Allworth Chief Investment Officer Andy Stout discusses inflation and its impact on the markets.

In last month’s Market Update, I discussed the idea that “headline inflation” had likely peaked. While that remains the most probable outcome, considering this week’s market turbulence in response to the release of August’s inflation print, I want to revisit the topic.

Inflation slows, but not as much as expected

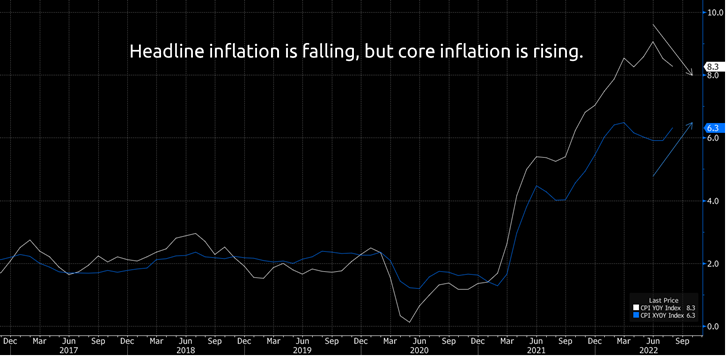

Even though inflation declined in August, the data was anything but encouraging. Headline consumer inflation (CPI) fell from 8.5% to 8.3% on a year-over-year basis. Unfortunately, economists thought it would decline even more, settling in at 8.1%. Additionally, the monthly change in headline inflation was a 0.1% increase, which was worse than the forecasted 0.1% decrease.

But the more significant concern was the change in core inflation, which is headline inflation excluding food and energy prices. Core CPI jumped 0.6% in August compared to July (which was double the expected 0.3% monthly increase). As a result, core inflation rose from 5.9% to 6.3% over the previous year.

Aside from a drop in energy prices, almost every other major category experienced price pressure. In fact, nearly 60% of the CPI components had an annualized inflation rate greater than 4% based on August’s monthly change.

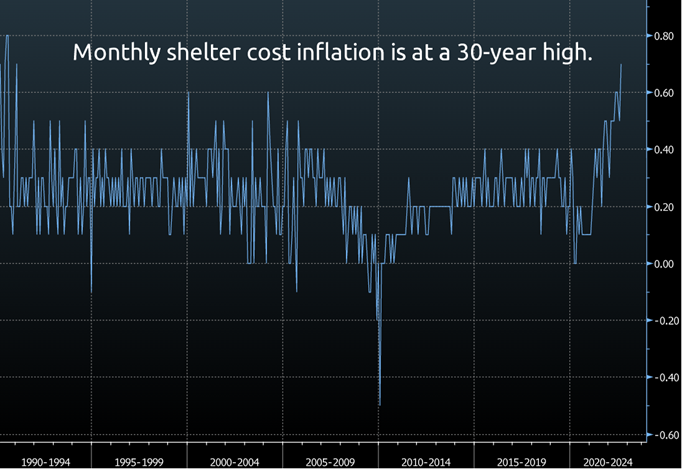

Shelter costs, making up 32% of total inflation, had the largest impact, climbing by 0.7% last month. This was the biggest jump since 1991. Fed rate hikes should reduce shelter inflation because these rate increases will help lift mortgage rates. Unfortunately, low housing inventory and a lag in rental price adjustments will likely result in continued elevated shelter inflation lasting into early 2023.

The latest inflation report means the Fed will hike more

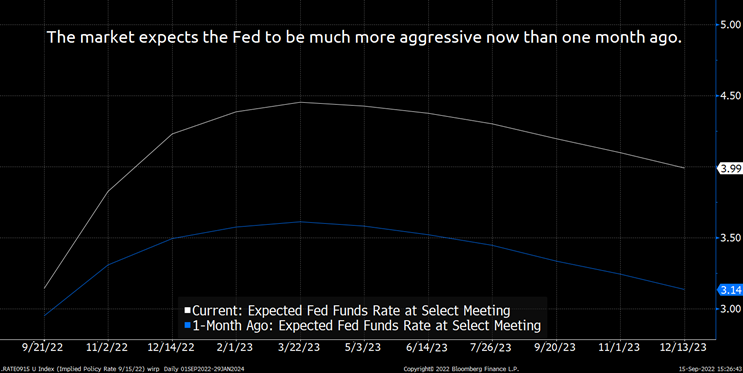

About a month ago, markets expected a less aggressive Fed. But since then, Fed Chair Jerome Powell indirectly supported a Wall Street Journal report that the Fed was on track to hike rates by 0.75% at its September 21st meeting. And that was before this week’s inflation release.

We can gauge the number of rate hikes and cuts the market expects the Fed to implement by analyzing specific types of tradeable securities, specifically fed fund futures. These instruments show that the market expects larger rate hikes over the next few months. For example, the chart below shows expected short-term interest rates approaching 4.5% by next March. That is about 1% greater than market expectations from only one month ago.

The economic impact

The August inflation print caused the market to reassess the economic implications of the Fed’s rate hike path. Consumer spending represents about 70% of the total US economy, and consumers are forced to spend less when interest rates rise. So, these potentially higher rates will have a negative economic impact.

Another consideration worth noting is that Fed rate hikes affect the economy with a lag of roughly 6-12 months. The committee has already raised interest rates from 0% to 2.5%. Additionally, the Fed is widely expected to hike by 0.75% at its September 21st meeting.

Herein lies the risk: The Fed is aggressively hiking interest rates, but it can’t know the impact on the economy due to the lagged effect. So, the Fed’s upcoming rate hikes could cause the economy to slow down more than the Fed wants, pushing us into a recession.

While an economic slowdown can’t be ruled out, there’s also the chance that market expectations are overdone. We certainly expect the Fed to keep raising interest rates at the next couple of meetings, but the Fed’s terminal rate might not reach that 4.5%.

Inflation could decelerate quicker than expected for a handful of reasons: 1) With the upcoming holiday season, businesses might be forced to cut prices on some goods due to an excessive inventory build. 2) The drop in commodity prices should make its way into other areas of the economy. 3) Mortgage rates are above 6% for the first time since 2008. 4) There is evidence of an improving supply chain, such as declining shipping costs and backlogs. 5) More people are entering the labor force, which could help reduce wage inflation.

Should the Fed become convinced that a decline in inflation is sustainable, the committee might stop raising rates before the fed funds rate gets to 4.5%.

One thing is clear: The uncertainty surrounding when and where the Fed will stop hiking interest rates is a primary catalyst for the uptick in market volatility. This turbulence may continue until we get some additional clarity, so, as your advisor knows well, a deep understanding of the Fed’s reaction function is critical when developing an appropriate investment mix to support your financial plan.

September 16, 2022

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.

Give yourself an advantage. Sign up to receive monthly insights from our Chief Investment Officer, and be the first to know about upcoming educational webinars. You'll also get instant access to our retirement planning checklist.

January 12, 2024

Fourth Quarter 2023 Market Update

January 12, 2024

Fourth Quarter 2023 Market Update

Allworth's Co-CEO Scott Hanson and Chief Investment Officer Andy Stout team up for this fourth quarter 2023 market update video.

Read Now December 15, 2023

December 2023 Market Update

December 15, 2023

December 2023 Market Update

Chief Investment Officer Andy Stout takes a look back on the year to help give perspective to what's on the horizon in 2024. At the beginning of this …

Read Now November 17, 2023

November 2023 Market Update

November 17, 2023

November 2023 Market Update

Chief Investment Officer Andy Stout examines whether there’s a chance the US dollar will lose its status as the world’s reserve currency. There is a …

Read Now