began by cutting rates by half a percentage point on March 3. Because disruptions in the fixed income market continued, the Fed announced $1.5 trillion in capital injections and then, last weekend, unloaded most of its conventional tools. This included the Fed Funds Rate being cut to 0-0.25%, $700 billion in QE, increasing available U.S. dollars via swap lines, banks’ reserve requirement ratio being cut to zero, and the discount rate being cut to 0.25%.

The Fed still has some tools left, such as open-ended QE, additional forward guidance, commercial paper funding facility (this has been implemented), and possibly negative rates. (With the exception of negative rates, there is a good chance the Fed uses each of these tools.)

Key point: Because monetary policy acts with a lag, this will be very beneficial when the coronavirus scare lessens. The immediate purpose of these moves is to improve the functioning of the capital markets.

The Trump administration waived student loan interest on federal loans and instructed the Secretary of Energy to make large purchases to fill up the strategic petroleum reserves. Helping to alleviate the coronavirus stress, Congress will pass a bill that includes free testing for those suspected of having the virus, two weeks of paid sick leave for those infected, additional state funds for unemployment benefits, and more money for food assistance.

Additional fiscal action is likely occur.

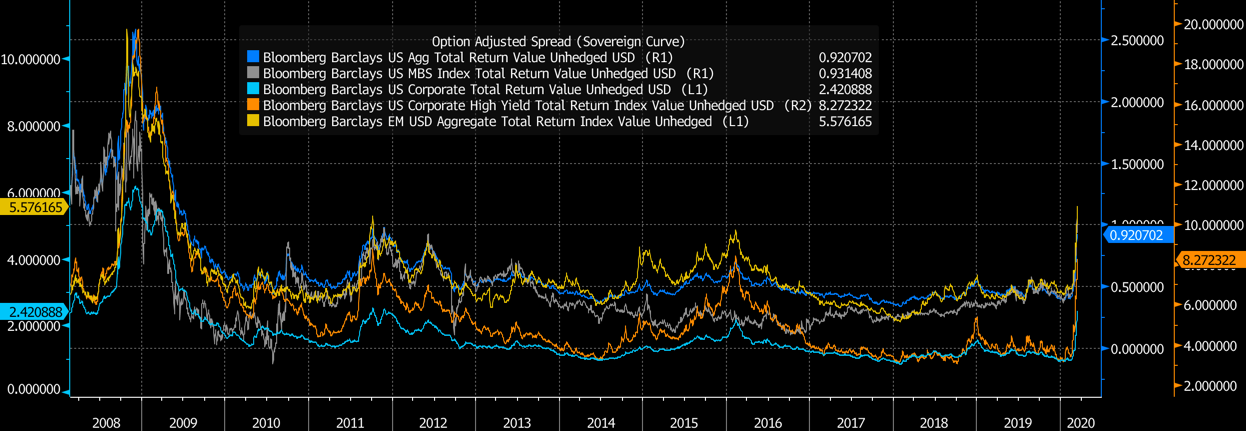

1.3 Credit Spreads

Even given the current market turbulence, credit spreads remain far from what we saw in 2008. (A ‘credit spread’ is the difference in yield between a U.S. Treasury bond and another debt security of the same maturity (though of a different credit quality)).

Key point: Over the past year, we’ve improved credit quality in our fixed income portfolio with 91% in investment grade debt. Given that economic risks are tilted to the downside, exposure to low rated credit should be minimized.

To our clients and readers, please know that we are well-positioned in virtually every way to handle any scenario that unfolds. We have a terrific, adaptable plan in place, highly experienced leadership and staff, and an advisory model that was founded with scenarios such as this in mind.

We’re going to get through this, together.

As always, please contact us if you have any questions.

All data from Bloomberg. The Allworth Recession Index is made up of leading economic indicators, which are data points that have historically moved before the economy. The index value is calculated as a percent of the indicators that are sending signals that suggests recession risk is elevated. When the index value is greater than 40%, we believe there is a greater chance for a recession in the next six to nine months. All data begins by 1971 unless noted below. The indicators that make up the Allworth Recession Index are the 3-Month Government Bond Yield, 2-Year Government Bond Yield (beginning in 1976), 10-year Government Bond Yield, BarCap US Corp HY YTW – 10 Year Spread (beginning in 1987), Conference Board Consumer Confidence, Consumer Price Index, NFIB Small Business Job Openings Hard to Fill (beginning in 1976), Private Housing Authorized by Building Permits by Type, US Federal Funds Effective Rate, US Initial Jobless Claims, US New Privately Owned Housing Units Started by Structure, and US Unemployment Rates.

Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

Active coronavirus cases are from worldometers.info.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

March 20, 2020

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now